- Australia

- /

- Specialty Stores

- /

- ASX:TPW

Despite lower earnings than three years ago, Temple & Webster Group (ASX:TPW) investors are up 322% since then

Investing can be hard but the potential fo an individual stock to pay off big time inspires us. You won't get it right every time, but when you do, the returns can be truly splendid. One such superstar is Temple & Webster Group Ltd (ASX:TPW), which saw its share price soar 322% in three years. Also pleasing for shareholders was the 10% gain in the last three months. But this move may well have been assisted by the reasonably buoyant market (up 4.5% in 90 days).

While the stock has fallen 4.4% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the three years of share price growth, Temple & Webster Group actually saw its earnings per share (EPS) drop 1.8% per year.

Based on these numbers, we think that the decline in earnings per share may not be a good representation of how the business has changed over the years. Therefore, it makes sense to look into other metrics.

It may well be that Temple & Webster Group revenue growth rate of 15% over three years has convinced shareholders to believe in a brighter future. If the company is being managed for the long term good, today's shareholders might be right to hold on.

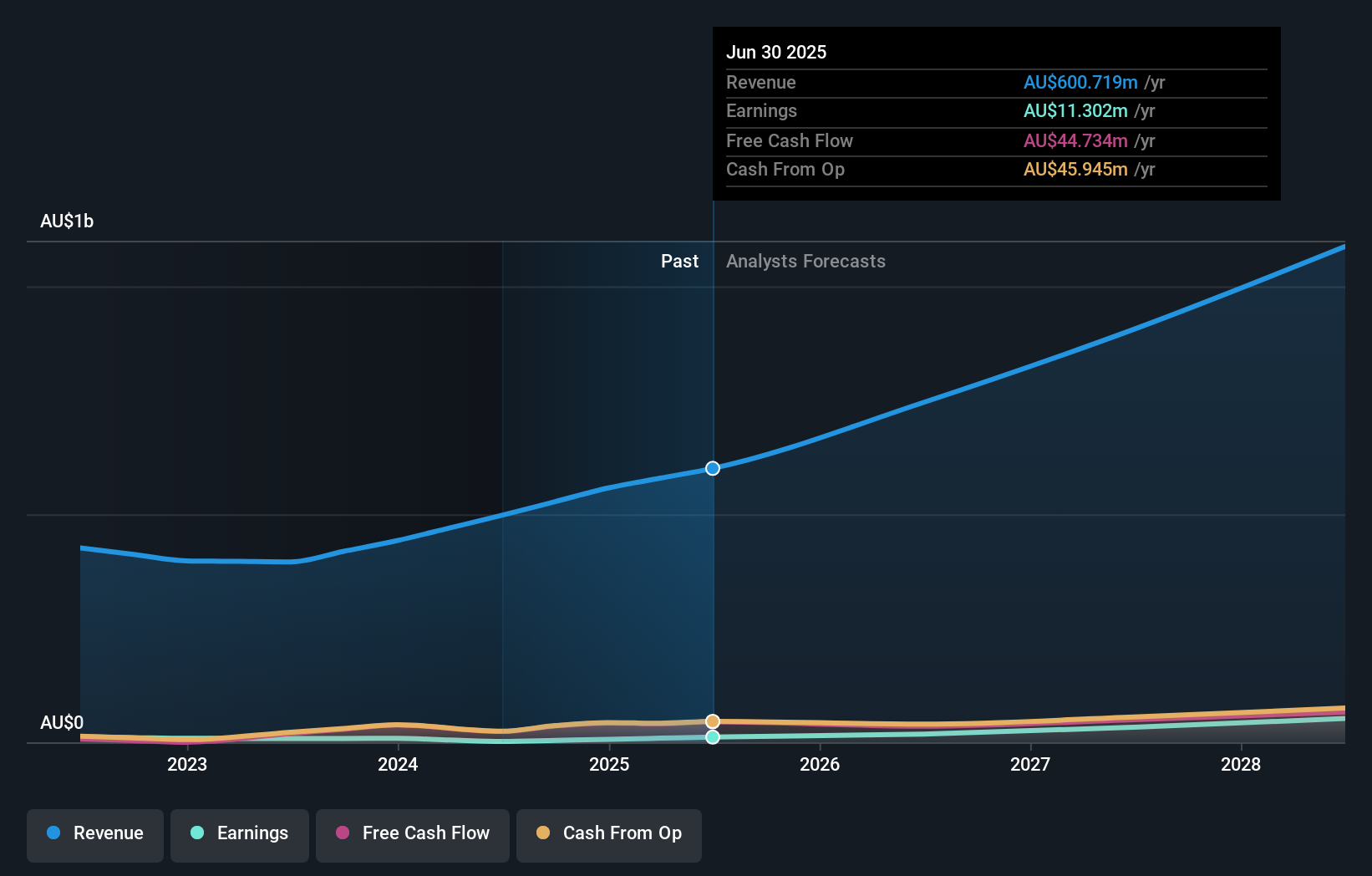

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Temple & Webster Group is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

It's nice to see that Temple & Webster Group shareholders have received a total shareholder return of 76% over the last year. That gain is better than the annual TSR over five years, which is 13%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

But note: Temple & Webster Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Temple & Webster Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:TPW

Temple & Webster Group

Engages in the online retail of furniture, homewares, and home improvement products through its online platform in Australia.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives