Asian Undervalued Small Caps With Insider Actions For August 2025

Reviewed by Simply Wall St

As Asian markets navigate a complex landscape marked by economic slowdowns and geopolitical tensions, small-cap stocks have emerged as intriguing focal points for investors. With the recent rally in Chinese indices and steady performance in Japan's markets, identifying small-cap opportunities with insider actions can provide valuable insights into potential growth areas amidst fluctuating market conditions.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Growthpoint Properties Australia | NA | 5.8x | 30.34% | ★★★★★☆ |

| Southern Cross Electrical Engineering | 16.4x | 0.6x | 34.95% | ★★★★☆☆ |

| East West Banking | 3.2x | 0.8x | 17.79% | ★★★★☆☆ |

| BWP Trust | 9.5x | 12.5x | 18.00% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 44.93% | ★★★★☆☆ |

| Daiwa House Logistics Trust | 13.0x | 6.8x | 14.55% | ★★★★☆☆ |

| Dicker Data | 20.0x | 0.7x | -30.11% | ★★★☆☆☆ |

| Elders | 21.2x | 0.4x | 46.99% | ★★★☆☆☆ |

| Pizu Group Holdings | 11.1x | 1.1x | 44.54% | ★★★☆☆☆ |

| Far East Orchard | 9.8x | 3.2x | 14.54% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

AMA Group (ASX:AMA)

Simply Wall St Value Rating: ★★★★★★

Overview: AMA Group operates in the automotive aftercare and accessories sector, focusing on collision repairs and parts supply, with a market capitalization of A$1.23 billion.

Operations: The primary revenue streams for AMA Group are Capital Smart and Ama Collision, contributing A$490.33 million and A$360.04 million, respectively. The company's gross profit margin has shown a trend of fluctuation, reaching 56.98% as of June 2025. Operating expenses are significant, with general and administrative expenses being a major component at A$438.59 million by the same period.

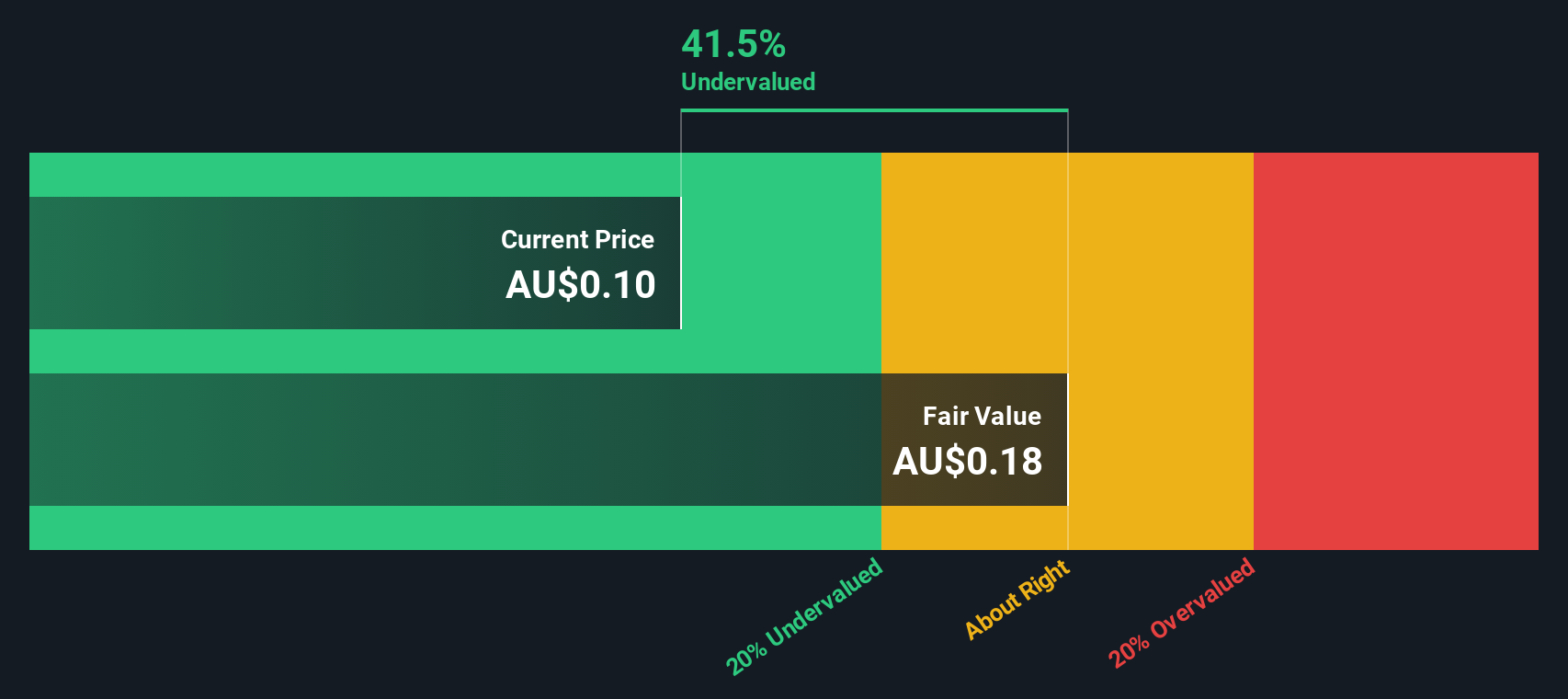

PE: -64.0x

AMA Group, a smaller player in Asia's market, recently reported full-year sales of A$1.01 billion, up from A$933 million last year. Despite a net loss of A$7.47 million, their earnings are projected to grow 69% annually. Insider confidence is evident with recent share purchases by insiders over the past quarter. While relying solely on external borrowing poses risks, the company's growth potential remains attractive for those seeking opportunities in this segment.

- Delve into the full analysis valuation report here for a deeper understanding of AMA Group.

Gain insights into AMA Group's historical performance by reviewing our past performance report.

Praemium (ASX:PPS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Praemium is a company that specializes in providing software and programming solutions, with operations focused on the financial services sector, and has a market capitalization of A$0.85 billion.

Operations: Praemium generates revenue primarily from its Software & Programming segment, with the latest reported figure being A$103.04 million. The company's gross profit margin has shown an upward trend, reaching 44.27% as of June 2025. Operating expenses have increased to A$26.50 million, impacting net income margins which stand at 13.16%.

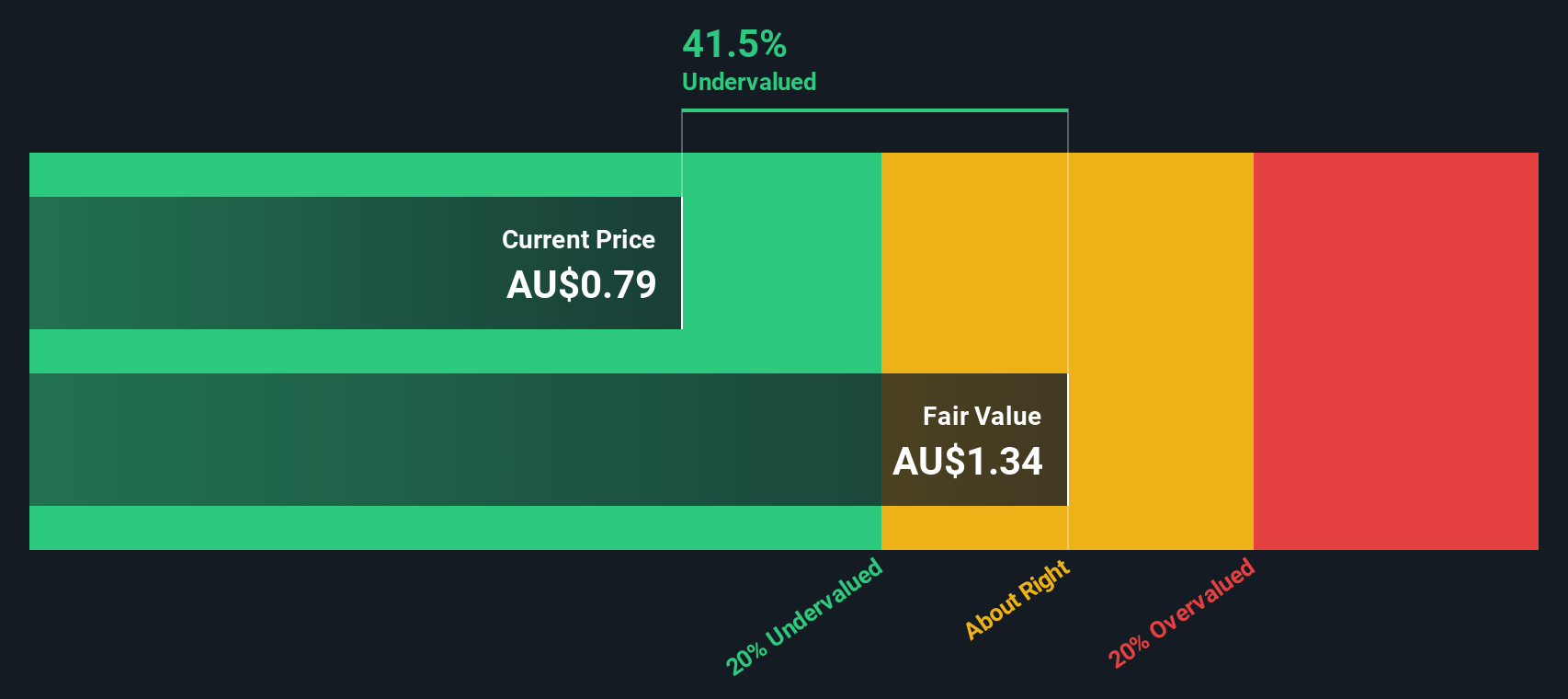

PE: 28.2x

Praemium, a small-cap company in Asia, showcases insider confidence with recent share purchases. Their financials reflect growth potential, reporting A$103.04 million in sales for the year ending June 30, 2025, up from A$82.73 million previously. Net income rose to A$13.56 million from A$8.75 million last year, indicating strong earnings quality despite large one-off items impacting results. The firm declared an interim dividend of A$0.0125 per share payable on September 18, 2025, suggesting steady shareholder returns amidst forecasted earnings growth of 16% annually.

- Get an in-depth perspective on Praemium's performance by reading our valuation report here.

Explore historical data to track Praemium's performance over time in our Past section.

Daiwa House Logistics Trust (SGX:DHLU)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Daiwa House Logistics Trust focuses on investing in logistics and industrial properties, with a market capitalization of S$0.76 billion.

Operations: Daiwa House Logistics Trust generates revenue primarily from investing in logistics and industrial properties, with a recent revenue figure of SGD 58.69 million. The company's cost structure includes significant components such as COGS and operating expenses, impacting its profitability. The gross profit margin has shown fluctuations, reaching 76.97% recently, reflecting the efficiency of managing direct costs relative to sales.

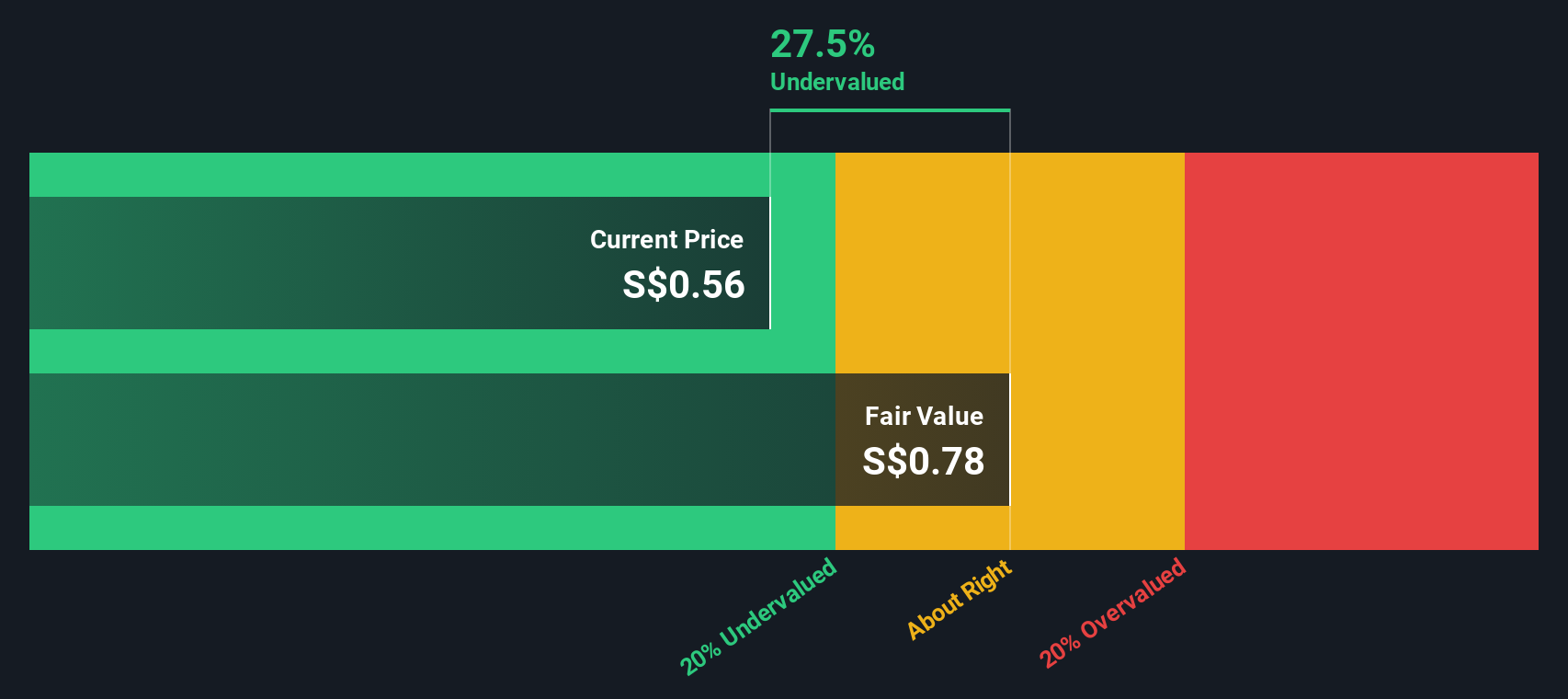

PE: 13.0x

Daiwa House Logistics Trust, a smaller player in Asia's market, recently reported half-year sales of S$29.17 million, up from S$27.58 million the previous year. However, net income fell to S$10.06 million from S$14.13 million due to large one-off items affecting earnings quality and a forecasted earnings decline of 1.1% annually over three years. Insider confidence is evident with recent share purchases by insiders, suggesting belief in future potential despite decreased dividends and reliance on external borrowing for funding stability.

- Click to explore a detailed breakdown of our findings in Daiwa House Logistics Trust's valuation report.

Gain insights into Daiwa House Logistics Trust's past trends and performance with our Past report.

Where To Now?

- Unlock our comprehensive list of 40 Undervalued Asian Small Caps With Insider Buying by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PPS

Praemium

Provides advisors and wealth management solutions in Australia and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives