The Australian market is experiencing a challenging period, with futures indicating a significant downturn and volatility on the rise. Despite these turbulent conditions, penny stocks—though an old-fashioned term—remain an intriguing area for investors seeking value in smaller or newer companies. By focusing on those with strong financial foundations, such stocks can offer potential stability and growth opportunities. In this article, we explore three penny stocks that exhibit financial strength and may present promising prospects for investors looking to uncover hidden value.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Dusk Group (ASX:DSK) | A$0.82 | A$51.06M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.96 | A$454.92M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.60 | A$265.7M | ✅ 4 ⚠️ 2 View Analysis > |

| Veris (ASX:VRS) | A$0.066 | A$34.76M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 2 View Analysis > |

| Praemium (ASX:PPS) | A$0.79 | A$377.96M | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.11 | A$1.29B | ✅ 4 ⚠️ 2 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.68 | A$248.12M | ✅ 3 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.39 | A$132.75M | ✅ 3 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.38 | A$624.51M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 414 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Atturra (ASX:ATA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Atturra Limited, along with its subsidiaries, offers advisory and information technology solutions across Australia, New Zealand, Singapore, North America, and Hong Kong with a market cap of A$277.97 million.

Operations: The company generates revenue of A$300.62 million from its Information Technology (IT) Solutions segment.

Market Cap: A$277.97M

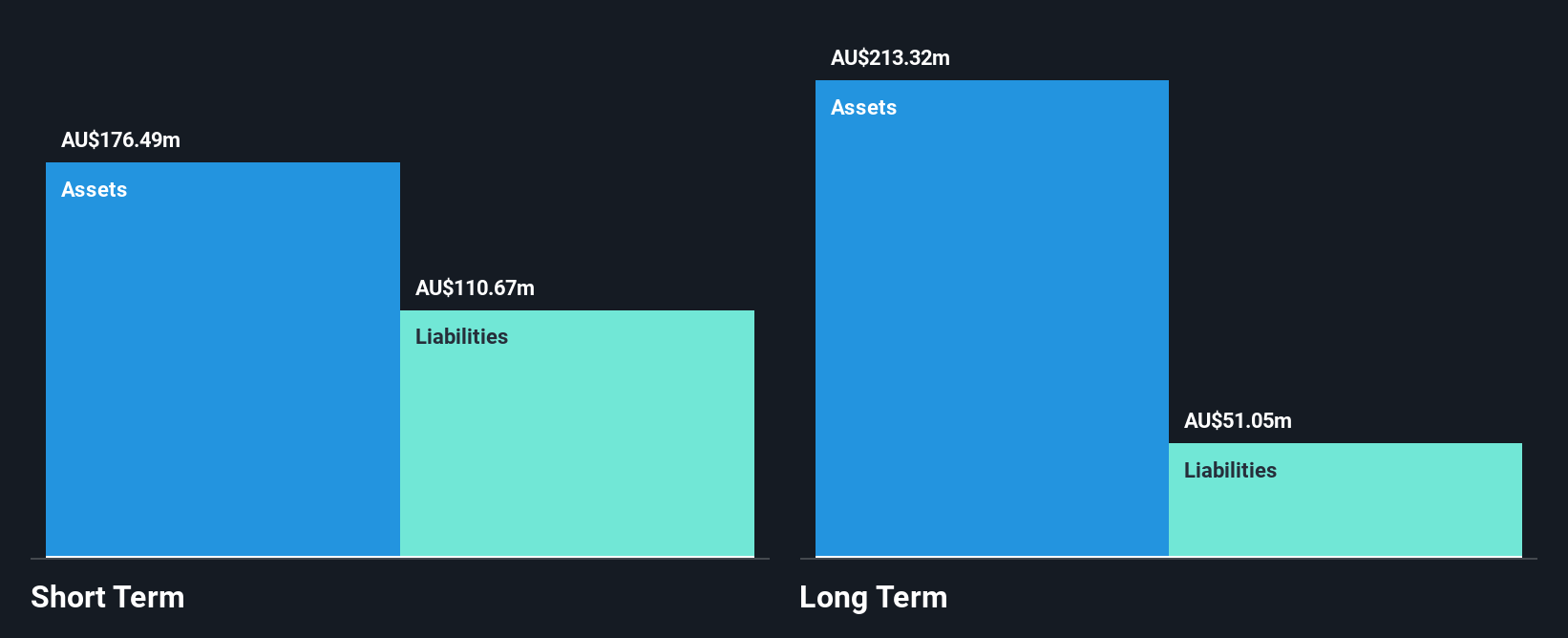

Atturra Limited, with a market cap of A$277.97 million and revenue of A$300.62 million, shows financial stability through its well-covered interest payments and operating cash flow relative to debt. The company has more cash than total debt, indicating sound liquidity management. Despite stable weekly volatility and experienced leadership, Atturra faces challenges with low return on equity at 4% and declining net profit margins from 4% to 3%. Recent share buybacks demonstrate shareholder value focus, while earnings are forecasted to grow by nearly 17% annually despite past negative growth trends compared to industry averages.

- Click to explore a detailed breakdown of our findings in Atturra's financial health report.

- Learn about Atturra's future growth trajectory here.

Cleo Diagnostics (ASX:COV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cleo Diagnostics Ltd is a biotechnology company that develops and commercializes non-invasive blood tests for detecting ovarian cancer in Australia, with a market cap of A$82.88 million.

Operations: Cleo Diagnostics generates its revenue of A$0.85 million from the Medical Labs & Research segment.

Market Cap: A$82.88M

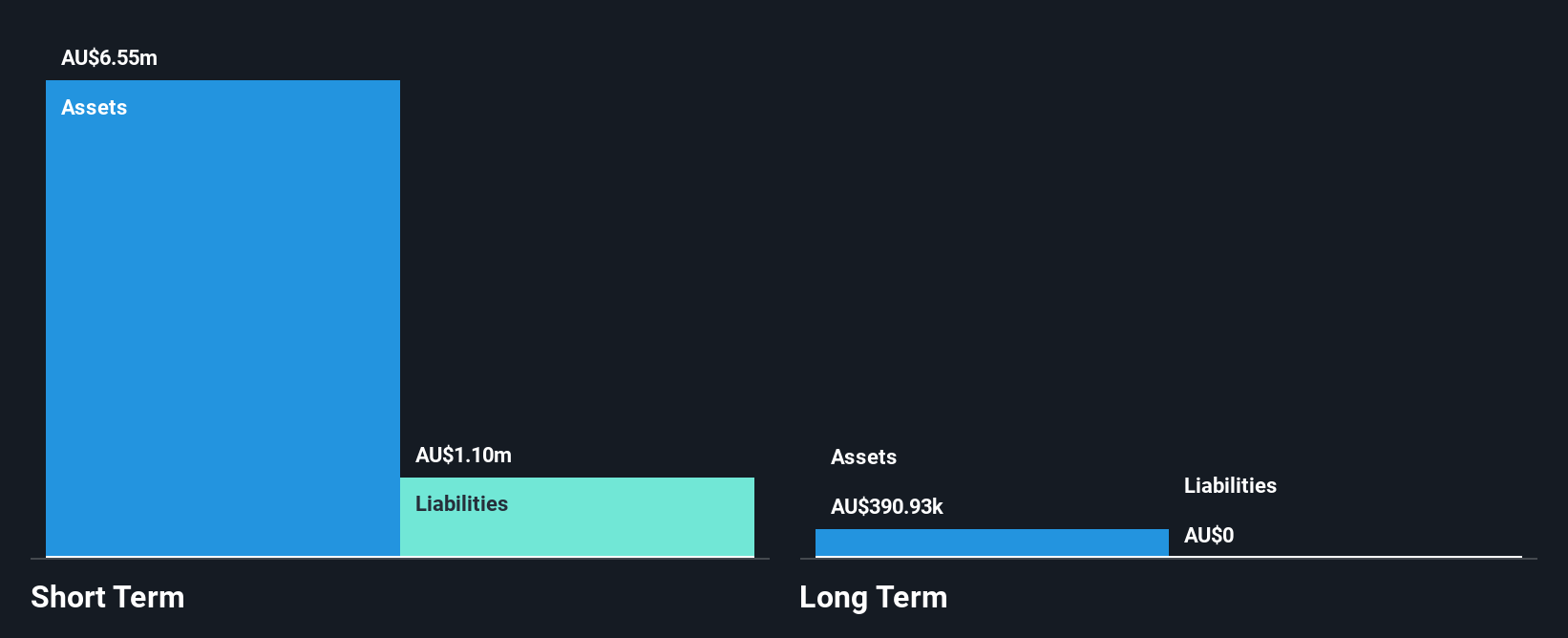

Cleo Diagnostics Ltd, a biotechnology firm with a market cap of A$82.88 million, remains pre-revenue with earnings under US$1 million. Despite this, the company has shown substantial revenue growth of 300.9% over the past year and maintains financial stability with short-term assets exceeding liabilities by A$5.4 million and no long-term debt or liabilities. The management team and board are experienced, averaging 3.1 years in tenure, while shareholders have not faced significant dilution recently. Although unprofitable with a negative return on equity of -68.54%, Cleo Diagnostics benefits from a cash runway extending beyond one year without debt obligations.

- Take a closer look at Cleo Diagnostics' potential here in our financial health report.

- Gain insights into Cleo Diagnostics' past trends and performance with our report on the company's historical track record.

SRG Global (ASX:SRG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SRG Global Limited operates in engineering, mining, maintenance and construction contracting across Australia and New Zealand with a market cap of A$1.65 billion.

Operations: The company's revenue is derived from two main segments: Engineering and Construction, which contributes A$455.93 million, and Maintenance and Industrial Services, generating A$867.38 million.

Market Cap: A$1.65B

SRG Global, with a market cap of A$1.65 billion, operates in engineering and construction sectors, generating substantial revenue from its two primary segments. The company has shown consistent profitability growth over the past five years, although recent earnings growth of 37.9% is below its five-year average. SRG's financial health is robust with short-term assets exceeding liabilities and cash surpassing total debt; operating cash flow covers debt well. Despite a low return on equity of 12.1%, the company's net profit margins have improved slightly to 3.6%. Upcoming earnings results are expected shortly after recent M&A discussions regarding TAMS acquisition.

- Click here to discover the nuances of SRG Global with our detailed analytical financial health report.

- Examine SRG Global's earnings growth report to understand how analysts expect it to perform.

Make It Happen

- Click this link to deep-dive into the 414 companies within our ASX Penny Stocks screener.

- Contemplating Other Strategies? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ATA

Atturra

Provides advisory and information technology solutions in Australia, New Zealand, Singapore, North America, and Hong Kong.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives