Qoria Limited's (ASX:QOR) Shares Climb 30% But Its Business Is Yet to Catch Up

Qoria Limited (ASX:QOR) shareholders would be excited to see that the share price has had a great month, posting a 30% gain and recovering from prior weakness. The last month tops off a massive increase of 114% in the last year.

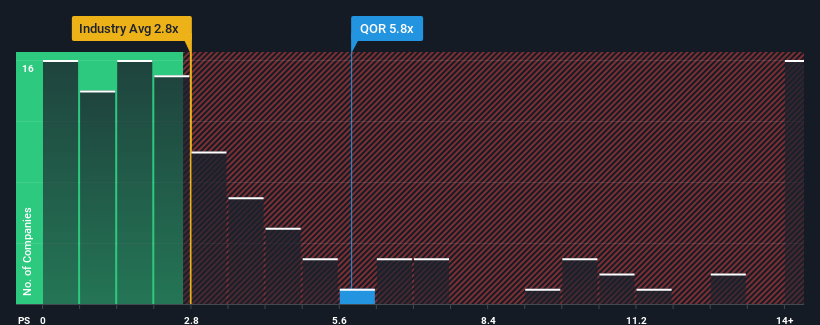

Since its price has surged higher, you could be forgiven for thinking Qoria is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 5.8x, considering almost half the companies in Australia's Software industry have P/S ratios below 2.8x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Qoria

How Has Qoria Performed Recently?

Recent revenue growth for Qoria has been in line with the industry. It might be that many expect the mediocre revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Qoria will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Qoria?

The only time you'd be truly comfortable seeing a P/S as steep as Qoria's is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 24%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 18% per year as estimated by the six analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 21% each year, which is noticeably more attractive.

With this information, we find it concerning that Qoria is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Qoria's P/S

Qoria's P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Qoria, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You always need to take note of risks, for example - Qoria has 2 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on Qoria, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Qoria might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:QOR

Qoria

Qoria Limited markets, distributes, and sells cyber safety products and services in Australia, New Zealand, the United Kingdom, the United States, Europe, and internationally.

Good value with reasonable growth potential.

Market Insights

Community Narratives