- Australia

- /

- Capital Markets

- /

- ASX:TIP

January 2025 ASX Penny Stocks To Watch

Reviewed by Simply Wall St

The Australian market has shown resilience, with the ASX200 closing up 0.57% at 8,447 points amid expectations of an interest rate cut by February due to easing inflation pressures. In this context, penny stocks—despite their somewhat outdated name—remain a compelling investment area when supported by strong financials. These smaller or newer companies can offer unique opportunities for growth and value, making them worth considering for investors seeking potential long-term success in under-the-radar firms.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.77 | A$143.12M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.575 | A$67.99M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.99 | A$247.08M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.97 | A$322.38M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.92 | A$104.55M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.52 | A$104.08M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.18 | A$331.46M | ★★★★☆☆ |

| Servcorp (ASX:SRV) | A$5.02 | A$491.43M | ★★★★☆☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$235.35M | ★★★★★★ |

Click here to see the full list of 1,031 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Big River Industries (ASX:BRI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Big River Industries Limited, with a market cap of A$110.56 million, operates in the manufacture, distribution, and retail of timber and building products across Australia and New Zealand.

Operations: The company's revenue is derived from two main segments: Panels, generating A$123.58 million, and Construction, contributing A$291.09 million.

Market Cap: A$110.56M

Big River Industries Limited, with a market cap of A$110.56 million, operates in the timber and building products sector. The company has demonstrated significant earnings growth over the past five years, although recent performance shows negative earnings growth and reduced profit margins from 4.9% to 1.9%. Despite this, its debt is well covered by operating cash flow at 40.5%, and short-term assets exceed both short-term and long-term liabilities, indicating solid financial health. Trading below estimated fair value suggests potential undervaluation; however, an inexperienced management team may present challenges in maintaining consistent dividend payouts and achieving forecasted earnings growth of 20.86% annually.

- Jump into the full analysis health report here for a deeper understanding of Big River Industries.

- Gain insights into Big River Industries' future direction by reviewing our growth report.

Janison Education Group (ASX:JAN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Janison Education Group Limited provides online assessment software, products, and services across Australia, New Zealand, Asia, and other international markets with a market cap of A$44.18 million.

Operations: The company's revenue is primarily derived from its Solutions segment, which generated A$28.03 million, and its Assessments segment, contributing A$15.03 million.

Market Cap: A$44.18M

Janison Education Group Limited, with a market cap of A$44.18 million, remains unprofitable and is not expected to achieve profitability in the next three years. The company benefits from a debt-free status and has sufficient cash runway for over three years based on current free cash flow. Its short-term assets of A$16.9 million exceed both short-term and long-term liabilities, indicating reasonable financial stability despite ongoing losses that have increased at 43.1% annually over five years. Recent board changes include the appointment of Ms Maria Clemente as Company Secretary following Ms Belinda Cleminson's resignation, suggesting potential shifts in governance dynamics.

- Click here to discover the nuances of Janison Education Group with our detailed analytical financial health report.

- Evaluate Janison Education Group's prospects by accessing our earnings growth report.

Teaminvest Private Group (ASX:TIP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Teaminvest Private Group Limited is a private equity firm focusing on middle market and mature companies through buyout and growth capital transactions, with a market cap of A$57.19 million.

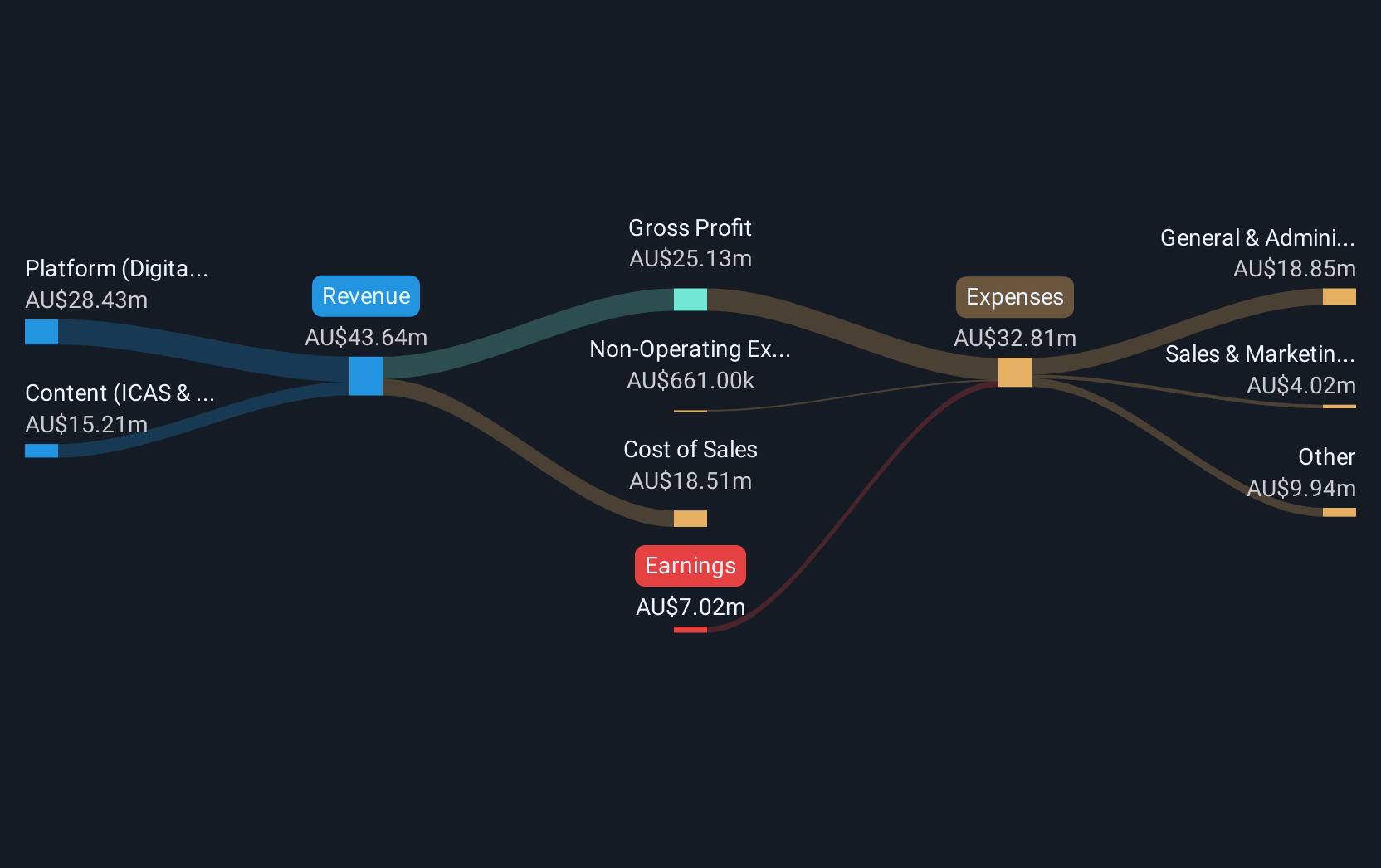

Operations: The company's revenue is primarily derived from its Equity segment, which contributes A$98.82 million, followed by the Education & Corporate and Wealth segments, generating A$4.23 million and A$3.04 million respectively.

Market Cap: A$57.19M

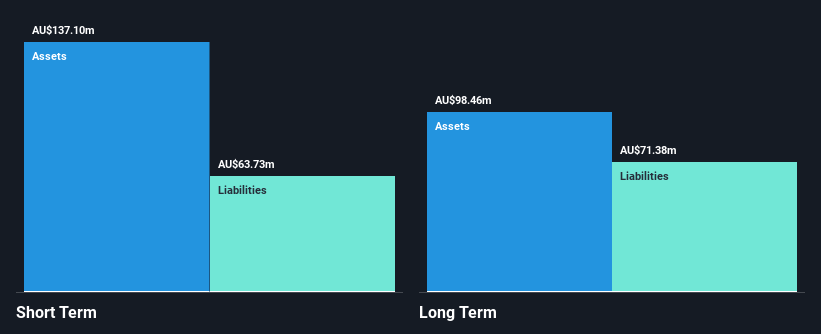

Teaminvest Private Group Limited, with a market cap of A$57.19 million, focuses on middle-market and mature companies through buyout and growth capital transactions. Despite its unprofitability and negative return on equity (-1.47%), the company demonstrates financial resilience with short-term assets (A$40.6M) exceeding both short-term (A$28.4M) and long-term liabilities (A$21.7M). Its interest payments are well-covered by EBIT, indicating effective debt management, further supported by operating cash flow covering debt at a very large rate. The experienced board and management team bolster governance stability amidst challenges in achieving profitability as losses have increased over five years.

- Take a closer look at Teaminvest Private Group's potential here in our financial health report.

- Examine Teaminvest Private Group's past performance report to understand how it has performed in prior years.

Key Takeaways

- Explore the 1,031 names from our ASX Penny Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teaminvest Private Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TIP

Teaminvest Private Group

A private equity firm specializing in middle market and mature companies providing buyout and growth capital transactions.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives