As Australian shares experience a modest uptick, following Wall Street's lead, investors are keenly observing the market dynamics influenced by global economic indicators. Amidst these developments, penny stocks remain an intriguing area of investment, offering potential opportunities in smaller or less-established companies. While the term "penny stocks" may seem outdated, these investments can still provide value when backed by strong financials and growth prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.39 | A$118.93M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.50 | A$68.17M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.775 | A$48.57M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.87 | A$441.09M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.85 | A$3.24B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.22 | A$1.36B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.84 | A$120.9M | ✅ 4 ⚠️ 2 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.48 | A$228.68M | ✅ 4 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.21 | A$122.75M | ✅ 4 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.45 | A$639.96M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 428 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Actinogen Medical (ASX:ACW)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Actinogen Medical Limited is an Australian biotechnology company focused on developing therapies for neurological and neuropsychiatric diseases linked to dysregulated brain cortisol, with a market cap of A$190.94 million.

Operations: Actinogen Medical Limited has not reported any revenue segments.

Market Cap: A$190.94M

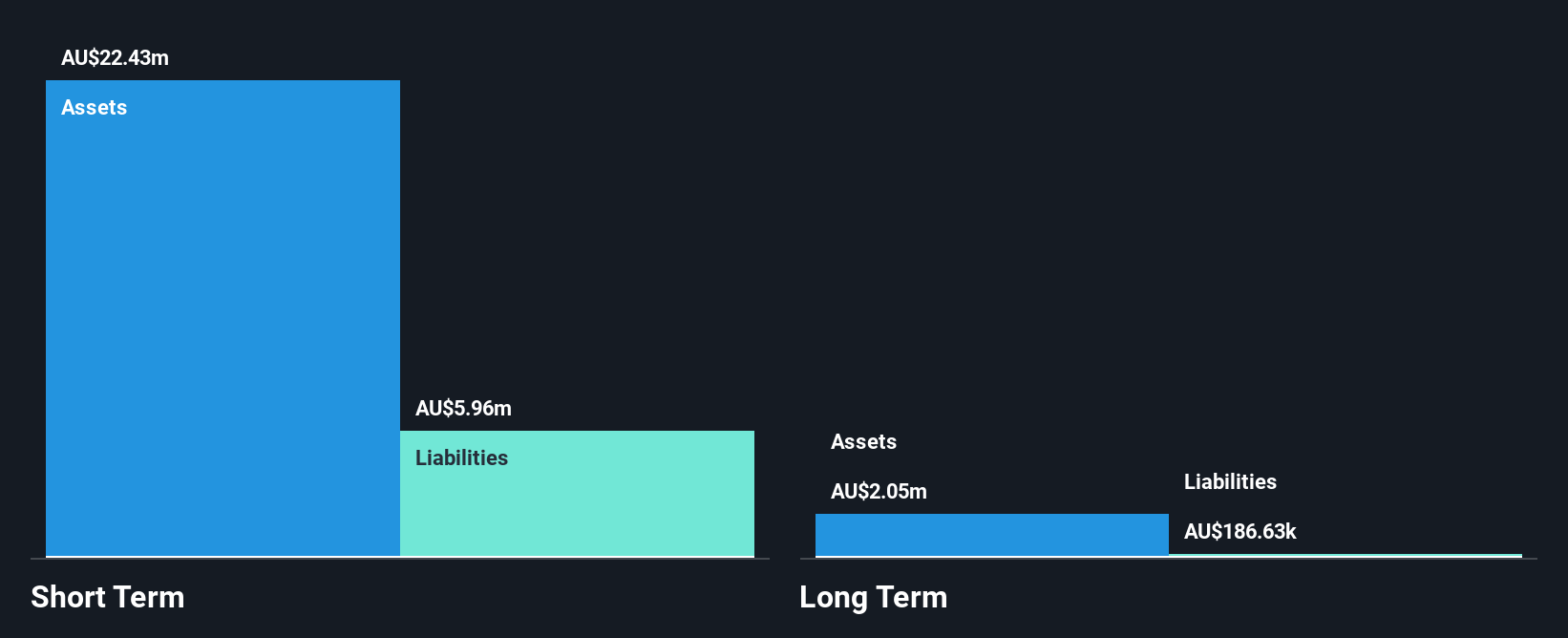

Actinogen Medical Limited, with a market cap of A$190.94 million, operates as a pre-revenue biotech firm focused on neurological therapies. Despite being unprofitable and having experienced increased losses over the past five years, its financial position shows more cash than debt and short-term assets covering liabilities. Recent developments include accelerated progress in the XanaMIA phase 2b/3 Alzheimer's trial, with final results expected in November next year. The board and management team are seasoned but profitability is not anticipated soon. Revenue growth is forecasted at 64.39% annually; however, earnings are expected to decline significantly over the next three years.

- Navigate through the intricacies of Actinogen Medical with our comprehensive balance sheet health report here.

- Gain insights into Actinogen Medical's future direction by reviewing our growth report.

Appen (ASX:APX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Appen Limited is an AI lifecycle company offering data sourcing, data annotation, and model evaluation solutions across Australia, the United States, and internationally, with a market cap of A$199.21 million.

Operations: Appen's revenue is derived from three segments: Corporate ($1.24 billion), New Markets ($126.84 million), and Global Services ($96.93 million).

Market Cap: A$199.21M

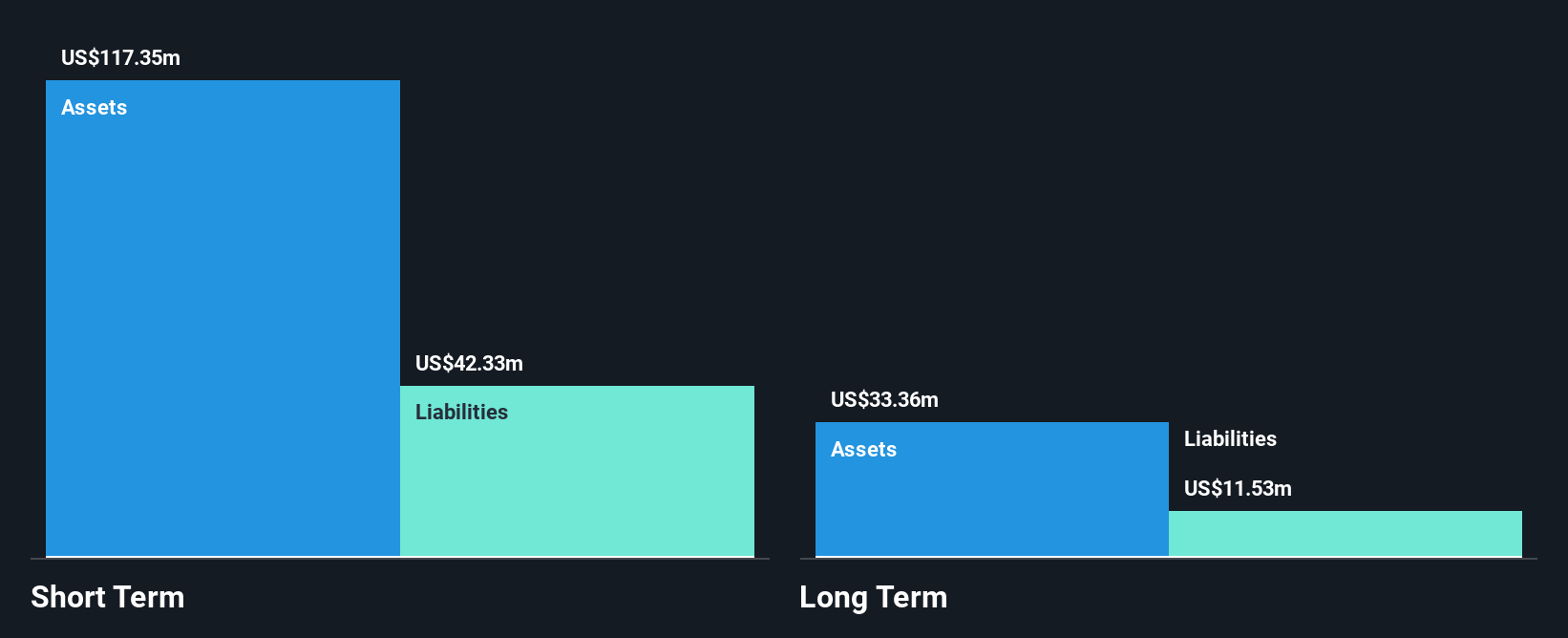

Appen Limited, with a market cap of A$199.21 million, is currently unprofitable and has experienced increased losses over the past five years. Despite trading at a significant discount to its estimated fair value and being debt-free, the company faces challenges due to its negative return on equity of -22.22%. The management team is relatively inexperienced with an average tenure of 1.9 years; however, the board is seasoned with 4.3 years on average. Appen's short-term assets exceed its liabilities, providing a stable financial footing, while earnings are forecasted to grow substantially by 68.24% per year.

- Unlock comprehensive insights into our analysis of Appen stock in this financial health report.

- Gain insights into Appen's outlook and expected performance with our report on the company's earnings estimates.

Calix (ASX:CXL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Calix Limited is an environmental technology company offering industrial solutions for global decarbonisation and sustainability challenges across various regions, with a market cap of A$142.28 million.

Operations: Calix generates revenue through its LEILAC segment at A$3.84 million, Suspro at A$0.01 million, and Magnesia at A$24.32 million.

Market Cap: A$142.28M

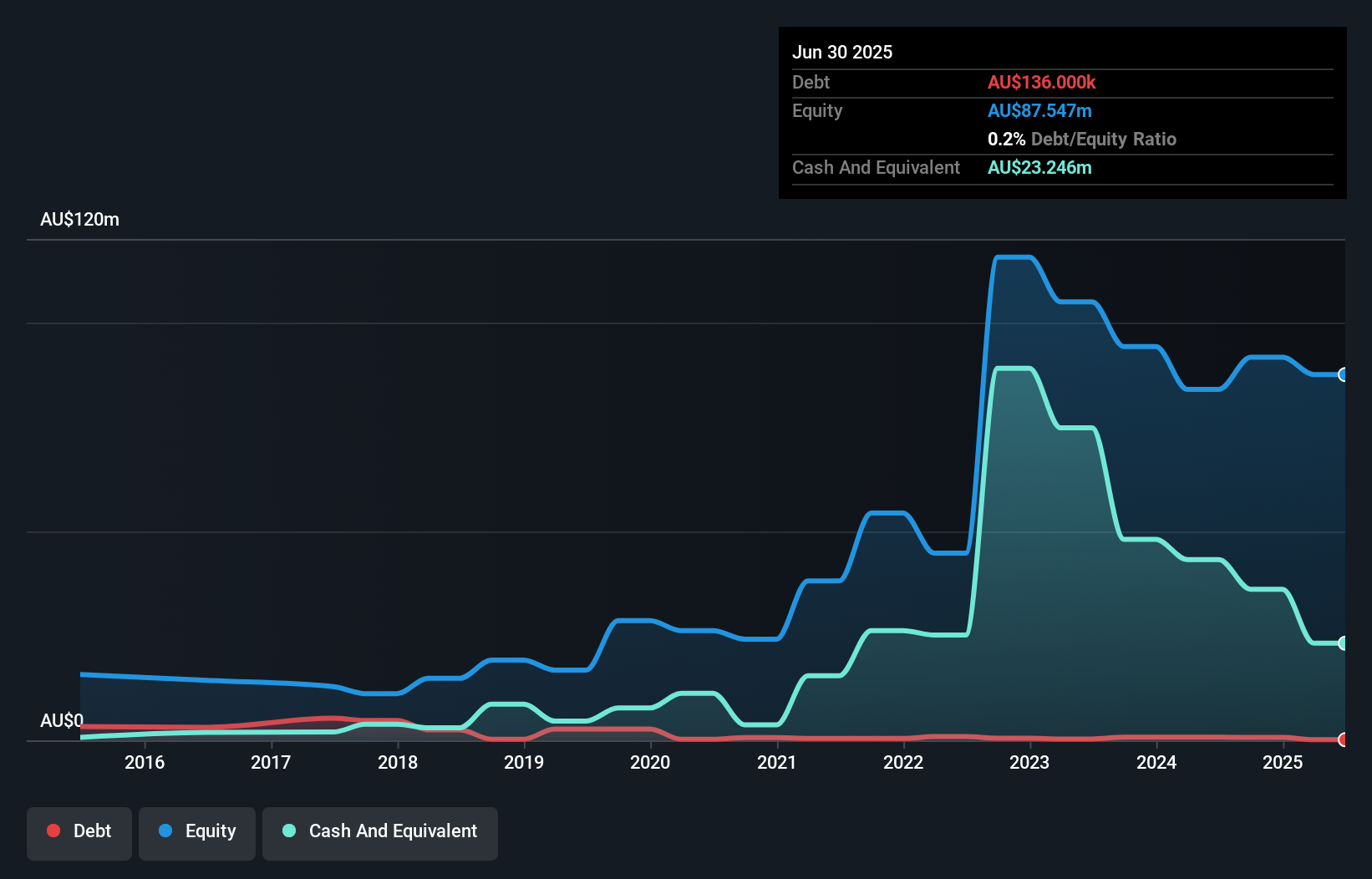

Calix Limited, with a market cap of A$142.28 million, is currently unprofitable but shows potential through strategic developments. The recent Joint Development Agreement with Rio Tinto for the Zero Emissions Steel Technology (Zesty™) demonstration plant highlights its commitment to sustainability and innovation. Despite a volatile share price and limited cash runway, Calix's short-term assets exceed its liabilities, indicating some financial stability. The company has reduced its debt-to-equity ratio significantly over five years and maintains an experienced management team with an average tenure of 9.8 years, which may support future growth initiatives in the environmental technology sector.

- Dive into the specifics of Calix here with our thorough balance sheet health report.

- Evaluate Calix's prospects by accessing our earnings growth report.

Next Steps

- Navigate through the entire inventory of 428 ASX Penny Stocks here.

- Curious About Other Options? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:APX

Appen

Operates as an AI lifecycle company that provides data sourcing, data annotation, and model evaluation solutions in Australia, the United States, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion