Will Qoria’s (ASX:QOR) Upcoming Earnings Call Reveal Shifts in Strategic Direction?

Reviewed by Sasha Jovanovic

- Qoria Limited has announced it will release its first quarter 2026 financial results and hold an earnings call on October 21, 2025.

- Anticipation surrounding this upcoming earnings release is drawing greater investor attention to Qoria as market participants look for fresh insights into the company's performance and direction.

- To explore how this anticipation may influence Qoria's investment narrative, we'll focus on the heightened attention around its forthcoming earnings announcement.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Qoria's Investment Narrative?

To be a Qoria shareholder today, you’d want to believe in its transition from consistent losses toward breakeven, a narrative fueled by rising revenue (now A$117.3 million) and narrowing net losses. Recent index inclusions and a solid management team provide extra credibility, but a Price-To-Sales ratio above peers keeps value-conscious investors watchful. The upcoming Q1 2026 results announcement, just flagged by management, puts added scrutiny on near-term performance and cash position. Historically, quarterly updates have sparked significant price shifts, yet this latest news alone may not reshape the most pressing catalysts: a pathway to profitability, ongoing revenue growth, and managing less than a year of cash runway. The biggest risk remains whether recent financial momentum is sustainable, especially given Qoria’s track record of losses and reliance on capital raising.

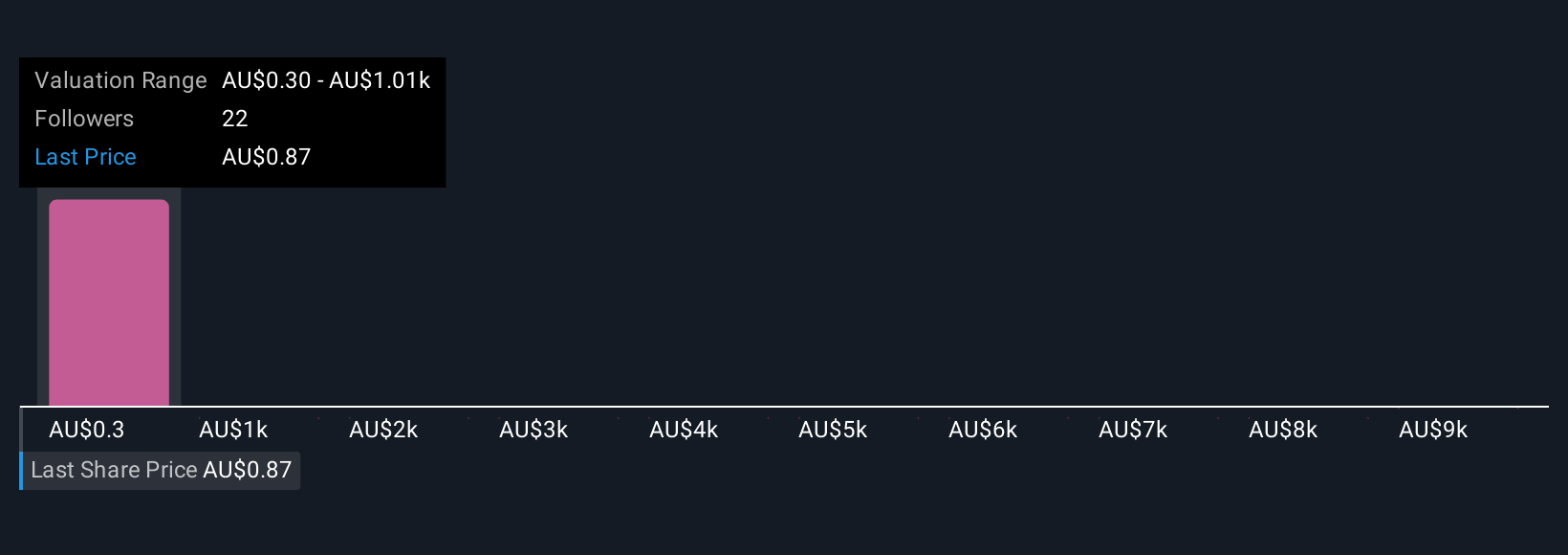

But even strong revenue growth may be overshadowed by Qoria’s short cash runway. Despite retreating, Qoria's shares might still be trading 8% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 6 other fair value estimates on Qoria - why the stock might be worth as much as 11% more than the current price!

Build Your Own Qoria Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Qoria research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Qoria research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Qoria's overall financial health at a glance.

No Opportunity In Qoria?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qoria might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:QOR

Qoria

Qoria Limited markets, distributes, and sells cyber safety products and services in Australia, New Zealand, the United Kingdom, the United States, Europe, and internationally.

Reasonable growth potential and slightly overvalued.

Market Insights

Community Narratives