DigitalX Limited's (ASX:DCC) weak earnings were disregarded by the market. Despite the market responding positively, we think that there are several concerning factors that investors should be aware of.

See our latest analysis for DigitalX

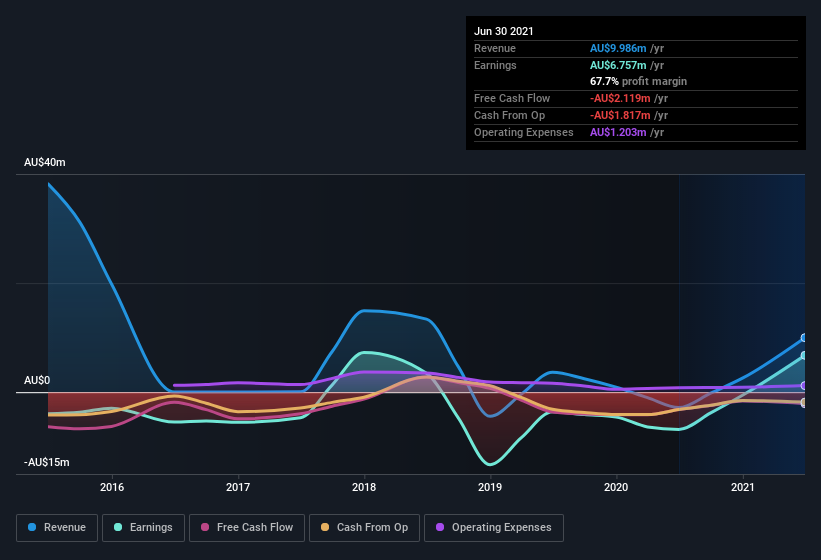

Examining Cashflow Against DigitalX's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

DigitalX has an accrual ratio of 0.35 for the year to June 2021. We can therefore deduce that its free cash flow fell well short of covering its statutory profit, suggesting we might want to think twice before putting a lot of weight on the latter. Over the last year it actually had negative free cash flow of AU$2.1m, in contrast to the aforementioned profit of AU$6.76m. We also note that DigitalX's free cash flow was actually negative last year as well, so we could understand if shareholders were bothered by its outflow of AU$2.1m. However, that's not the end of the story. We can look at how unusual items in the profit and loss statement impacted its accrual ratio, as well as explore how dilution is impacting shareholders negatively. One positive for DigitalX shareholders is that it's accrual ratio was significantly better last year, providing reason to believe that it may return to stronger cash conversion in the future. As a result, some shareholders may be looking for stronger cash conversion in the current year.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of DigitalX.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. DigitalX expanded the number of shares on issue by 21% over the last year. That means its earnings are split among a greater number of shares. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. You can see a chart of DigitalX's EPS by clicking here.

How Is Dilution Impacting DigitalX's Earnings Per Share? (EPS)

As it happens, we don't know how much the company made or lost three years ago, because we don't have the data. Zooming in to the last year, we still can't talk about growth rates coherently, since it made a loss last year. What we do know is that while it's great to see a profit over the last twelve months, that profit would have been better, on a per share basis, if the company hadn't needed to issue shares. So you can see that the dilution has had a bit of an impact on shareholders.

In the long term, if DigitalX's earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

How Do Unusual Items Influence Profit?

The fact that the company had unusual items boosting profit by AU$434k, in the last year, probably goes some way to explain why its accrual ratio was so weak. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And, after all, that's exactly what the accounting terminology implies. If DigitalX doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

Our Take On DigitalX's Profit Performance

DigitalX didn't back up its earnings with free cashflow, but this isn't too surprising given profits were inflated by unusual items. Meanwhile, the new shares issued mean that shareholders now own less of the company, unless they tipped in more cash themselves. For all the reasons mentioned above, we think that, at a glance, DigitalX's statutory profits could be considered to be low quality, because they are likely to give investors an overly positive impression of the company. If you'd like to know more about DigitalX as a business, it's important to be aware of any risks it's facing. Every company has risks, and we've spotted 4 warning signs for DigitalX (of which 1 is significant!) you should know about.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading DigitalX or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:DCC

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)