Investor Optimism Abounds Qoria Limited (ASX:QOR) But Growth Is Lacking

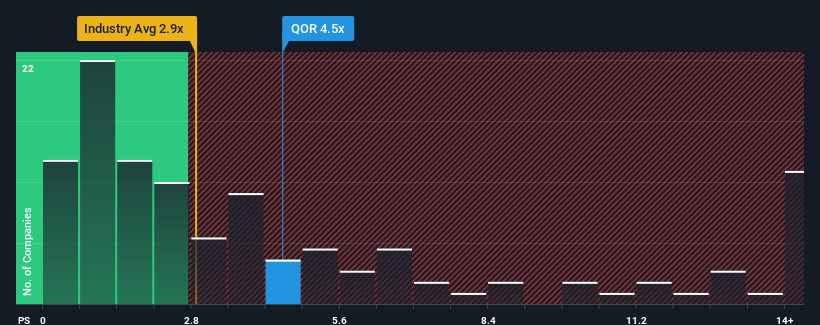

When close to half the companies in the Software industry in Australia have price-to-sales ratios (or "P/S") below 2.9x, you may consider Qoria Limited (ASX:QOR) as a stock to potentially avoid with its 4.5x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

We check all companies for important risks. See what we found for Qoria in our free report.See our latest analysis for Qoria

How Has Qoria Performed Recently?

Qoria could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

Keen to find out how analysts think Qoria's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as Qoria's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 19% per year during the coming three years according to the five analysts following the company. With the industry predicted to deliver 40% growth each year, the company is positioned for a weaker revenue result.

In light of this, it's alarming that Qoria's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've concluded that Qoria currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Qoria with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Qoria might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:QOR

Qoria

Qoria Limited markets, distributes, and sells cyber safety products and services in Australia, New Zealand, the United Kingdom, the United States, Europe, and internationally.

Reasonable growth potential and fair value.

Market Insights

Community Narratives