As Australian shares brace for a downturn, mirroring the decline in U.S. markets, investors are increasingly looking for opportunities that can withstand volatility. Penny stocks, though an older term, represent smaller or less-established companies that may offer significant value when chosen wisely. By focusing on those with strong financials and potential growth paths, investors can uncover opportunities among these lesser-known entities.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.69 | A$79.72M | ★★★★★★ |

| Bisalloy Steel Group (ASX:BIS) | A$3.34 | A$158.48M | ★★★★★★ |

| Regal Partners (ASX:RPL) | A$3.00 | A$1.01B | ★★★★★★ |

| GTN (ASX:GTN) | A$0.58 | A$113.9M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.43 | A$376.38M | ★★★★★☆ |

| CTI Logistics (ASX:CLX) | A$1.725 | A$134.57M | ★★★★☆☆ |

| Sugar Terminals (NSX:SUG) | A$1.10 | A$381.6M | ★★★★★★ |

| Perenti (ASX:PRN) | A$1.265 | A$1.18B | ★★★★★★ |

| West African Resources (ASX:WAF) | A$2.24 | A$2.55B | ★★★★★★ |

| Accent Group (ASX:AX1) | A$1.865 | A$1.06B | ★★★★☆☆ |

Click here to see the full list of 1,011 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Ai-Media Technologies (ASX:AIM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ai-Media Technologies Limited offers technology-driven captioning, transcription, and translation services across several regions including Australia, New Zealand, Singapore, Malaysia, North America, and the United Kingdom with a market cap of A$149.30 million.

Operations: The company generates revenue of A$65.30 million from its Internet Software & Services segment.

Market Cap: A$149.3M

Ai-Media Technologies, with a market cap of A$149.30 million, operates in the Internet Software & Services segment and has been unprofitable but is reducing losses by 34.8% annually over five years. It maintains a strong financial position with short-term assets exceeding liabilities and more cash than debt, providing a cash runway beyond three years due to positive free cash flow growth. Despite recent earnings showing increased net loss for H1 2025, Ai-Media's innovative AI-driven captioning solutions showcased at ISE 2025 highlight its commitment to expanding accessibility services across Europe amid upcoming regulatory changes.

- Click here and access our complete financial health analysis report to understand the dynamics of Ai-Media Technologies.

- Learn about Ai-Media Technologies' future growth trajectory here.

Delta Lithium (ASX:DLI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Delta Lithium Limited engages in the exploration and development of lithium and gold properties in Western Australia, with a market cap of A$128.98 million.

Operations: Delta Lithium Limited does not report any revenue segments.

Market Cap: A$128.98M

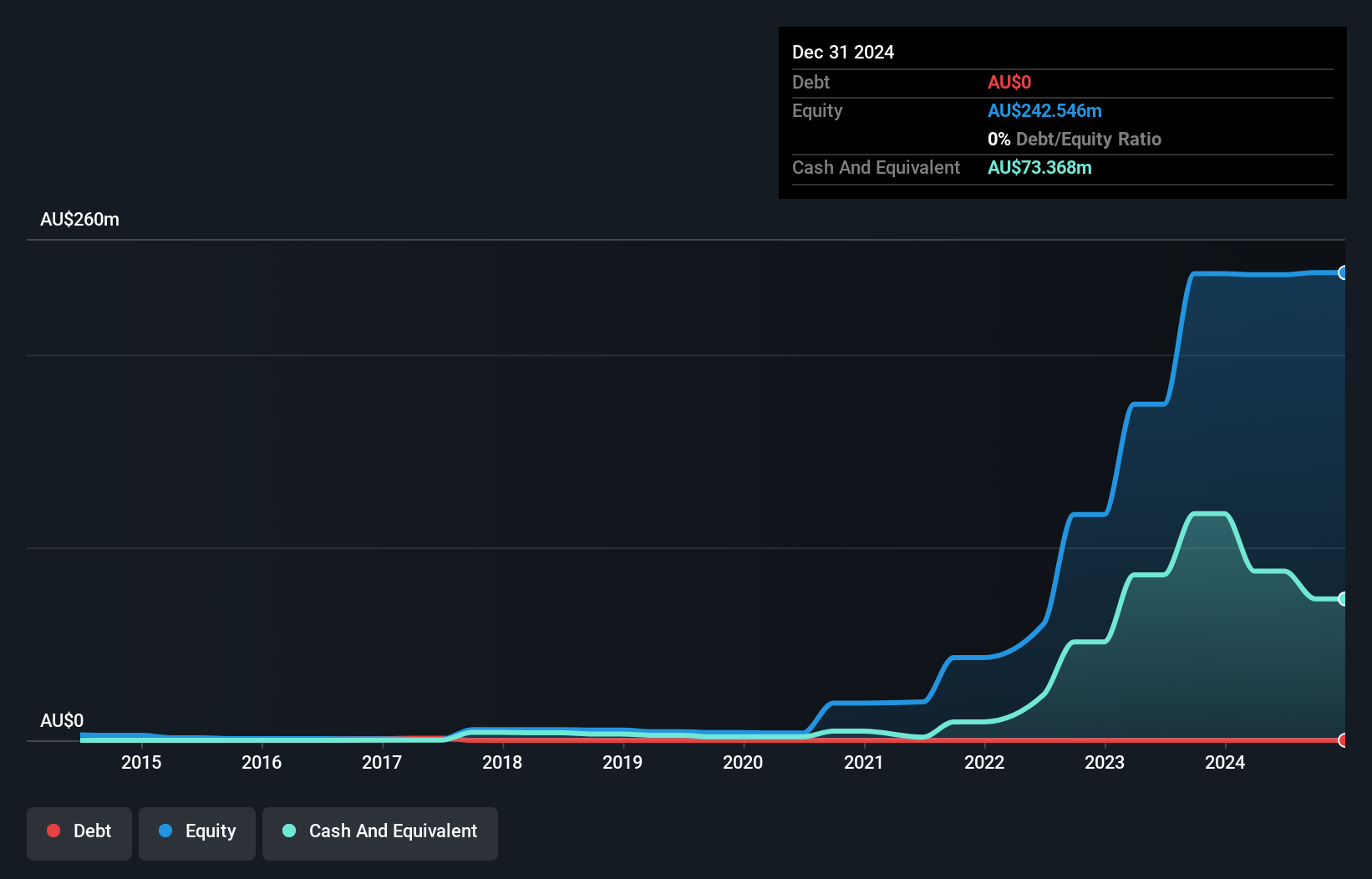

Delta Lithium Limited, with a market cap of A$128.98 million, focuses on lithium and gold exploration in Western Australia. The company is pre-revenue, reporting A$1.45 million for the half-year ended December 31, 2024. Despite being unprofitable and not expected to reach profitability within three years, Delta Lithium maintains a strong financial position with short-term assets of A$89.8 million exceeding both short-term and long-term liabilities significantly. The company is debt-free and has a cash runway for more than two years if free cash flow continues to decrease at historical rates, providing some stability amid its ongoing development phase.

- Click here to discover the nuances of Delta Lithium with our detailed analytical financial health report.

- Assess Delta Lithium's future earnings estimates with our detailed growth reports.

Kinatico (ASX:KYP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kinatico Ltd offers screening, verification, and SaaS-based workforce management and compliance technology systems in Australia and New Zealand, with a market cap of A$73.46 million.

Operations: The company generates revenue primarily from providing screening and verification checks, amounting to A$30.35 million.

Market Cap: A$73.46M

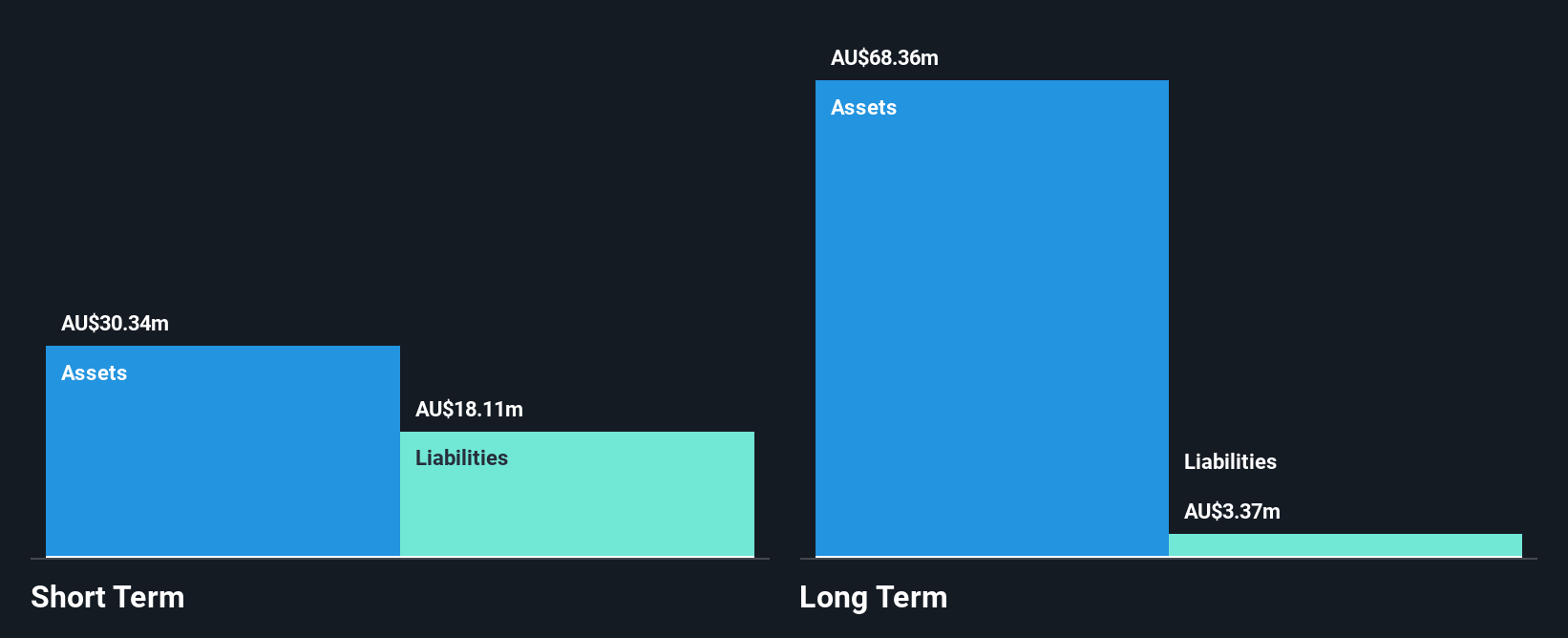

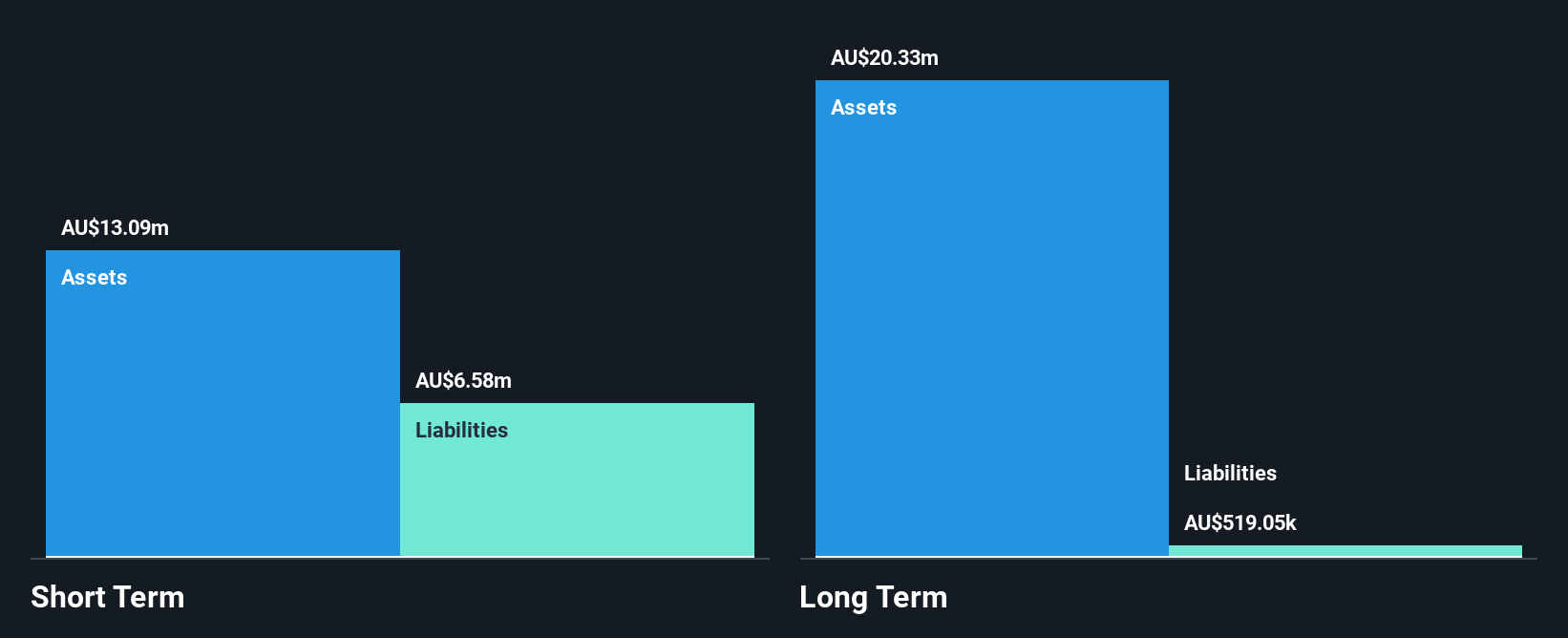

Kinatico Ltd, with a market cap of A$73.46 million, generates revenue from its screening and verification services, reporting A$15.6 million for the half-year ended December 31, 2024. Despite a decrease in profit margins to 2.8% from last year's 5.5%, the company remains debt-free with short-term assets of A$13.1 million exceeding liabilities significantly. Earnings are forecasted to grow by over 54% annually, though recent negative earnings growth presents challenges compared to industry averages. Trading at a significant discount to estimated fair value and having high-quality earnings further highlight Kinatico's potential as an investment consideration within this sector.

- Take a closer look at Kinatico's potential here in our financial health report.

- Gain insights into Kinatico's outlook and expected performance with our report on the company's earnings estimates.

Key Takeaways

- Gain an insight into the universe of 1,011 ASX Penny Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinatico might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:KYP

Kinatico

Provides screening, verification, and SaaS-based workforce management and compliance technology systems in Australia and New Zealand.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives