The Australian stock market recently saw a modest gain, with the ASX 200 closing up by 0.29%, as sectors like Real Estate and Healthcare led the charge while Materials and Industrials lagged. Amidst these fluctuations, investors are keenly observing the Reserve Bank of Australia's stance on inflation, which remains a pressing concern with rates unchanged for now. In such a climate, penny stocks—though an old term—still capture interest as they often represent smaller companies that can offer growth potential at lower price points. By focusing on those with solid financials and promising fundamentals, these stocks may provide opportunities for those looking to explore underappreciated segments of the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.85 | A$236.3M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.95 | A$317.49M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.51 | A$316.27M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.68 | A$823.33M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$3.17 | A$146.32M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$199.48M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.88 | A$105.46M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.87 | A$480.5M | ★★★★☆☆ |

Click here to see the full list of 1,055 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

COSOL (ASX:COS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: COSOL Limited, with a market cap of A$181.01 million, offers information technology services across the Asia Pacific, North America, Europe, the Middle East, Africa, and other international markets.

Operations: The company's revenue is derived from COSOL Asia Pacific, which accounts for A$88.99 million, and COSOL North America, contributing A$13.88 million.

Market Cap: A$181.01M

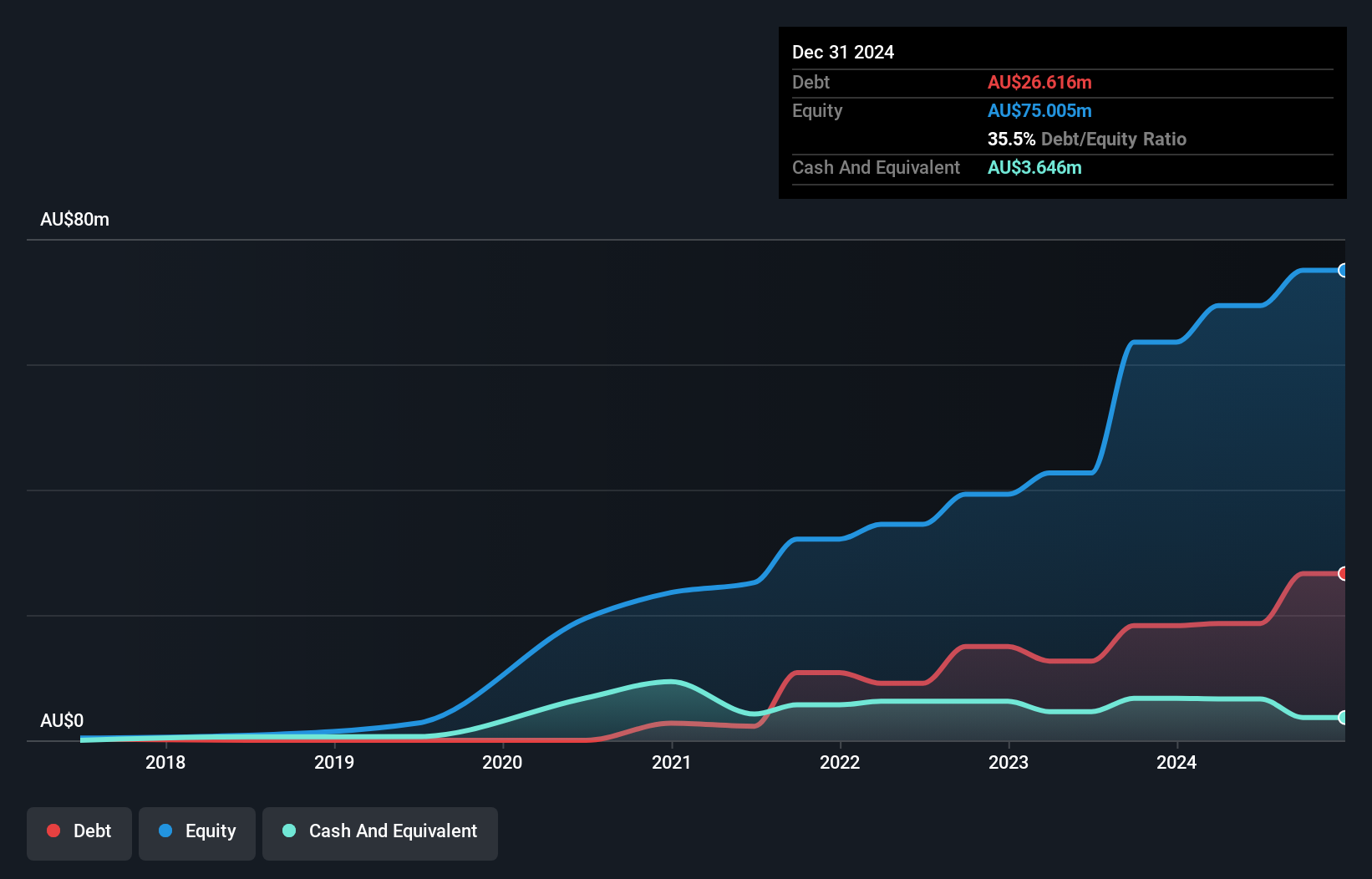

COSOL Limited, with a market cap of A$181.01 million, demonstrates solid financial health and operational stability. The company's short-term assets exceed both its short- and long-term liabilities, indicating strong liquidity management. While its earnings growth over the past year (6.7%) slightly lags behind industry benchmarks, COSOL's debt is well-covered by operating cash flow (39.4%), suggesting prudent debt management. Recent leadership changes include Scott McGowan's appointment as Managing Director and CEO, reinforcing strategic continuity amid the OneCOSOL transformation program. Despite significant insider selling recently, COSOL trades at a good value compared to peers and industry standards.

- Click here and access our complete financial health analysis report to understand the dynamics of COSOL.

- Assess COSOL's future earnings estimates with our detailed growth reports.

Environmental Group (ASX:EGL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Environmental Group Limited specializes in designing, applying, and servicing emission control systems and gas turbine inlet and exhaust systems globally, with a market cap of A$117.95 million.

Operations: The company's revenue is derived from several segments, including EGL Waste (A$0.85 million), EGL Energy (A$37.86 million), Egl Clean Air Tapc (A$17.40 million), Egl Clean Air Airtight (A$15.54 million), and EGL Turbine Enhancement (A$27.13 million).

Market Cap: A$117.95M

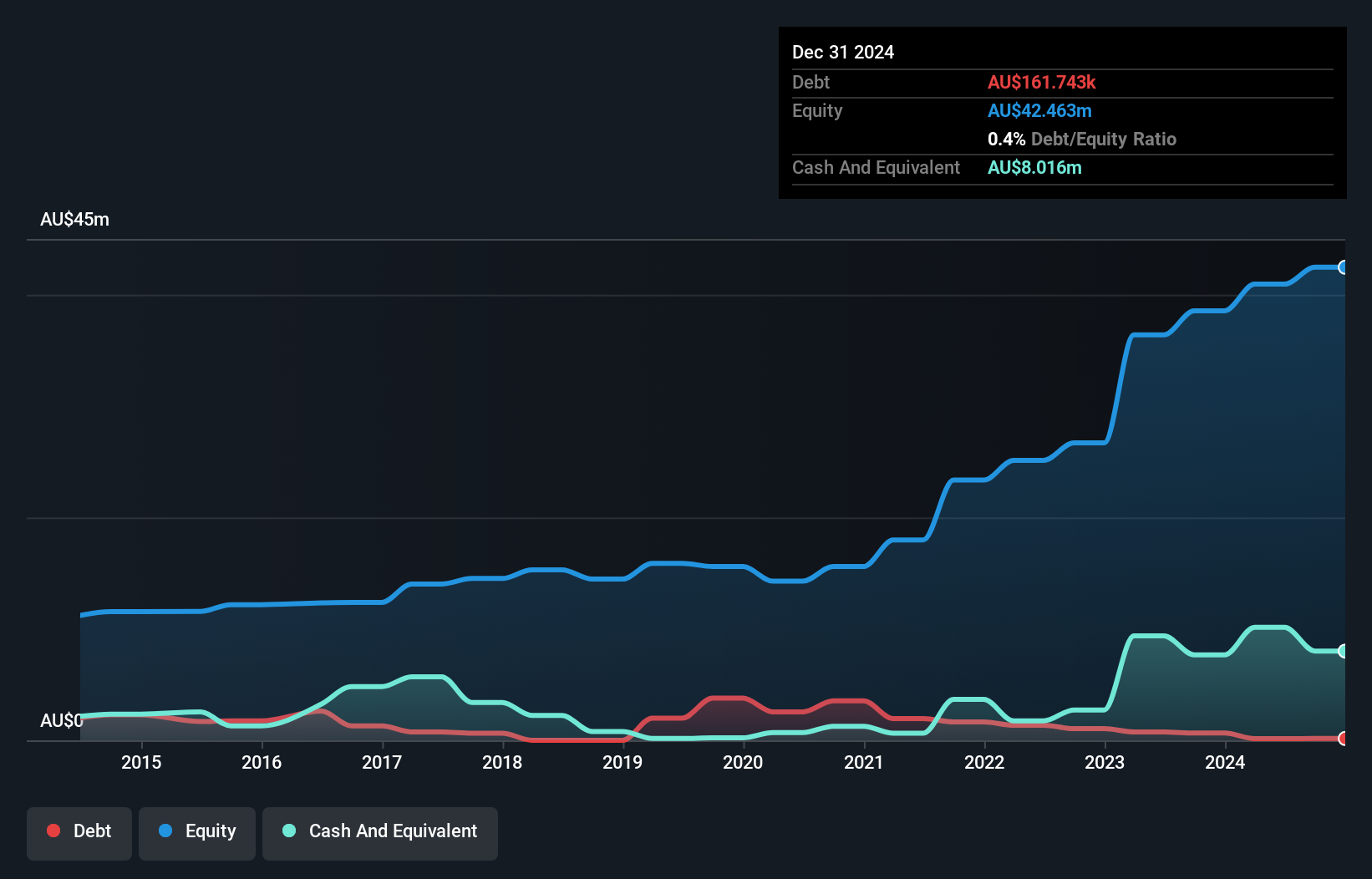

Environmental Group Limited, with a market cap of A$117.95 million, showcases robust financials and growth potential in the penny stock segment. Its earnings have grown significantly by 68% over the past year, outpacing its five-year average growth rate of 46%. The company maintains strong liquidity with short-term assets exceeding liabilities and has reduced its debt to equity ratio from 12.5% to 0.4% over five years. Despite having a relatively new board of directors, EGL's management team is experienced, contributing to high-quality earnings and effective debt coverage by operating cash flow at a very large multiple.

- Dive into the specifics of Environmental Group here with our thorough balance sheet health report.

- Examine Environmental Group's earnings growth report to understand how analysts expect it to perform.

Vmoto (ASX:VMT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Vmoto Limited, with a market cap of A$30.71 million, develops, manufactures, markets, and distributes electric two-wheel vehicles globally.

Operations: The company generates revenue of A$50.64 million from the manufacture and distribution of electric two-wheel vehicles.

Market Cap: A$30.71M

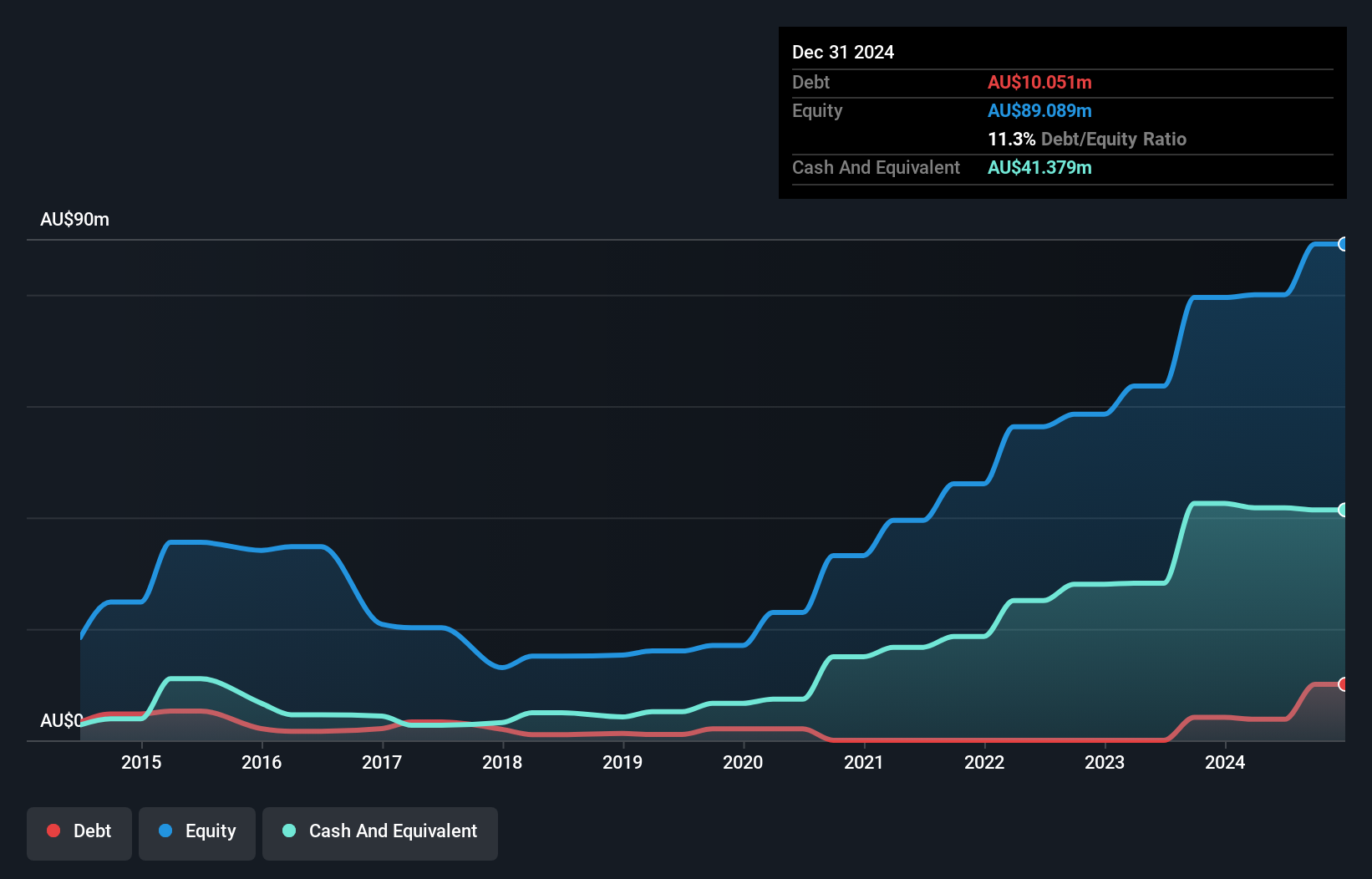

Vmoto Limited, with a market cap of A$30.71 million, is navigating challenges typical of penny stocks. The company remains unprofitable but has managed to reduce losses at a rate of 20.2% annually over five years. Despite shareholder dilution and high share price volatility, Vmoto's financial position is bolstered by short-term assets exceeding both short and long-term liabilities significantly. The recent announcement of a buyback program indicates strategic moves as the company prepares for delisting, offering shareholders an exit strategy while maintaining more cash than its total debt, highlighting prudent financial management amidst ongoing operational hurdles.

- Navigate through the intricacies of Vmoto with our comprehensive balance sheet health report here.

- Gain insights into Vmoto's past trends and performance with our report on the company's historical track record.

Summing It All Up

- Jump into our full catalog of 1,055 ASX Penny Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VMT

Vmoto

Engages in the development, manufacture, marketing, and distribution of electric two-wheel vehicles worldwide.

Excellent balance sheet low.

Market Insights

Community Narratives