- Australia

- /

- Metals and Mining

- /

- ASX:HAV

3 ASX Penny Stocks With Market Caps Larger Than A$90M

Reviewed by Simply Wall St

The Australian market has been experiencing volatility, with geopolitical events and rising inflation contributing to uncertainty. Despite these challenges, investors continue to explore opportunities beyond the major players, considering penny stocks as a viable option. While the term "penny stocks" might seem outdated, these smaller or newer companies can still offer intriguing prospects for growth at lower price points, especially when backed by strong financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.465 | A$133.26M | ✅ 4 ⚠️ 3 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.88 | A$54.8M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.98 | A$458M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.56 | A$262.75M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.044 | A$51.47M | ✅ 3 ⚠️ 1 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.22 | A$1.36B | ✅ 3 ⚠️ 1 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.87 | A$265.71M | ✅ 3 ⚠️ 2 View Analysis > |

| Perenti (ASX:PRN) | A$2.55 | A$2.4B | ✅ 3 ⚠️ 3 View Analysis > |

| GWA Group (ASX:GWA) | A$2.40 | A$630.63M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 418 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

DUG Technology (ASX:DUG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: DUG Technology Ltd is a technology company offering hardware and software solutions to the technology and resource sectors across Australia, the United States, the United Kingdom, Malaysia, and the United Arab Emirates with a market cap of A$301.26 million.

Operations: DUG Technology Ltd generates revenue from three primary segments: Hpcaas ($27.44 million), Services ($51.87 million), and Software ($10.47 million).

Market Cap: A$301.26M

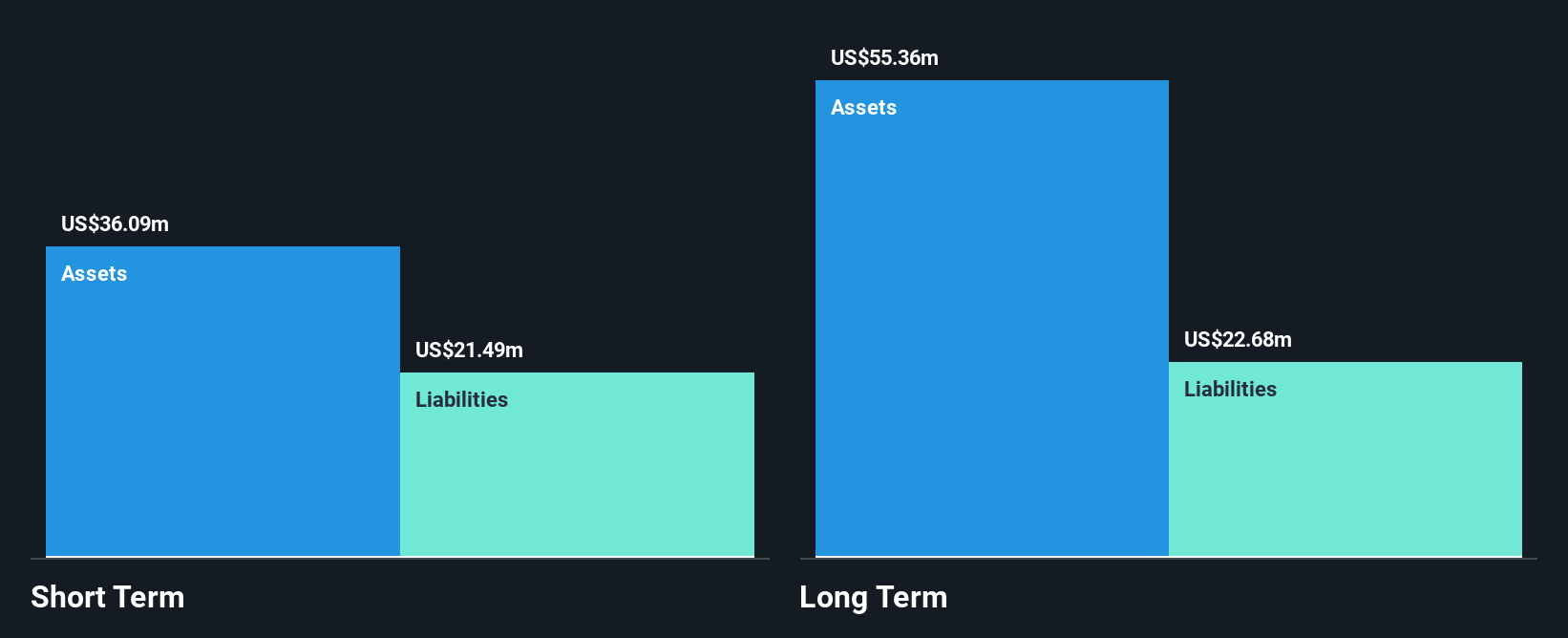

DUG Technology Ltd, with a market cap of A$301.26 million, operates in the technology sector offering solutions across multiple regions. The company reported annual revenue of US$66.09 million and a net loss of US$3.89 million for the year ending June 30, 2025, indicating financial challenges despite reducing losses over five years at a significant rate. DUG's short-term assets exceed both its long-term and short-term liabilities, reflecting solid liquidity management. Trading well below estimated fair value and not experiencing shareholder dilution recently, it presents potential value but remains unprofitable with negative return on equity (-9.32%).

- Click here to discover the nuances of DUG Technology with our detailed analytical financial health report.

- Examine DUG Technology's earnings growth report to understand how analysts expect it to perform.

Havilah Resources (ASX:HAV)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Havilah Resources Limited, along with its subsidiaries, focuses on the exploration and evaluation of mineral tenements and mining leases in Australia, with a market cap of A$96.35 million.

Operations: Havilah Resources Limited does not currently report any distinct revenue segments.

Market Cap: A$96.35M

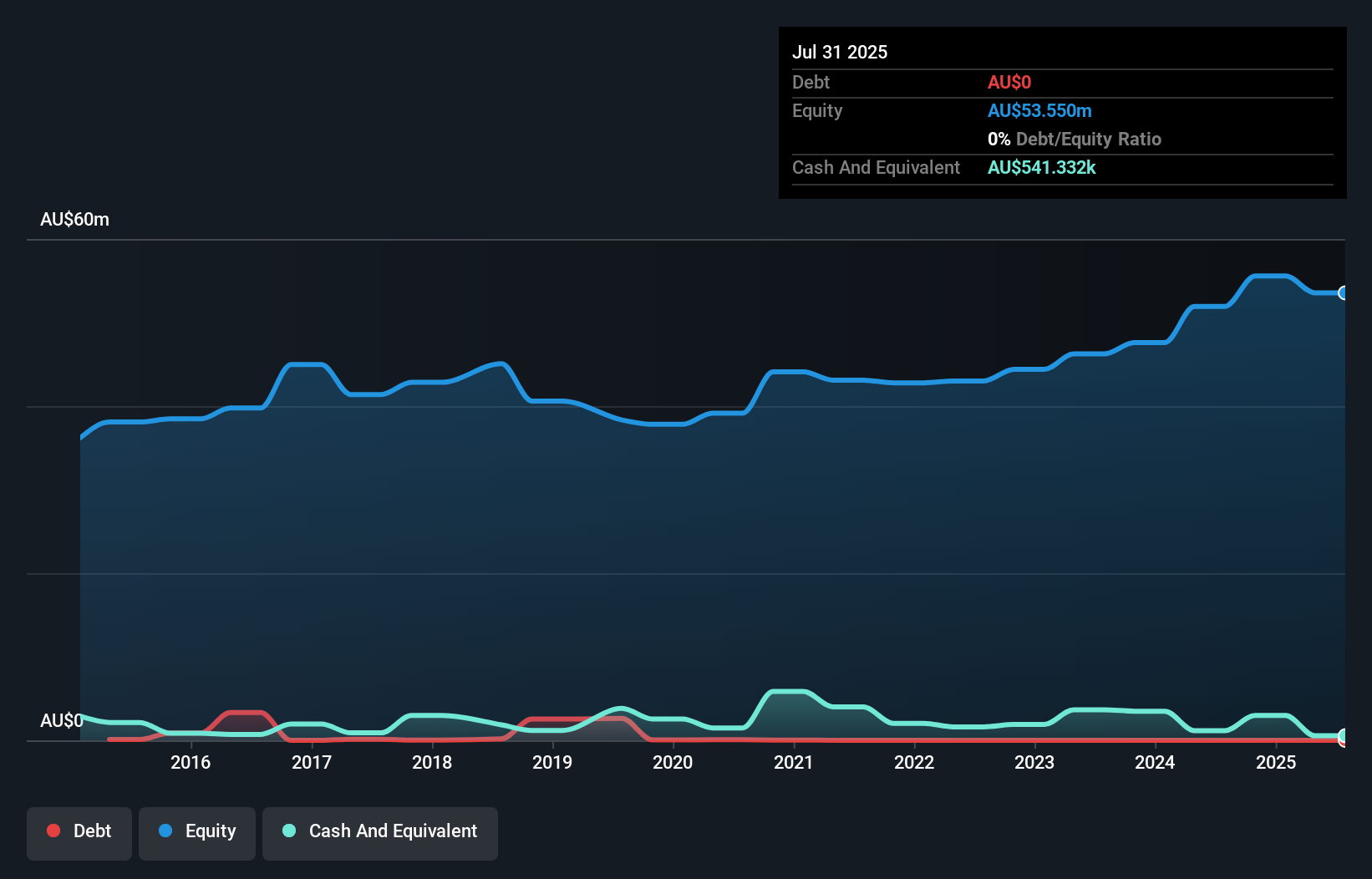

Havilah Resources Limited, with a market cap of A$96.35 million, remains pre-revenue as it focuses on mineral exploration in Australia. The company reported a net loss of A$3.28 million for the year ending July 31, 2025, following an equity offering that raised A$2 million. Recent high-grade uranium drilling results at Johnson Dam suggest potential for significant discoveries, though challenges such as drillhole positioning persist. Havilah's short-term assets significantly exceed both its short and long-term liabilities, and it operates debt-free with an experienced management team averaging 6.5 years tenure but continues to be unprofitable with negative return on equity (-6.13%).

- Unlock comprehensive insights into our analysis of Havilah Resources stock in this financial health report.

- Gain insights into Havilah Resources' historical outcomes by reviewing our past performance report.

ReadyTech Holdings (ASX:RDY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ReadyTech Holdings Limited offers technology-based solutions across Australia, New Zealand, the United Kingdom, and the United States, with a market cap of A$260.72 million.

Operations: ReadyTech Holdings generates revenue from three primary segments: Workforce Solutions (A$34.59 million), Government and Justice (A$43.67 million), and Education and Work Pathways (A$43.57 million).

Market Cap: A$260.72M

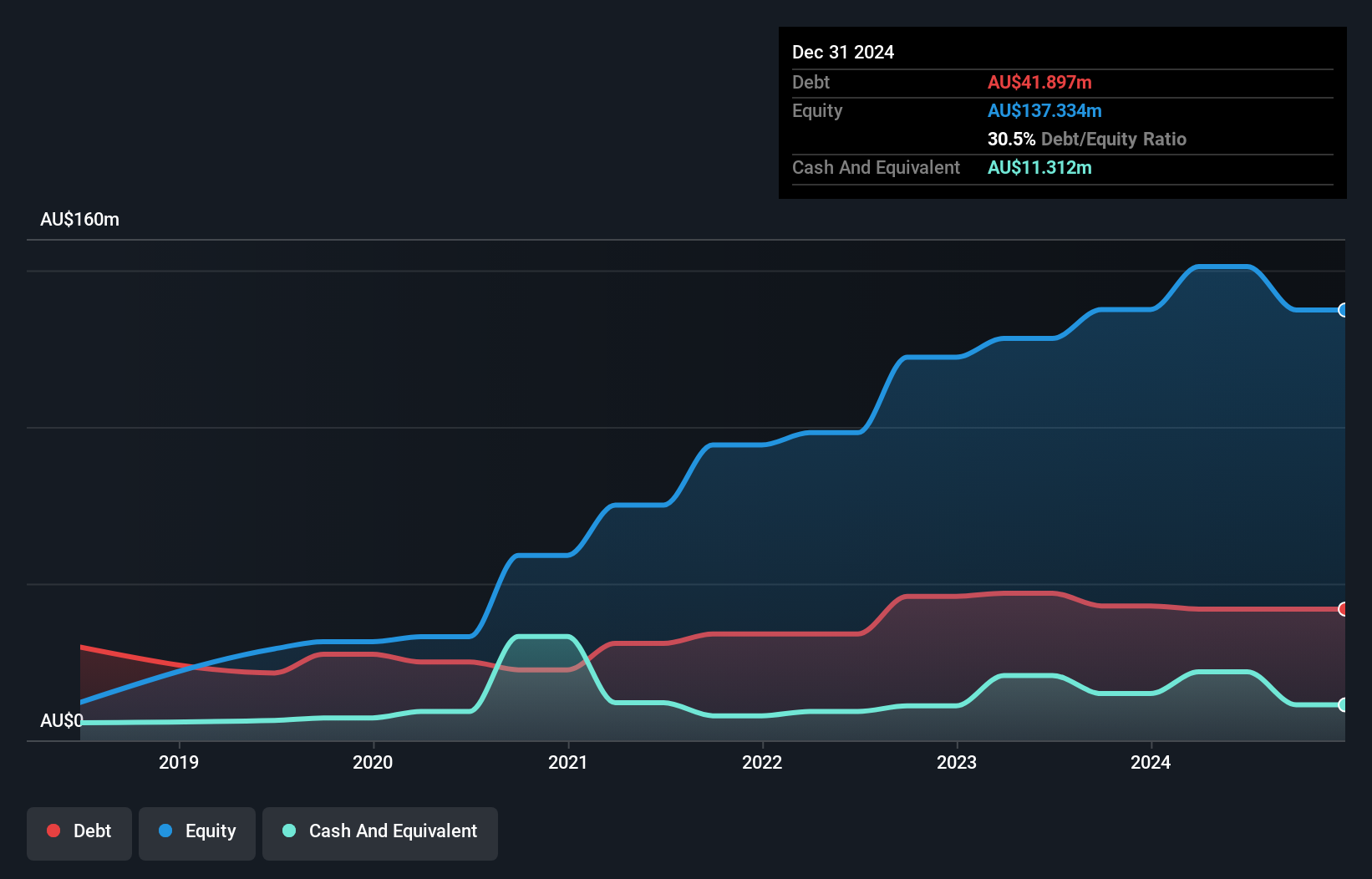

ReadyTech Holdings Limited, with a market cap of A$260.72 million, is currently unprofitable but has shown stable weekly volatility at 7%. The company's revenue streams include Workforce Solutions (A$34.59 million), Government and Justice (A$43.67 million), and Education and Work Pathways (A$43.57 million). Despite a net loss of A$16.14 million for the year ending June 30, 2025, ReadyTech forecasts revenue growth to reach up to A$153 million by 2027. The recent appointment of Bryce Thompson as CFO brings extensive technology finance expertise to the seasoned management team averaging over five years in tenure.

- Jump into the full analysis health report here for a deeper understanding of ReadyTech Holdings.

- Learn about ReadyTech Holdings' future growth trajectory here.

Summing It All Up

- Click here to access our complete index of 418 ASX Penny Stocks.

- Ready To Venture Into Other Investment Styles? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Havilah Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HAV

Havilah Resources

Engages in the exploration and evaluation of mineral exploration tenements and mining leases in Australia.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives