When Can We Expect A Profit From Envirosuite Limited (ASX:EVS)?

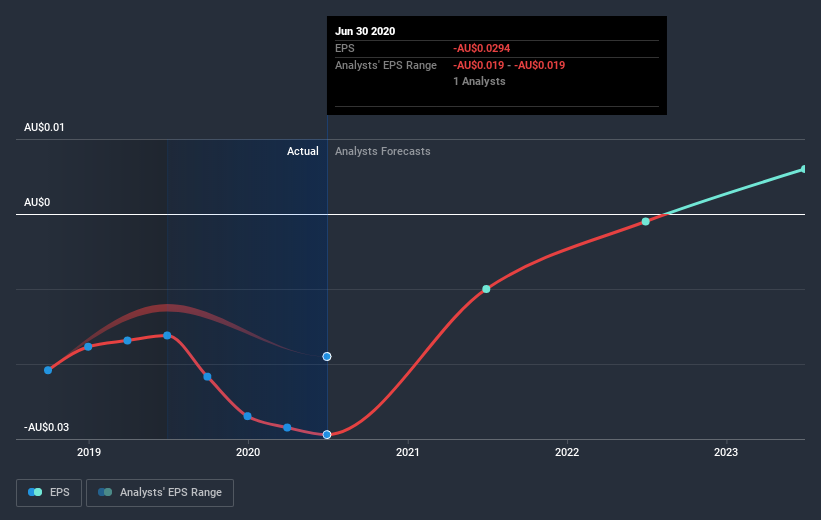

With the business potentially at an important milestone, we thought we'd take a closer look at Envirosuite Limited's (ASX:EVS) future prospects. Envirosuite Limited develops and sells environmental management technology platform solutions. The AU$169m market-cap company announced a latest loss of AU$18m on 30 June 2020 for its most recent financial year result. The most pressing concern for investors is Envirosuite's path to profitability – when will it breakeven? We've put together a brief outline of industry analyst expectations for the company, its year of breakeven and its implied growth rate.

Check out our latest analysis for Envirosuite

Envirosuite is bordering on breakeven, according to some Australian Software analysts. They anticipate the company to incur a final loss in 2022, before generating positive profits of AU$6.7m in 2023. Therefore, the company is expected to breakeven roughly 2 years from today. In order to meet this breakeven date, we calculated the rate at which the company must grow year-on-year. It turns out an average annual growth rate of 92% is expected, which signals high confidence from analysts. Should the business grow at a slower rate, it will become profitable at a later date than expected.

Given this is a high-level overview, we won’t go into details of Envirosuite's upcoming projects, however, bear in mind that by and large a high growth rate is not out of the ordinary, particularly when a company is in a period of investment.

Before we wrap up, there’s one aspect worth mentioning. Envirosuite currently has no debt on its balance sheet, which is rare for a loss-making growth company, which typically has high debt relative to its equity. The company currently operates purely off its shareholder funding and has no debt obligation, reducing concerns around repayments and making it a less risky investment.

Next Steps:

There are too many aspects of Envirosuite to cover in one brief article, but the key fundamentals for the company can all be found in one place – Envirosuite's company page on Simply Wall St. We've also put together a list of relevant factors you should further examine:

- Historical Track Record: What has Envirosuite's performance been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Envirosuite's board and the CEO’s background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

If you decide to trade Envirosuite, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Envirosuite might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:EVS

Envirosuite

Develops and sells environmental management technology solutions.

Reasonable growth potential and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion