The Australian stock market recently demonstrated resilience by climbing back above the 7,800 points level, with energy stocks leading the gains. In such a dynamic market landscape, identifying promising investment opportunities requires a keen eye for financial strength and growth potential. Penny stocks, though often associated with smaller or newer companies and considered somewhat outdated in terminology, continue to offer intriguing possibilities for investors seeking value at lower price points.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.57 | A$122.48M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$2.10 | A$154.99M | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.58 | A$74.53M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.35 | A$362.33M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.60 | A$115.38M | ✅ 3 ⚠️ 2 View Analysis > |

| GR Engineering Services (ASX:GNG) | A$2.84 | A$475.28M | ✅ 2 ⚠️ 1 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.19 | A$151.37M | ✅ 3 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$1.795 | A$603.41M | ✅ 4 ⚠️ 3 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.47 | A$1.13B | ✅ 5 ⚠️ 1 View Analysis > |

| LaserBond (ASX:LBL) | A$0.3825 | A$44.88M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 984 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Pointerra (ASX:3DP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Pointerra Limited offers a cloud-based platform for managing and analyzing 3D data in Australia and the United States, with a market cap of A$64.57 million.

Operations: The company's revenue is derived from its operations in Australia, generating A$6.61 million, and the United States, contributing A$8.04 million.

Market Cap: A$64.57M

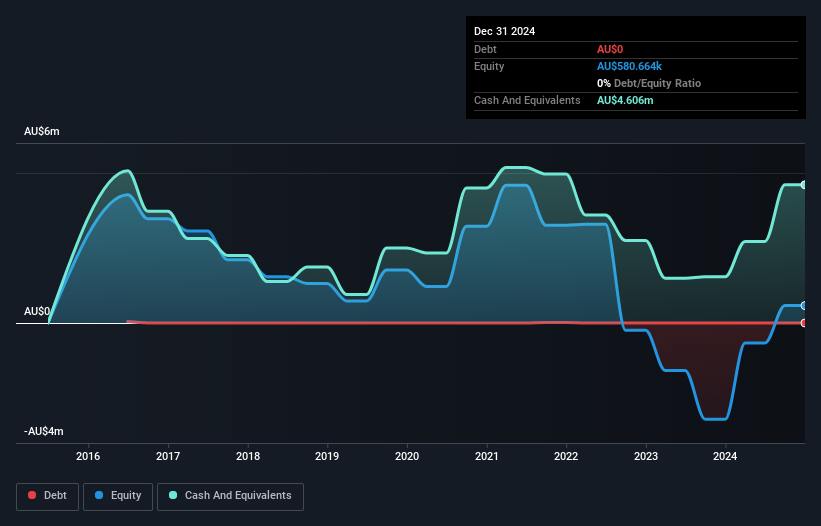

Pointerra Limited, with a market cap of A$64.57 million, has shown significant revenue growth, reporting A$6.99 million in sales for the half-year ending December 2024 compared to A$2.45 million the previous year. Despite being unprofitable and having a negative return on equity of -1.17%, it maintains a strong cash runway exceeding three years without debt obligations. The company's short-term assets cover both its short and long-term liabilities comfortably. However, its share price remains highly volatile, and the board lacks experience with an average tenure of 1.4 years, indicating potential governance challenges ahead.

- Click here and access our complete financial health analysis report to understand the dynamics of Pointerra.

- Explore Pointerra's analyst forecasts in our growth report.

Finbar Group (ASX:FRI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Finbar Group Limited, along with its subsidiaries, is involved in property development and investment in Australia, with a market capitalization of A$201.37 million.

Operations: The company's revenue is primarily derived from Residential Apartment Development (A$362.48 million), supplemented by Commercial Office/Retail Development (A$25.06 million) and Property Rental (A$10.06 million).

Market Cap: A$201.37M

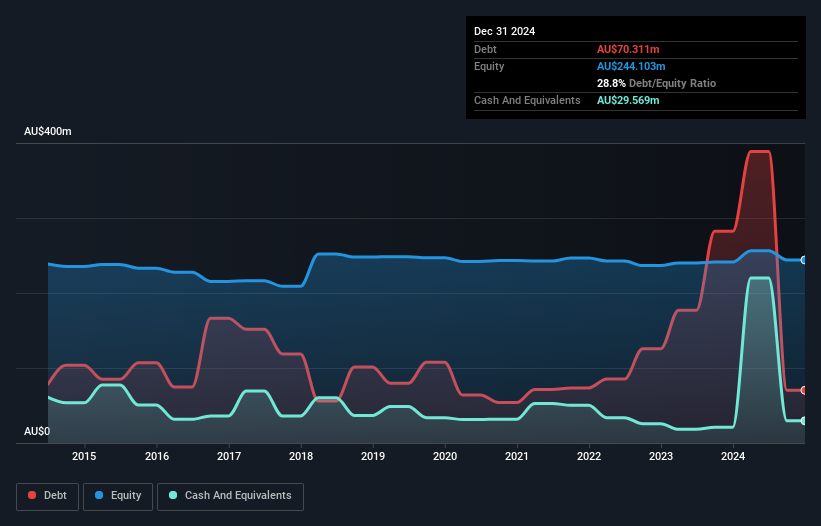

Finbar Group Limited, with a market cap of A$201.37 million, has demonstrated robust earnings growth of 386.7% over the past year, significantly outpacing the real estate industry. The company reported half-year sales of A$218.29 million and net income of A$9.37 million as of December 2024. Despite a reduction in profit margins from last year, Finbar's debt is well-managed with strong coverage by operating cash flow and reduced debt to equity ratio over five years. Recent board changes include appointing Ms. Melissa Chan as an alternate director, bringing extensive real estate and financial expertise to support strategic objectives.

- Navigate through the intricacies of Finbar Group with our comprehensive balance sheet health report here.

- Gain insights into Finbar Group's past trends and performance with our report on the company's historical track record.

SenSen Networks (ASX:SNS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SenSen Networks Limited develops and sells SenDISA platform-based products and services across North America, Australia, New Zealand, and Asia, with a market cap of A$30.14 million.

Operations: The company's revenue is derived from the regions of Australia and New Zealand (A$8.92 million), North America (A$2.74 million), and Asia (A$0.54 million).

Market Cap: A$30.14M

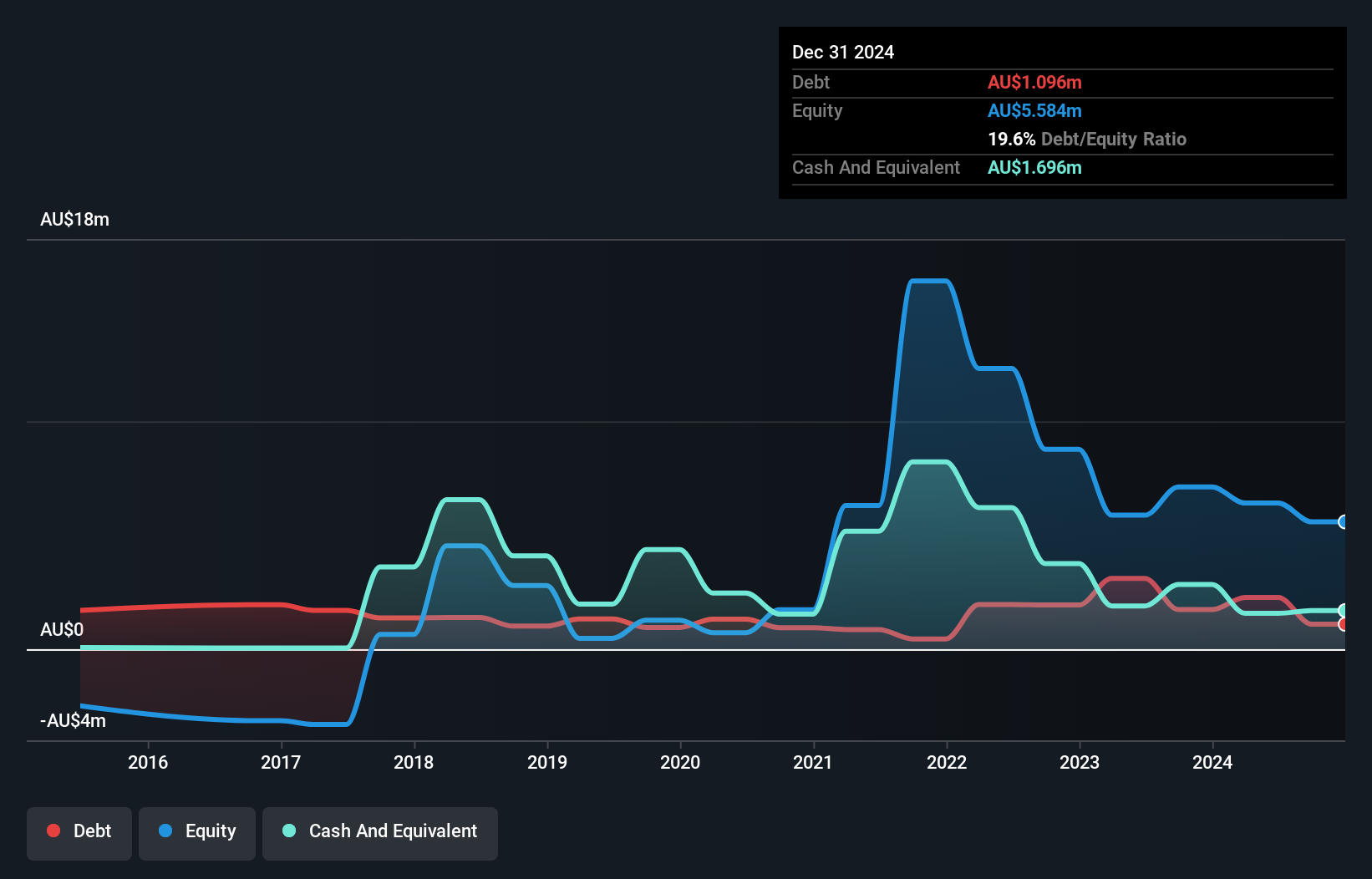

SenSen Networks Limited, with a market cap of A$30.14 million, operates across multiple regions but remains unprofitable, reporting a net loss of A$1.59 million for the half year ending December 2024. The company has managed to slightly increase sales to A$5.48 million from the previous year while reducing its debt-to-equity ratio significantly over five years. Despite having more cash than debt and sufficient cash runway for over three years based on current free cash flow, SenSen's short-term assets fall short of covering its liabilities. Recent board changes include appointing Jenny Martin as Non-Executive Director to strengthen financial oversight amidst ongoing volatility in share price and earnings challenges.

- Jump into the full analysis health report here for a deeper understanding of SenSen Networks.

- Learn about SenSen Networks' historical performance here.

Make It Happen

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 981 more companies for you to explore.Click here to unveil our expertly curated list of 984 ASX Penny Stocks.

- Seeking Other Investments? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:3DP

Pointerra

Provides a cloud-based solution for storing, processing, managing, analyzing, extracting, visualizing, and sharing 3D data in Australia and the United States.

Exceptional growth potential and undervalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion