Novatti Group Limited (ASX:NOV) Not Doing Enough For Some Investors As Its Shares Slump 27%

Unfortunately for some shareholders, the Novatti Group Limited (ASX:NOV) share price has dived 27% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 66% share price decline.

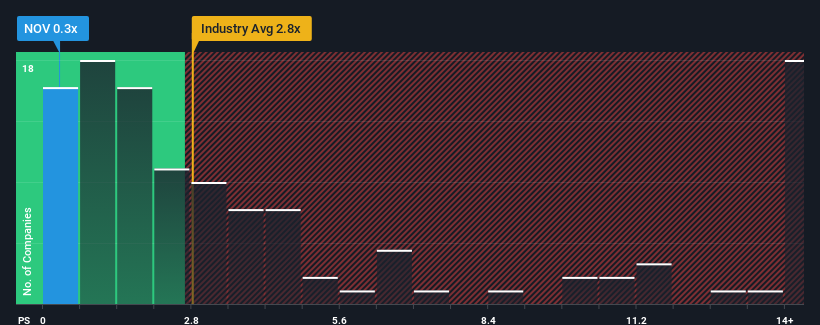

Since its price has dipped substantially, Novatti Group may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.3x, since almost half of all companies in the Software industry in Australia have P/S ratios greater than 2.8x and even P/S higher than 7x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Novatti Group

What Does Novatti Group's Recent Performance Look Like?

Recent times haven't been great for Novatti Group as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Novatti Group.How Is Novatti Group's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Novatti Group's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 10% last year. Pleasingly, revenue has also lifted 133% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 9.2% per annum during the coming three years according to the sole analyst following the company. That's shaping up to be materially lower than the 21% per annum growth forecast for the broader industry.

With this in consideration, its clear as to why Novatti Group's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Novatti Group's P/S

Novatti Group's P/S looks about as weak as its stock price lately. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of Novatti Group's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 3 warning signs for Novatti Group (1 is potentially serious!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Novatti Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:NOV

Slight risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success