Shareholders Will Probably Hold Off On Increasing Qoria Limited's (ASX:QOR) CEO Compensation For The Time Being

Key Insights

- Qoria will host its Annual General Meeting on 23rd of November

- CEO Tim Levy's total compensation includes salary of AU$375.0k

- Total compensation is 37% above industry average

- Over the past three years, Qoria's EPS fell by 22% and over the past three years, the total loss to shareholders 50%

Shareholders of Qoria Limited (ASX:QOR) will have been dismayed by the negative share price return over the last three years. Per share earnings growth is also lacking, despite revenue growth. Shareholders will have a chance to take their concerns to the board at the next AGM on 23rd of November and vote on resolutions including executive compensation, which studies show may have an impact on company performance. Here's why we think shareholders should hold off on a raise for the CEO at the moment.

See our latest analysis for Qoria

How Does Total Compensation For Tim Levy Compare With Other Companies In The Industry?

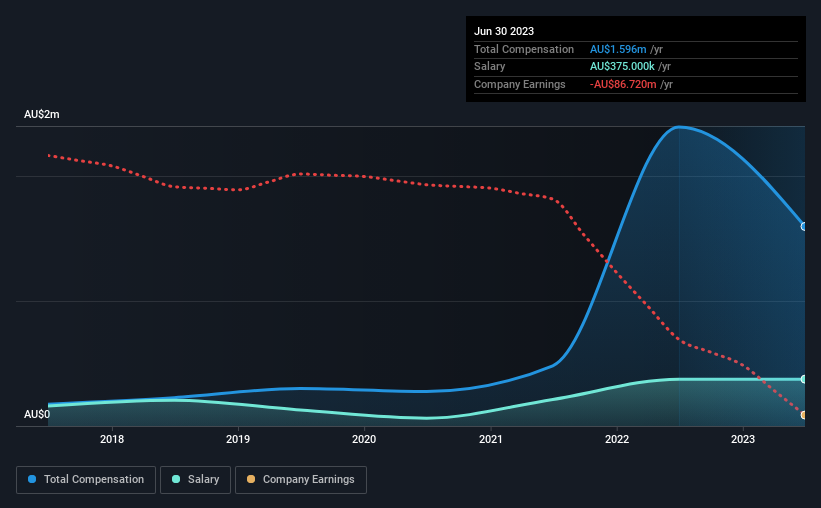

According to our data, Qoria Limited has a market capitalization of AU$233m, and paid its CEO total annual compensation worth AU$1.6m over the year to June 2023. That's a notable decrease of 33% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at AU$375k.

For comparison, other companies in the Australian Software industry with market capitalizations ranging between AU$154m and AU$615m had a median total CEO compensation of AU$1.2m. Hence, we can conclude that Tim Levy is remunerated higher than the industry median. Moreover, Tim Levy also holds AU$3.5m worth of Qoria stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | AU$375k | AU$375k | 23% |

| Other | AU$1.2m | AU$2.0m | 77% |

| Total Compensation | AU$1.6m | AU$2.4m | 100% |

Talking in terms of the industry, salary represented approximately 59% of total compensation out of all the companies we analyzed, while other remuneration made up 41% of the pie. Qoria sets aside a smaller share of compensation for salary, in comparison to the overall industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Qoria Limited's Growth

Over the last three years, Qoria Limited has shrunk its earnings per share by 22% per year. In the last year, its revenue is up 82%.

Investors would be a bit wary of companies that have lower EPS But in contrast the revenue growth is strong, suggesting future potential for EPS growth. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Qoria Limited Been A Good Investment?

The return of -50% over three years would not have pleased Qoria Limited shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

The returns to shareholders is disappointing along with lack of earnings growth, which goes some way in explaining the poor returns. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We did our research and identified 3 warning signs (and 1 which doesn't sit too well with us) in Qoria we think you should know about.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Qoria might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:QOR

Qoria

Qoria Limited markets, distributes, and sells cyber safety products and services in Australia, New Zealand, the United Kingdom, the United States, Europe, and internationally.

Reasonable growth potential and fair value.

Market Insights

Community Narratives