- Australia

- /

- Specialty Stores

- /

- ASX:SSG

ASX Penny Stocks To Watch In March 2025

Reviewed by Simply Wall St

As the Australian share market remains relatively stable with the ASX 200 futures indicating a nearly flat opening, investors are turning their attention to broader economic influences like the upcoming election campaign. For those interested in smaller or newer companies, penny stocks continue to be an intriguing investment area despite their outdated name. These stocks can offer unique growth opportunities when backed by strong financial health, and we will explore several that stand out for their potential in today's market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.63 | A$124.82M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.80 | A$1.02B | ✅ 4 ⚠️ 1 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.50 | A$71M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.46 | A$380.05M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.63 | A$126.66M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.13 | A$151.37M | ✅ 3 ⚠️ 2 View Analysis > |

| NobleOak Life (ASX:NOL) | A$1.405 | A$130.66M | ✅ 4 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.37 | A$872.03M | ✅ 5 ⚠️ 3 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.80 | A$1.29B | ✅ 5 ⚠️ 1 View Analysis > |

| LaserBond (ASX:LBL) | A$0.39 | A$45.17M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 980 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

MaxiPARTS (ASX:MXI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MaxiPARTS Limited, with a market cap of A$113.40 million, distributes and sells commercial truck and trailer parts in Australia through its subsidiaries.

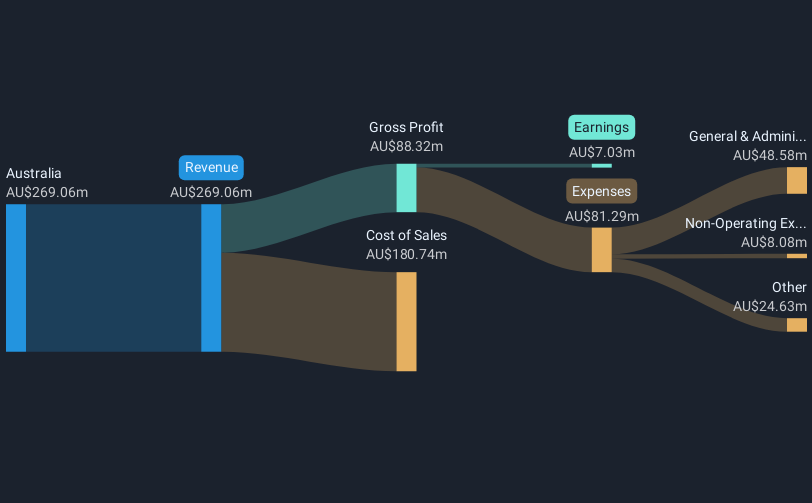

Operations: The company's revenue is derived entirely from its operations in Australia, amounting to A$269.06 million.

Market Cap: A$113.4M

MaxiPARTS Limited, with a market cap of A$113.40 million, has shown promising financial health for a penny stock. The company reported significant earnings growth, with net income rising to A$3.72 million for the half year ended December 31, 2024. It maintains strong coverage of interest payments through EBIT and has reduced its debt-to-equity ratio over the past five years from 38.2% to 24.1%. While its return on equity remains low at 6.9%, MaxiPARTS is trading at a substantial discount to estimated fair value and offers fully franked dividends, recently increased to A$0.0305 per share.

- Take a closer look at MaxiPARTS' potential here in our financial health report.

- Assess MaxiPARTS' future earnings estimates with our detailed growth reports.

S2 Resources (ASX:S2R)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: S2 Resources Ltd is involved in the exploration and evaluation of mineral properties in Australia and Finland, with a market capitalization of A$32.61 million.

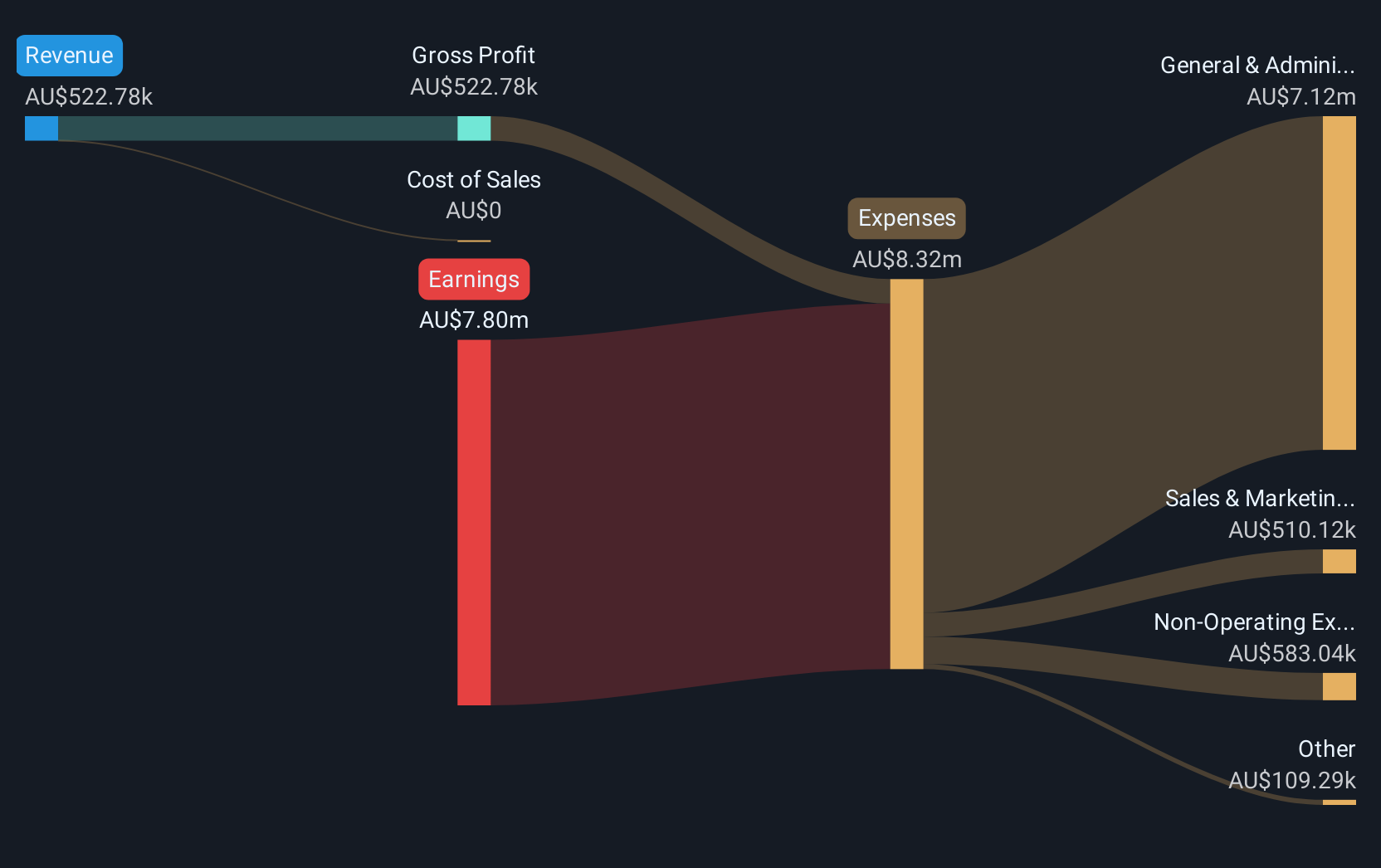

Operations: S2 Resources Ltd does not report any specific revenue segments.

Market Cap: A$32.61M

S2 Resources Ltd, with a market cap of A$32.61 million, operates in the mineral exploration sector and is currently pre-revenue, generating less than US$1 million. Despite reporting a net income of A$2.34 million for the half year ended December 31, 2024, it remains unprofitable with negative return on equity at -69.54%. The company has no debt and its short-term assets significantly exceed liabilities; however, it faces challenges with less than one year of cash runway under current conditions. The management team is experienced but profitability isn't expected within the next three years according to forecasts.

- Click to explore a detailed breakdown of our findings in S2 Resources' financial health report.

- Explore S2 Resources' analyst forecasts in our growth report.

Shaver Shop Group (ASX:SSG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shaver Shop Group Limited operates as a retailer of personal care and grooming products across Australia and New Zealand, with a market capitalization of A$166.39 million.

Operations: The company's revenue is primarily generated from retail store sales of specialist personal grooming products, amounting to A$218.14 million.

Market Cap: A$166.39M

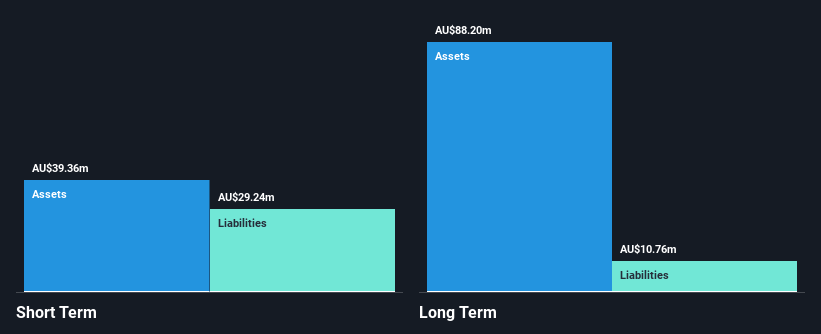

Shaver Shop Group Limited, with a market cap of A$166.39 million, is trading at 60.3% below its estimated fair value and has recently been added to the S&P/ASX All Ordinaries Index. The company is debt-free with short-term assets exceeding liabilities, but its return on equity is considered low at 15.9%. Despite negative earnings growth over the past year, sales trends have shown slight improvement in recent months with online and in-store sales gaining traction. The dividend yield stands at 8.03%, though it is not well covered by earnings, reflecting potential sustainability concerns despite management's confidence as evidenced by a recent dividend increase.

- Click here to discover the nuances of Shaver Shop Group with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Shaver Shop Group's future.

Summing It All Up

- Investigate our full lineup of 980 ASX Penny Stocks right here.

- Ready To Venture Into Other Investment Styles? Trump's oil boom is here — pipelines are primed to profit. Discover the 20 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SSG

Shaver Shop Group

Shaver Shop Group Limited retails personal care and grooming products in Australia and New Zealand.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives