- Australia

- /

- Aerospace & Defense

- /

- ASX:DRO

Undiscovered Gems In Australia Spotlighting 3 Promising Small Caps

Reviewed by Simply Wall St

The Australian market has experienced a slight downturn with the ASX200 closing down 0.15%, driven by increased conflict in the Middle East which has affected most sectors, though it boosted the Energy sector. Amid these fluctuations, small-cap stocks often present unique opportunities for investors willing to explore beyond the well-trodden paths of larger indices. In this environment, identifying promising small-cap companies requires a keen eye for potential growth and resilience amidst broader market volatility. Here are three lesser-known Australian small caps that stand out as undiscovered gems worth watching.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

| Bisalloy Steel Group | 0.95% | 10.27% | 24.14% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Lycopodium | NA | 17.22% | 33.85% | ★★★★★★ |

| SKS Technologies Group | NA | 34.65% | 47.39% | ★★★★★★ |

| Red Hill Minerals | NA | 75.05% | 36.74% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| Hearts and Minds Investments | 1.00% | 18.81% | 20.95% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

DroneShield (ASX:DRO)

Simply Wall St Value Rating: ★★★★★★

Overview: DroneShield Limited develops, commercializes, and sells hardware and software technology for drone detection and security in Australia and the United States, with a market cap of approximately A$1.26 billion.

Operations: DroneShield Limited generates revenue primarily from its Aerospace & Defense segment, amounting to A$67.52 million. The company has a market cap of approximately A$1.26 billion.

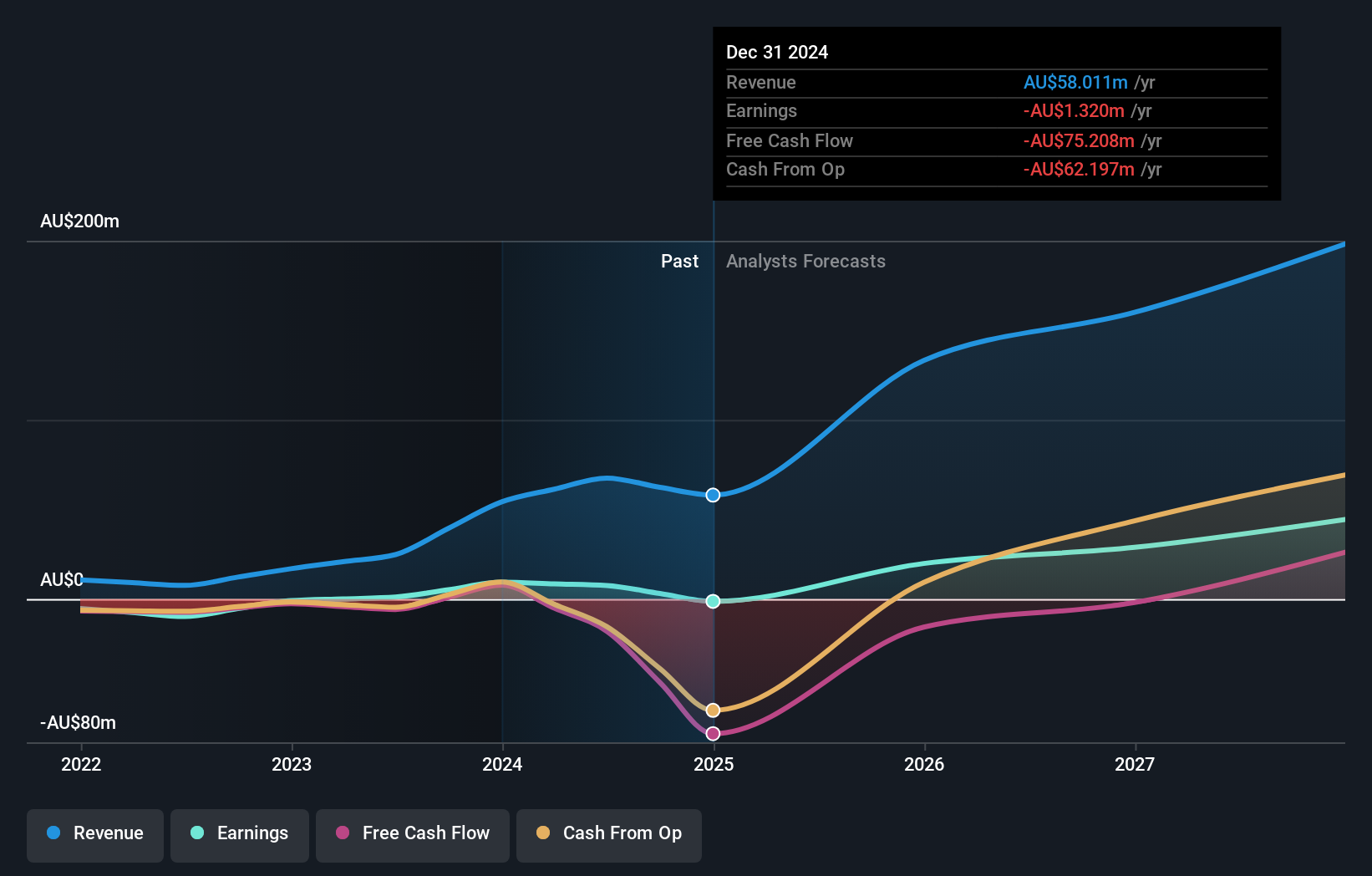

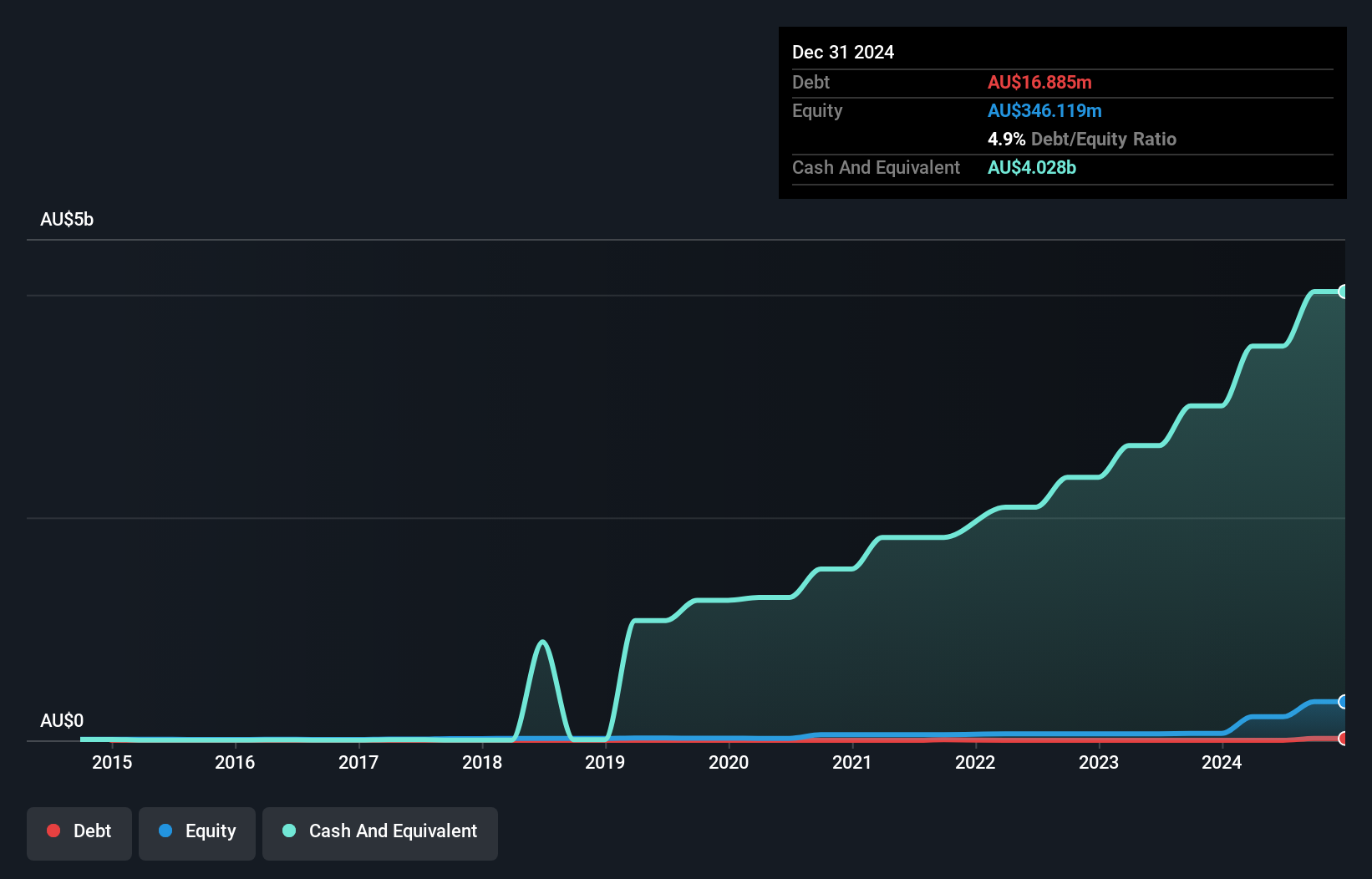

DroneShield, a nimble player in the Aerospace & Defense sector, has seen its earnings soar by 612% over the past year, outpacing industry growth of 14%. Despite being debt-free now compared to a 41.5% debt-to-equity ratio five years ago, it faces volatility with its share price fluctuating significantly recently. The company reported sales of A$23.99 million for the half-year ended June 2024 but incurred a net loss of A$4.8 million during this period.

- Click here to discover the nuances of DroneShield with our detailed analytical health report.

Evaluate DroneShield's historical performance by accessing our past performance report.

Generation Development Group (ASX:GDG)

Simply Wall St Value Rating: ★★★★★★

Overview: Generation Development Group Limited (ASX:GDG) operates in Australia, focusing on the marketing and management of life insurance and life investment products and services, with a market cap of A$853.24 million.

Operations: Generation Development Group Limited generates revenue primarily from Benefit Funds (A$316.26 million) and Benefit Funds Management & Funds Administration (A$37.26 million), with a smaller contribution from Other Business (A$3.54 million).

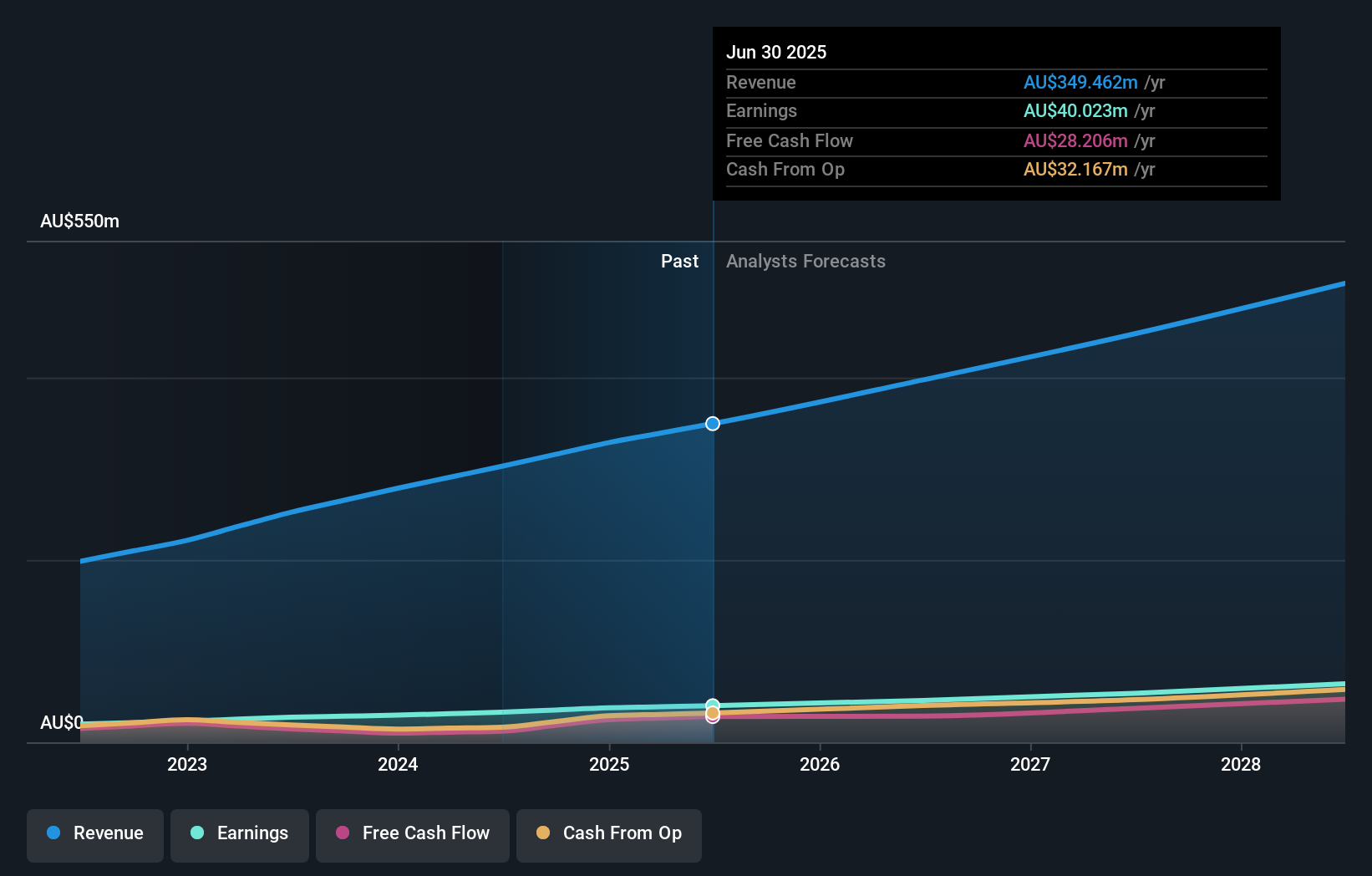

Generation Development Group, a nimble player in the financial sector, has demonstrated robust earnings growth of 30.3% over the past year, outpacing the insurance industry's 25.4%. The company remains debt-free and boasts high-quality earnings. For fiscal year 2024, GDG reported net income of A$5.84 million compared to A$4.48 million previously, with basic earnings per share rising to A$0.0301 from A$0.0238 last year, reflecting solid operational performance despite significant insider selling recently observed.

Supply Network (ASX:SNL)

Simply Wall St Value Rating: ★★★★★★

Overview: Supply Network Limited supplies aftermarket parts to the commercial vehicle industry in Australia and New Zealand, with a market cap of A$1.27 billion.

Operations: Supply Network Limited generates revenue primarily from the provision of aftermarket parts for the commercial vehicle market, amounting to A$302.72 million. The company focuses on this single revenue stream within Australia and New Zealand.

Supply Network, a promising player in the Australian market, has shown impressive growth. Over the past year, earnings surged by 20.5%, outpacing industry averages. Debt management seems prudent with a debt-to-equity ratio dropping from 24.6% to 9.3% over five years, and interest payments are well-covered at 22.6x EBIT. Recent annual results reveal sales of A$302.6 million and net income of A$33 million, alongside an increased dividend of A$0.33 per share for 2024.

- Delve into the full analysis health report here for a deeper understanding of Supply Network.

Review our historical performance report to gain insights into Supply Network's's past performance.

Seize The Opportunity

- Investigate our full lineup of 57 ASX Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DRO

DroneShield

Engages in the development, commercialization, and sale of hardware and software technology for drone detection and security in Australia and the United States.

Flawless balance sheet with high growth potential.