Janison Education Group's (ASX:JAN) Stock Price Has Reduced 11% In The Past Year

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. That downside risk was realized by Janison Education Group Limited (ASX:JAN) shareholders over the last year, as the share price declined 11%. That's well below the market decline of 2.2%. Janison Education Group hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Unhappily, the share price slid 3.8% in the last week.

See our latest analysis for Janison Education Group

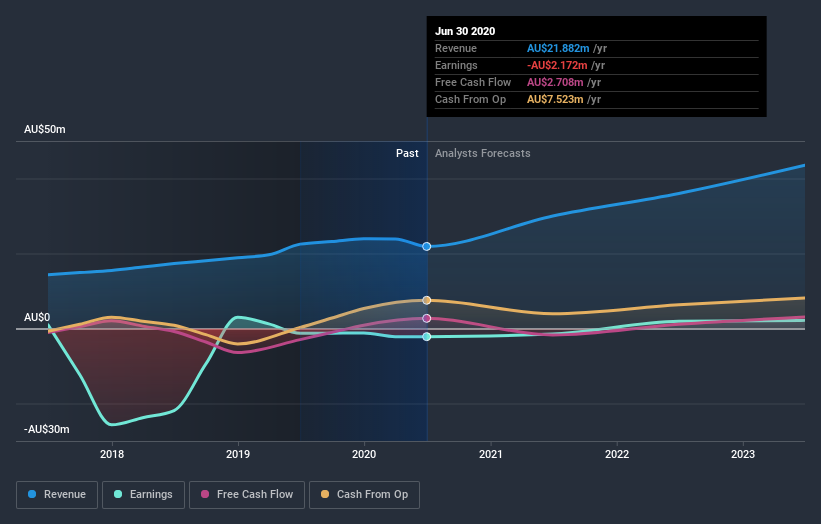

Given that Janison Education Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In just one year Janison Education Group saw its revenue fall by 2.8%. That's not what investors generally want to see. The stock price has languished lately, falling 11% in a year. That seems pretty reasonable given the lack of both profits and revenue growth. It's hard to escape the conclusion that buyers must envision either growth down the track, cost cutting, or both.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Janison Education Group stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While Janison Education Group shareholders are down 11% for the year, the market itself is up 2.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 3.8%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Janison Education Group has 2 warning signs we think you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you decide to trade Janison Education Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:JAN

Janison Education Group

Provides online assessment software, assessment products, and assessment services in Australia, New Zealand, Asia, and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives