Most Shareholders Will Probably Find That The CEO Compensation For Pointerra Limited (ASX:3DP) Is Reasonable

Performance at Pointerra Limited (ASX:3DP) has been reasonably good and CEO Ian Olson has done a decent job of steering the company in the right direction. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 23 November 2022. We present our case of why we think CEO compensation looks fair.

Our analysis indicates that 3DP is potentially undervalued!

How Does Total Compensation For Ian Olson Compare With Other Companies In The Industry?

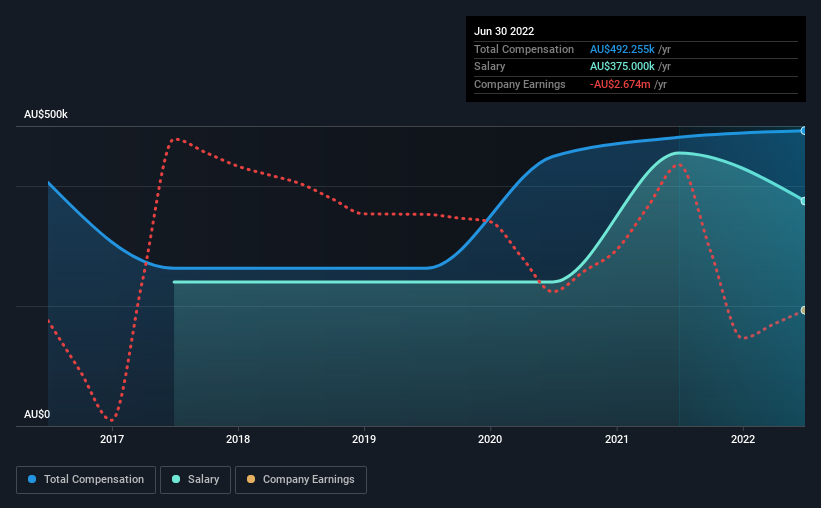

At the time of writing, our data shows that Pointerra Limited has a market capitalization of AU$132m, and reported total annual CEO compensation of AU$492k for the year to June 2022. That is, the compensation was roughly the same as last year. Notably, the salary which is AU$375.0k, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations under AU$295m, the reported median total CEO compensation was AU$491k. From this we gather that Ian Olson is paid around the median for CEOs in the industry. Furthermore, Ian Olson directly owns AU$8.3m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | AU$375k | AU$455k | 76% |

| Other | AU$117k | AU$26k | 24% |

| Total Compensation | AU$492k | AU$481k | 100% |

On an industry level, around 61% of total compensation represents salary and 39% is other remuneration. Pointerra pays out 76% of remuneration in the form of a salary, significantly higher than the industry average. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Pointerra Limited's Growth

Over the past three years, Pointerra Limited has seen its earnings per share (EPS) grow by 1.7% per year. It achieved revenue growth of 146% over the last year.

It's hard to interpret the strong revenue growth as anything other than a positive. Combined with modest EPS growth, we get a good impression of the company. We wouldn't say this is necessarily top notch growth, but it is certainly promising. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Pointerra Limited Been A Good Investment?

We think that the total shareholder return of 187%, over three years, would leave most Pointerra Limited shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. In saying that, any proposed increase to CEO compensation will still be assessed on how reasonable it is based on performance and industry benchmarks.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 1 warning sign for Pointerra that you should be aware of before investing.

Switching gears from Pointerra, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:3DP

Pointerra

Provides a cloud-based solution for storing, processing, managing, analyzing, extracting, visualizing, and sharing 3D data in Australia and the United States.

Exceptional growth potential and undervalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion