Investor Optimism Abounds Objective Corporation Limited (ASX:OCL) But Growth Is Lacking

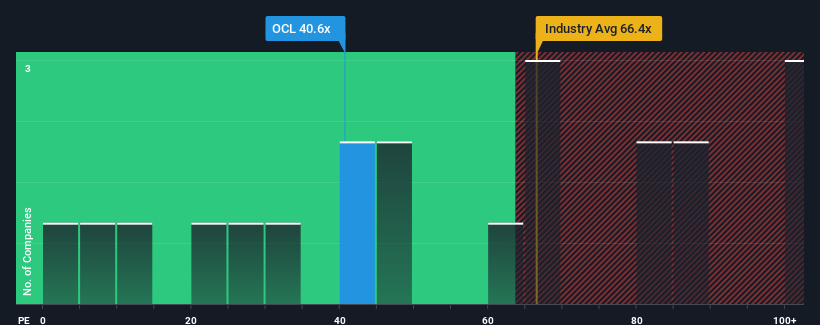

With a price-to-earnings (or "P/E") ratio of 40.6x Objective Corporation Limited (ASX:OCL) may be sending very bearish signals at the moment, given that almost half of all companies in Australia have P/E ratios under 19x and even P/E's lower than 11x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

With earnings growth that's superior to most other companies of late, Objective has been doing relatively well. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Objective

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Objective's is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 48% last year. The latest three year period has also seen an excellent 92% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings should grow by 11% per annum over the next three years. Meanwhile, the rest of the market is forecast to expand by 18% per year, which is noticeably more attractive.

With this information, we find it concerning that Objective is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From Objective's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Objective currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Objective with six simple checks on some of these key factors.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:OCL

Objective

Supplies information technology software and services in Australia and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives