The Australian market has been experiencing a surge in positive sentiment, buoyed by the Reserve Bank of Australia's recent rate cuts and strong performance in key indices like the ASX200 and All Ords. For investors seeking opportunities beyond established giants, penny stocks can present intriguing possibilities. Despite their vintage name, these smaller or newer companies often combine value with growth potential, making them worth watching for those interested in discovering under-the-radar investments with solid financial foundations.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.41 | A$117.5M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.21 | A$104.25M | ✅ 4 ⚠️ 3 View Analysis > |

| GTN (ASX:GTN) | A$0.39 | A$74.36M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.99 | A$461M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.68 | A$3.06B | ✅ 5 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$3.00 | A$1.01B | ✅ 4 ⚠️ 2 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$363.6M | ✅ 2 ⚠️ 2 View Analysis > |

| Austco Healthcare (ASX:AHC) | A$0.365 | A$133.41M | ✅ 4 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.82 | A$146.59M | ✅ 4 ⚠️ 2 View Analysis > |

| Reckon (ASX:RKN) | A$0.645 | A$73.08M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 458 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Accent Group (ASX:AX1)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Accent Group Limited operates in the retail, distribution, and franchise sectors for lifestyle footwear, apparel, and accessories across Australia and New Zealand, with a market cap of A$913.80 million.

Operations: The company's revenue is derived from two main segments: Retail, accounting for A$1.30 billion, and Wholesale, contributing A$475.92 million.

Market Cap: A$913.8M

Accent Group, with a market cap of A$913.80 million, recently completed a follow-on equity offering of A$60.45 million, enhancing its financial flexibility. The company faces challenges with short-term assets not covering long-term liabilities but maintains well-covered interest payments and debt by operating cash flow. Despite negative earnings growth last year and lower net profit margins, Accent's high-quality earnings and stable weekly volatility are positive indicators. Recent board changes signal strategic shifts as Nigel Wright takes over as Group Chair following Tom Miskell's retirement, potentially impacting governance and strategic direction in the retail sector.

- Jump into the full analysis health report here for a deeper understanding of Accent Group.

- Explore Accent Group's analyst forecasts in our growth report.

Janison Education Group (ASX:JAN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Janison Education Group Limited provides online assessment software, products, and services across Australia, New Zealand, Asia, and internationally with a market cap of A$59.77 million.

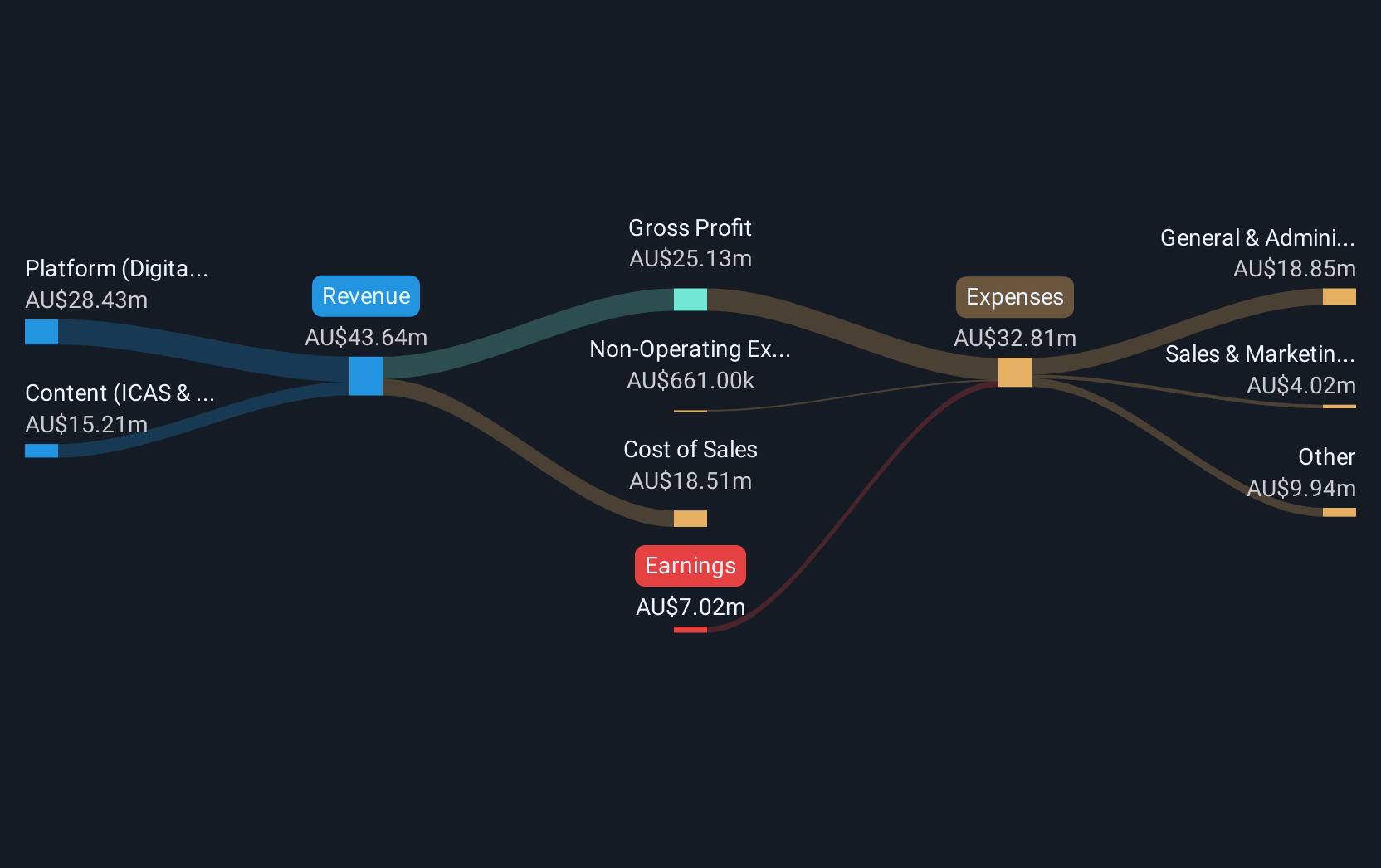

Operations: The company generates revenue from two main segments: Content (ICAS & AAS) with A$15.21 million and Platform (Digital Assessments) contributing A$28.43 million.

Market Cap: A$59.77M

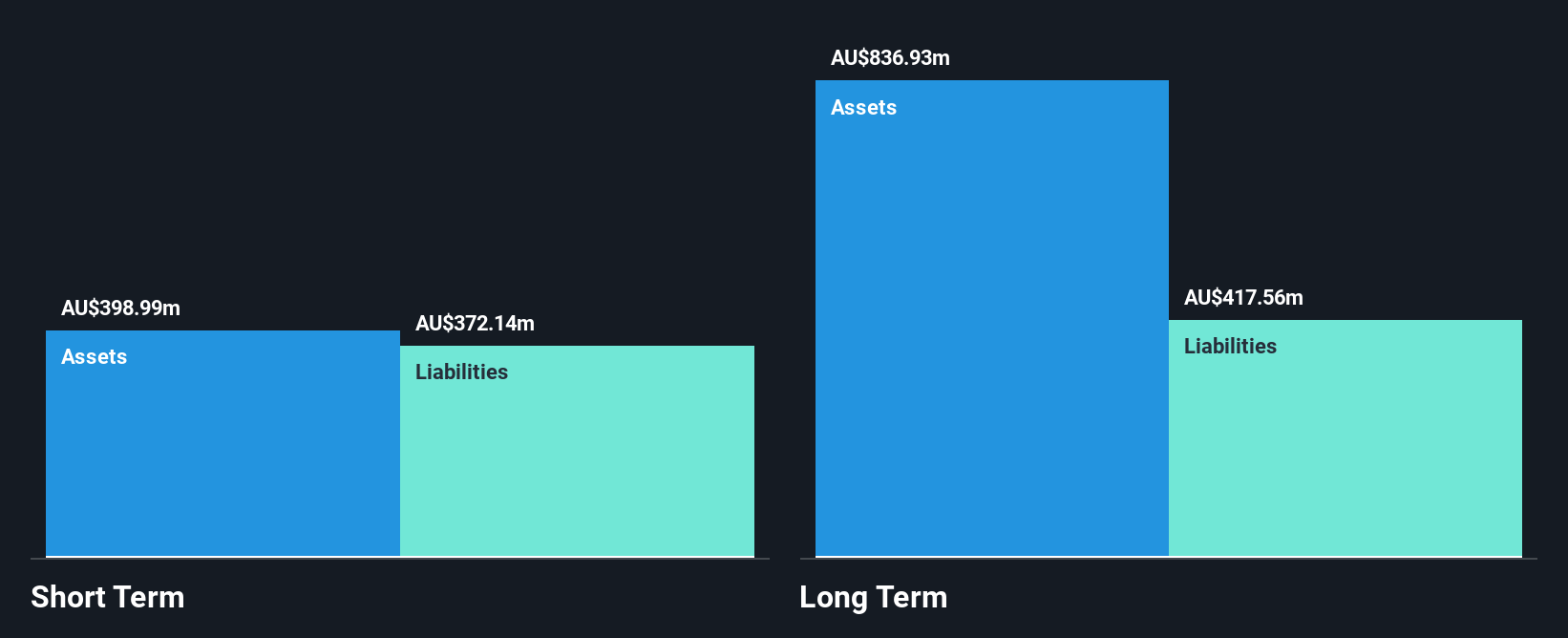

Janison Education Group, with a market cap of A$59.77 million, is navigating its unprofitable status by focusing on strategic leadership changes and maintaining a strong cash position. The recent appointment of Dharmendra Singh as CFO complements the new executive team aiming to accelerate transformation strategies. Despite negative returns on equity and increased losses over five years, Janison's short-term assets comfortably cover liabilities, and it remains debt-free. The company trades at a significant discount to its estimated fair value while having sufficient cash runway for over three years due to positive free cash flow growth.

- Navigate through the intricacies of Janison Education Group with our comprehensive balance sheet health report here.

- Gain insights into Janison Education Group's future direction by reviewing our growth report.

Wagners Holding (ASX:WGN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Wagners Holding Company Limited is involved in the production and sale of construction materials across Australia, the United States, New Zealand, the United Kingdom, PNG, and Malaysia with a market capitalization of A$418.39 million.

Operations: The company generates revenue from its Construction Materials segment at A$235.11 million, Project Services at A$146.75 million, Earth Friendly Concrete at A$0.11 million, and Composite Fibre Technology at A$63.02 million.

Market Cap: A$418.39M

Wagners Holding, with a market cap of A$418.39 million, has demonstrated strong financial performance despite being classified as a penny stock. The company has experienced significant earnings growth of 195.5% over the past year, surpassing both its industry and its own five-year average growth rate. Its short-term assets exceed short-term liabilities, although they fall short of covering long-term liabilities. Wagners' debt is well-managed with operating cash flow comfortably covering it, and interest payments are adequately covered by EBIT. Despite trading slightly below estimated fair value, the company's return on equity remains low at 13.7%.

- Dive into the specifics of Wagners Holding here with our thorough balance sheet health report.

- Examine Wagners Holding's earnings growth report to understand how analysts expect it to perform.

Turning Ideas Into Actions

- Click here to access our complete index of 458 ASX Penny Stocks.

- Searching for a Fresh Perspective? Uncover 14 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:JAN

Janison Education Group

Provides online assessment software, assessment products, and assessment services in Australia, New Zealand, Asia, and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives