Stock Analysis

- Australia

- /

- Commercial Services

- /

- ASX:C79

ASX Growth Companies With At Least 11% Insider Ownership

Reviewed by Simply Wall St

Amidst a generally bearish sentiment on the ASX200, influenced by higher-than-expected inflation data and varied sector performances, investors are keenly observing market dynamics and potential opportunities. In such conditions, growth companies with high insider ownership might attract attention as these insiders often have a vested interest in the company’s success, aligning their goals with those of shareholders.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

| Cettire (ASX:CTT) | 28.7% | 26.7% |

| Acrux (ASX:ACR) | 14.6% | 115.3% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

| Change Financial (ASX:CCA) | 26.6% | 76.4% |

| Botanix Pharmaceuticals (ASX:BOT) | 11.4% | 120.9% |

| Liontown Resources (ASX:LTR) | 16.4% | 62.3% |

| DUG Technology (ASX:DUG) | 28.1% | 43.2% |

| Argosy Minerals (ASX:AGY) | 14.5% | 129.6% |

Let's dive into some prime choices out of from the screener.

Altium (ASX:ALU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Altium Limited is a company that develops and markets computer software for electronic product design, operating globally with a market capitalization of approximately A$8.96 billion.

Operations: The company generates revenue through its cloud platform and design software segments, totaling approximately $60.36 million and $221.94 million respectively.

Insider Ownership: 11.7%

Altium, a company with high insider ownership, demonstrates promising growth prospects. Over the past year, its earnings grew by 12%, and it is expected to see an annual revenue increase of 16%, outpacing the Australian market's 5.4%. Notably, Altium's earnings are forecasted to grow at a robust rate of 21.2% annually, significantly above the market average of 13.7%. Recently, Altium expanded its market presence through a new distribution agreement in the Nordic countries with Kem-En-Tec, enhancing potential future revenue streams from its HoloMonitor technology.

- Navigate through the intricacies of Altium with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Altium's share price might be too optimistic.

Chrysos (ASX:C79)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chrysos Corporation Limited is a company focused on the development and supply of mining technology, with a market capitalization of approximately A$638.10 million.

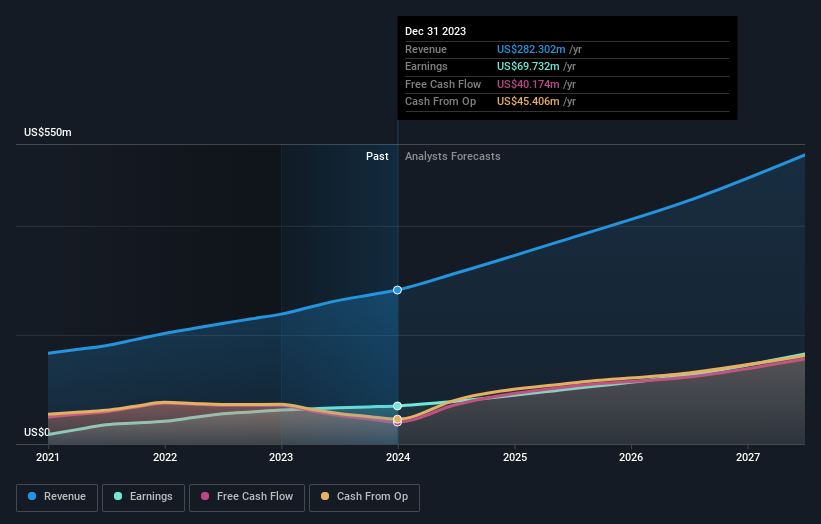

Operations: The company generates revenue primarily from its mining services segment, totaling A$34.24 million.

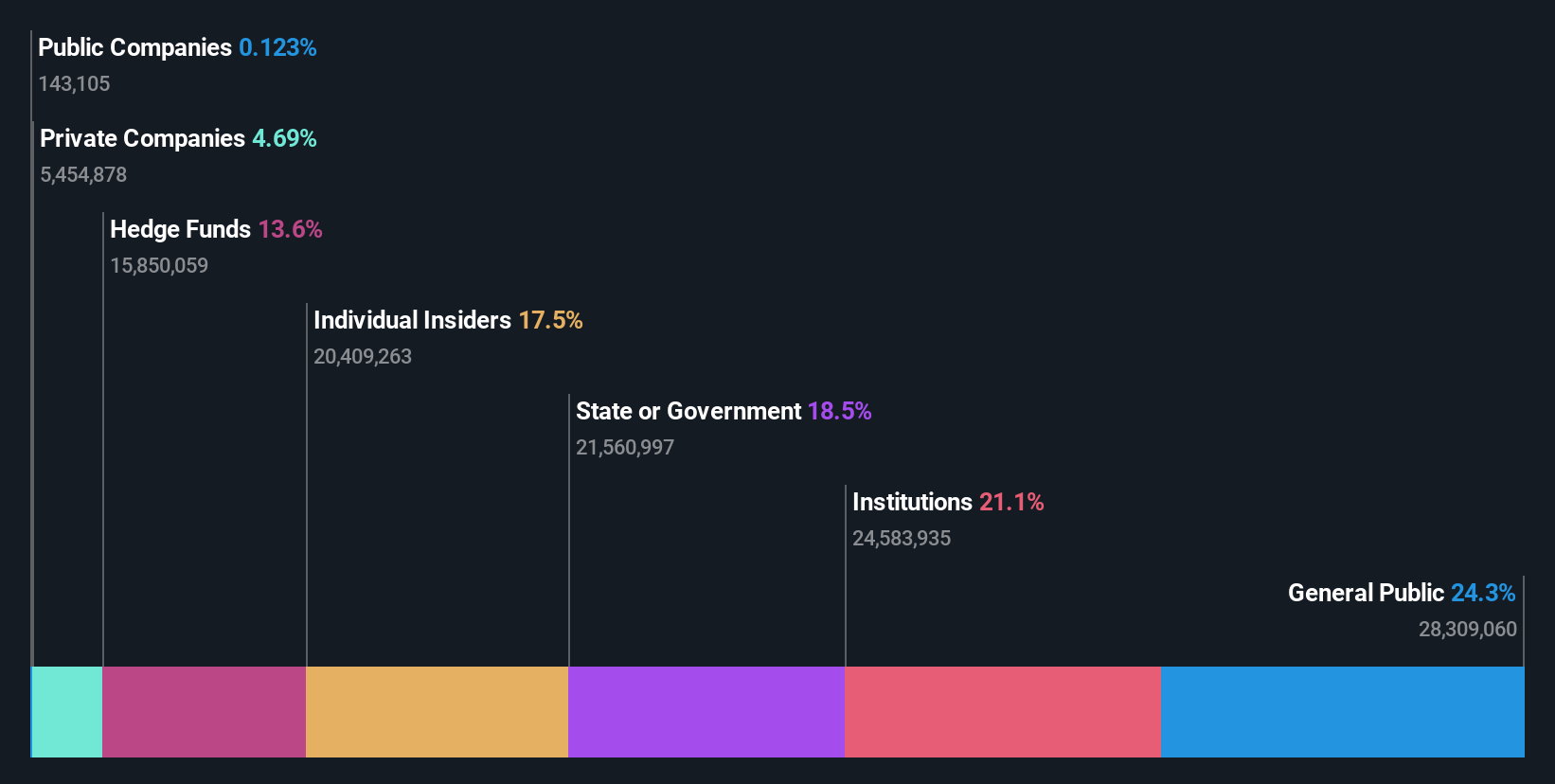

Insider Ownership: 21.3%

Chrysos Corporation Limited, while facing challenges such as insider selling and shareholder dilution in the past year, still shows robust growth potential. Analysts predict a significant revenue increase at 35.3% annually, far surpassing the Australian market's average of 5.4%. Furthermore, Chrysos is expected to turn profitable within three years with an anticipated substantial rise in stock price by 32.3%. However, concerns remain with its low forecasted return on equity at only 7.8%.

- Click here to discover the nuances of Chrysos with our detailed analytical future growth report.

- According our valuation report, there's an indication that Chrysos' share price might be on the expensive side.

Kelsian Group (ASX:KLS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kelsian Group Limited operates in the provision of land and marine transport and tourism services across Australia, the United States, Singapore, and the United Kingdom, with a market capitalization of approximately A$1.36 billion.

Operations: The company's revenue is divided into three main segments: Australian Bus operations generating A$934.76 million, International Bus services contributing A$448.87 million, and Marine and Tourism activities accounting for A$337.90 million.

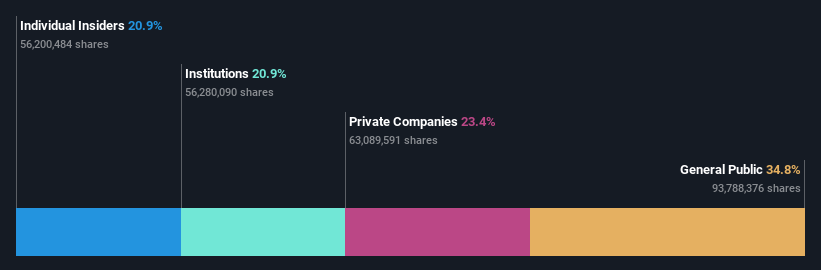

Insider Ownership: 20.9%

Kelsian Group demonstrates notable insider confidence with substantial buying over the past three months, indicating strong internal belief in the company's prospects. Analysts expect Kelsian's earnings to grow by 25.84% annually, outpacing the Australian market significantly. However, challenges persist with a forecasted low return on equity of 11.6% and poor coverage of interest payments by earnings. Despite these concerns, Kelsian is trading at 14.3% below estimated fair value, suggesting potential undervaluation.

- Get an in-depth perspective on Kelsian Group's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Kelsian Group is trading beyond its estimated value.

Summing It All Up

- Click here to access our complete index of 90 Fast Growing ASX Companies With High Insider Ownership.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Chrysos is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:C79

High growth potential with excellent balance sheet.