Megaport (ASX:MP1): Weighing Valuation After a Choppy Few Months and Rapid Growth

Reviewed by Simply Wall St

Megaport (ASX:MP1) has had a choppy few months, but its longer term returns and rapid revenue and earnings growth are drawing fresh attention from investors who are trying to gauge whether the current pullback offers value.

See our latest analysis for Megaport.

At A$12.59, Megaport’s recent pullback, including a weaker 90 day share price return, sits in sharp contrast to its strong year to date share price momentum and impressive multi year total shareholder returns. This suggests sentiment is consolidating rather than collapsing.

If Megaport’s run has you rethinking your tech exposure, it could be a good moment to explore other high growth names through our high growth tech and AI stocks.

With shares still trading at a sizeable discount to analyst targets despite powerful revenue and earnings momentum, the key question now is whether Megaport remains undervalued or if the market is already pricing in the next leg of growth.

Most Popular Narrative: 24.9% Undervalued

With Megaport last closing at A$12.59 against a narrative fair value of A$16.76, the prevailing view leans toward meaningful upside if growth plays out.

The rapid geographic and product expansion, such as the addition of 115 new data centers and numerous new on ramps and services (Internet, Global WAN, Security), substantially increases Megaport's addressable market and depth with existing clients, supporting both ARR expansion and higher customer stickiness. This is described as setting up outperformance in revenue and long term gross margins.

Curious how ambitious revenue compounding, rising margins, and a premium earnings multiple all fit together into that higher fair value? Uncover the full playbook behind those projections.

Result: Fair Value of $16.76 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could be challenged if hyperscalers further vertically integrate connectivity or if capital intensive expansion fails to deliver expected returns.

Find out about the key risks to this Megaport narrative.

Another Lens On Value

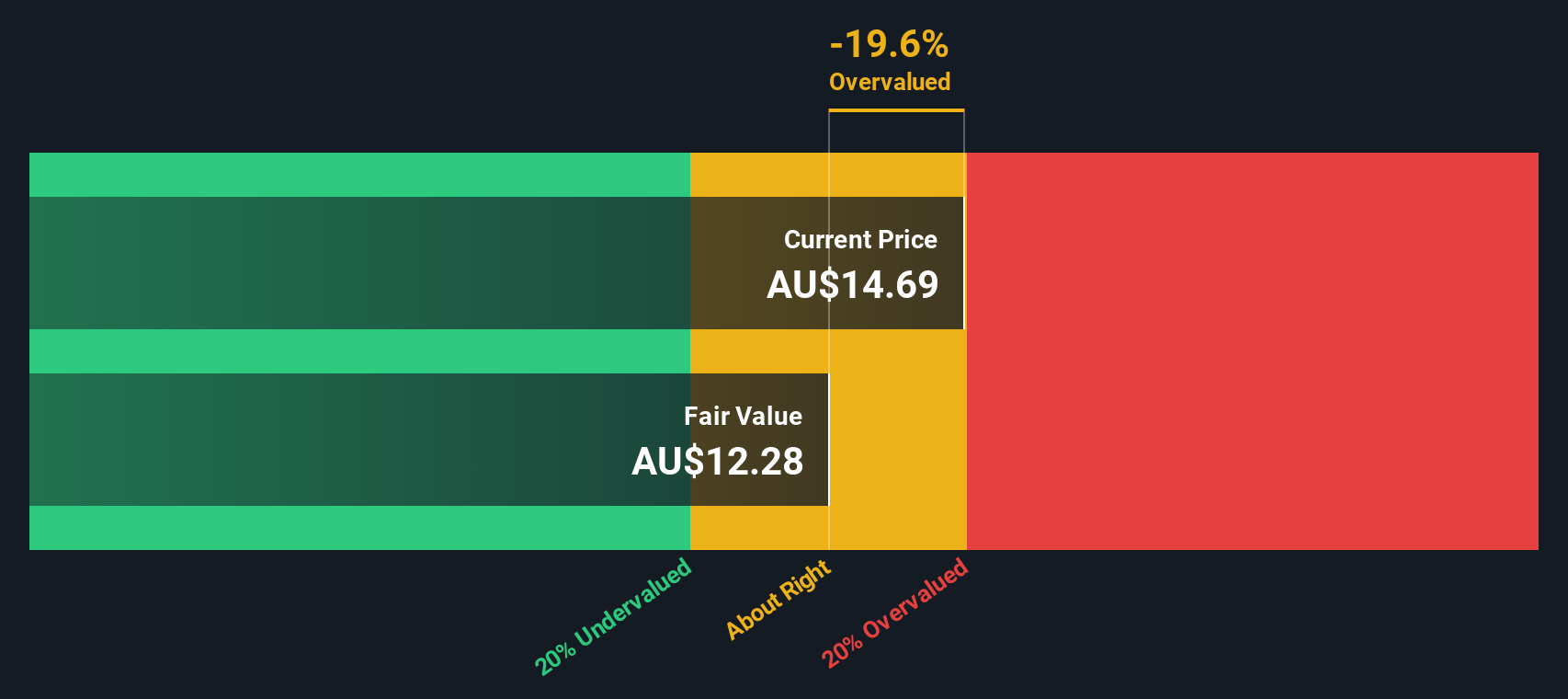

While the analyst narrative points to upside, our SWS DCF model is far more cautious and implies Megaport is trading above an intrinsic value of around A$3.54. If long term cash flows do not match the optimistic growth path, could today’s price be baking in too much hope?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Megaport Narrative

If you want to stress test these assumptions or rely on your own due diligence instead, you can build a personalised view in minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Megaport.

Ready for your next investing move?

Do not stop at a single story when you can scan the market for fresh opportunities. Let the Simply Wall Street Screener surface ideas you would hate to miss.

- Capture momentum in emerging technologies by targeting innovators through these 24 AI penny stocks that are reshaping industries with practical, scalable AI solutions.

- Lock in potential value by reviewing these 917 undervalued stocks based on cash flows that the market may be mispricing based on their underlying cash flows.

- Strengthen your income strategy by focusing on these 13 dividend stocks with yields > 3% that can help support a reliable return profile over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MP1

Megaport

Provides on-demand interconnection services in Australia, New Zealand, Hong Kong, Singapore, Japan, the United States of America, Canada, Mexico, and Brazil, and Europe.

High growth potential with excellent balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion