- Australia

- /

- Specialty Stores

- /

- ASX:SSG

3 Promising ASX Penny Stocks With Market Caps Up To A$600M

Reviewed by Simply Wall St

The ASX200 is set to open 0.72% higher today, reflecting cautious optimism as investors focus on key trade negotiations between the United States and China. In the context of this market landscape, penny stocks—though an outdated term—remain a relevant area for investment, often highlighting smaller or less-established companies with potential value. By focusing on those with strong financials and clear growth prospects, investors can uncover hidden gems within this segment of the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.74 | A$140.15M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.94 | A$1.1B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.55 | A$73.12M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.71 | A$417.83M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.625 | A$119.45M | ✅ 3 ⚠️ 2 View Analysis > |

| GR Engineering Services (ASX:GNG) | A$2.69 | A$450.18M | ✅ 2 ⚠️ 1 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.34 | A$158.48M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.43 | A$816.88M | ✅ 4 ⚠️ 4 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.515 | A$742.47M | ✅ 5 ⚠️ 3 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.83 | A$1.29B | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 989 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Kingsgate Consolidated (ASX:KCN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Kingsgate Consolidated Limited focuses on the exploration, development, and mining of gold and silver mineral properties with a market cap of A$536.12 million.

Operations: The company generates revenue primarily from its Chatree segment, amounting to A$210.69 million.

Market Cap: A$536.12M

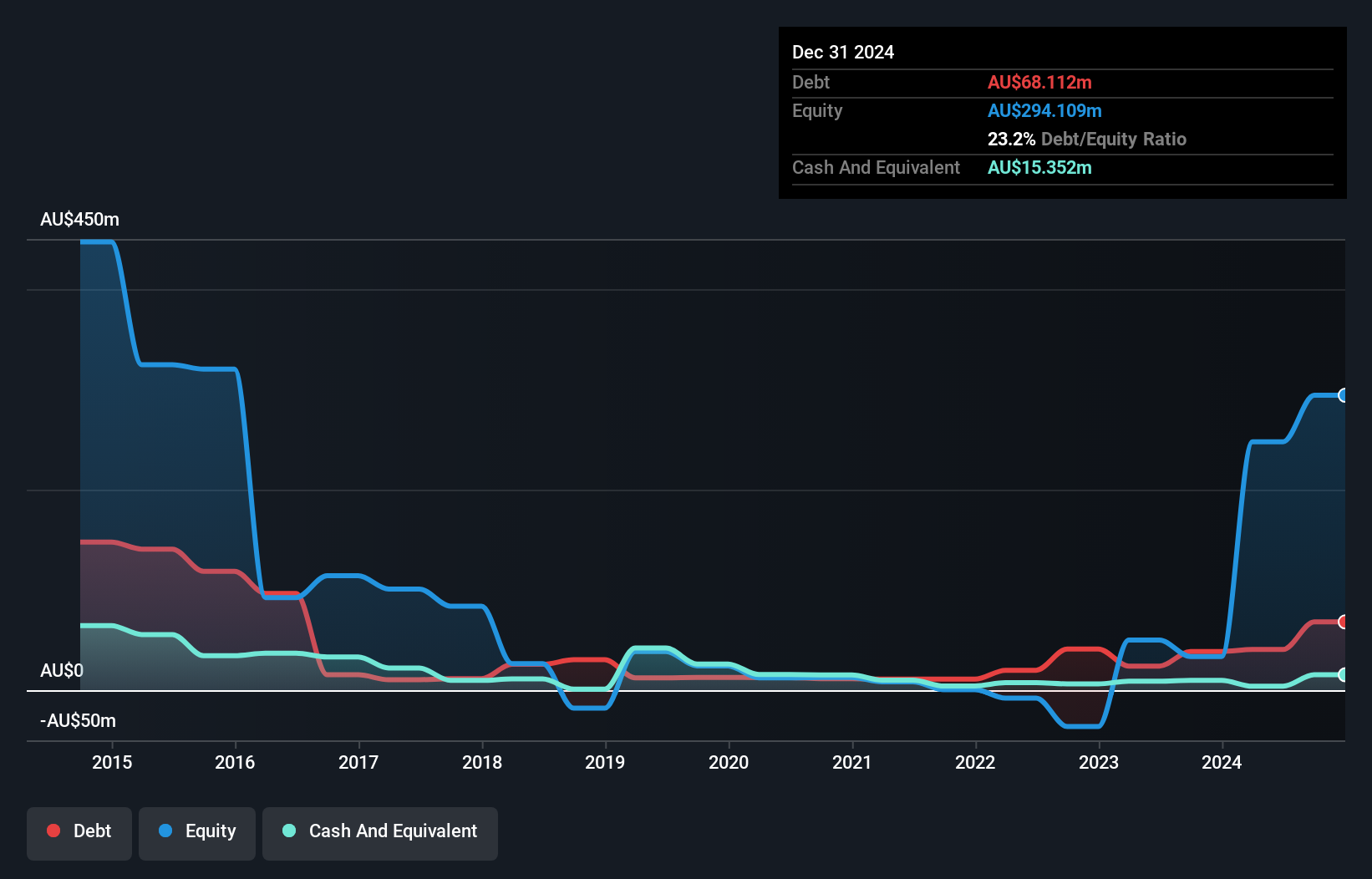

Kingsgate Consolidated has shown significant financial improvement, with recent earnings growth of 1203%, surpassing industry averages. The company reported a net income of A$2.45 million for the half year ending December 31, 2024, compared to a loss in the previous year. Its debt is well covered by operating cash flow at 69%, and interest payments are comfortably managed with EBIT coverage of 17.2 times. The stock is trading significantly below its estimated fair value and offers good relative value compared to peers. Kingsgate's board is experienced, although short-term assets do not cover long-term liabilities fully.

- Click here and access our complete financial health analysis report to understand the dynamics of Kingsgate Consolidated.

- Understand Kingsgate Consolidated's earnings outlook by examining our growth report.

NobleOak Life (ASX:NOL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NobleOak Life Limited, with a market cap of A$130.72 million, manufactures and distributes life insurance products in Australia.

Operations: The company's revenue is derived from three segments: Genus (A$15.00 million), Direct (A$94.32 million), and Strategic Partnerships (A$280.57 million).

Market Cap: A$130.72M

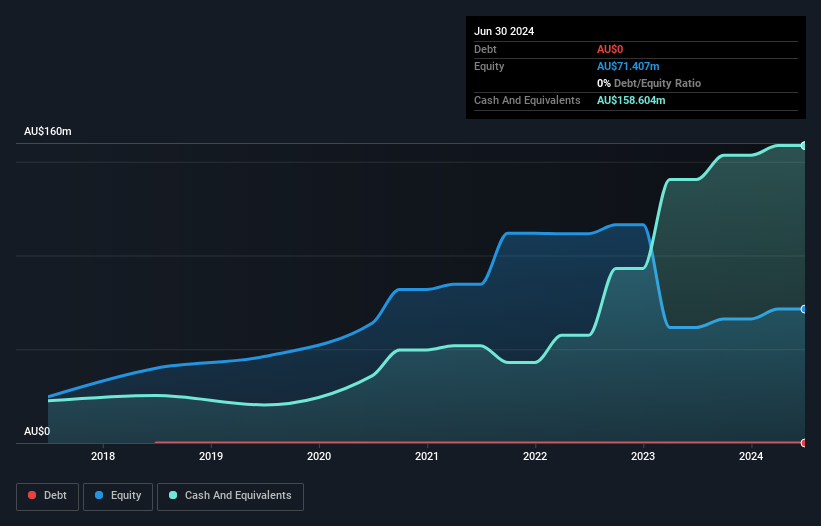

NobleOak Life Limited, with a market cap of A$130.72 million, demonstrates strong financial health and growth potential. The company reported significant earnings growth of 111.2% over the past year, surpassing industry averages. Its short-term assets (A$380.4M) comfortably cover both short-term liabilities (A$215.6M) and long-term liabilities (A$192.4M). NobleOak is debt-free, eliminating concerns about interest payments or cash flow coverage for debt obligations. Despite recent insider selling activity, the stock trades at a good value compared to its estimated fair value and peers in the industry, supported by an experienced management team with seasoned board oversight.

- Navigate through the intricacies of NobleOak Life with our comprehensive balance sheet health report here.

- Evaluate NobleOak Life's prospects by accessing our earnings growth report.

Shaver Shop Group (ASX:SSG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shaver Shop Group Limited is a retailer of personal care and grooming products operating in Australia and New Zealand, with a market capitalization of A$178.18 million.

Operations: The company generates revenue primarily from retail store sales of specialist personal grooming products, totaling A$218.14 million.

Market Cap: A$178.18M

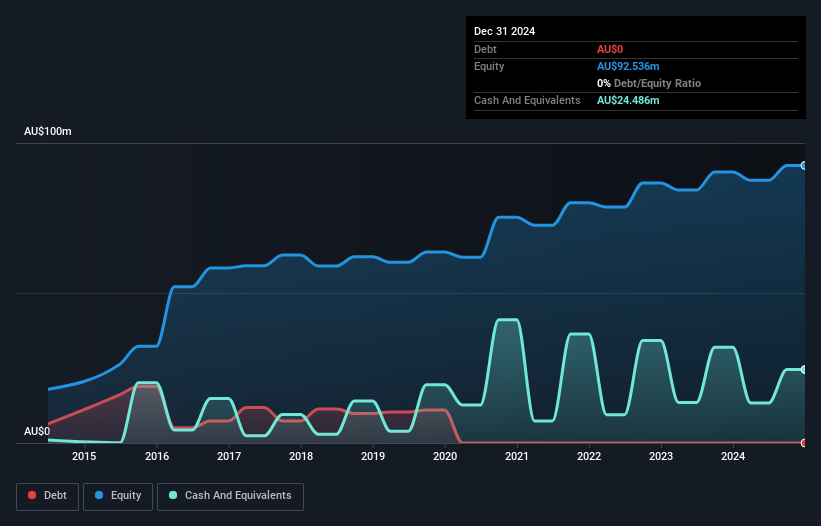

Shaver Shop Group Limited, with a market capitalization of A$178.18 million, has shown resilience despite recent challenges. The company is debt-free and maintains a strong balance sheet, with short-term assets (A$62.1M) exceeding both short-term (A$51.0M) and long-term liabilities (A$19.2M). Recent sales data indicates slight improvement in growth trends, particularly in online sales during the second half of fiscal year 2025. Although net profit margins have slightly decreased to 6.7% from 7.1%, the company's seasoned management team continues to provide stability amid modest earnings growth forecasts of approximately 7.96% annually.

- Take a closer look at Shaver Shop Group's potential here in our financial health report.

- Examine Shaver Shop Group's earnings growth report to understand how analysts expect it to perform.

Turning Ideas Into Actions

- Navigate through the entire inventory of 989 ASX Penny Stocks here.

- Interested In Other Possibilities? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SSG

Shaver Shop Group

Shaver Shop Group Limited retails personal care and grooming products in Australia and New Zealand.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives