Data#3 Limited (ASX:DTL) will increase its dividend from last year's comparable payment on the 29th of September to A$0.119. This makes the dividend yield 3.0%, which is above the industry average.

View our latest analysis for Data#3

Data#3's Dividend Is Well Covered By Earnings

If the payments aren't sustainable, a high yield for a few years won't matter that much. Prior to this announcement, Data#3's dividend made up quite a large proportion of earnings but only 12% of free cash flows. In general, cash flows are more important than earnings, so we are comfortable that the dividend will be sustainable going forward, especially with so much cash left over for reinvestment.

EPS is set to grow by 34.8% over the next year. If the dividend continues along recent trends, we estimate the payout ratio could reach 77%, which is on the higher side, but certainly still feasible.

Dividend Volatility

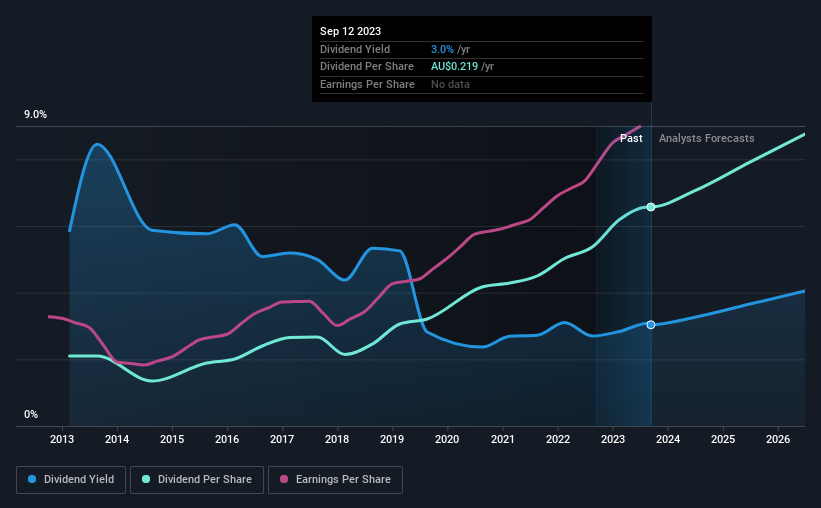

The company has a long dividend track record, but it doesn't look great with cuts in the past. The dividend has gone from an annual total of A$0.07 in 2013 to the most recent total annual payment of A$0.219. This works out to be a compound annual growth rate (CAGR) of approximately 12% a year over that time. It is great to see strong growth in the dividend payments, but cuts are concerning as it may indicate the payout policy is too ambitious.

Dividend Growth Could Be Constrained

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Data#3 has seen EPS rising for the last five years, at 21% per annum. However, Data#3 isn't reinvesting a lot back into the business, so we wonder how quickly it will be able to grow in the future.

In Summary

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. This company is not in the top tier of income providing stocks.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Taking the debate a bit further, we've identified 1 warning sign for Data#3 that investors need to be conscious of moving forward. Is Data#3 not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:DTL

Data#3

Provides information technology solutions and services in Australia.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion