- Australia

- /

- Retail Distributors

- /

- ASX:SNL

Supply Network (ASX:SNL) Is Up 6.7% After Double-Digit Revenue Growth - Has The Bull Case Changed?

Reviewed by Simply Wall St

- Supply Network Limited has reported its full-year results for the period ended June 30, 2025, posting sales of A$348.83 million and net income of A$40.02 million, both higher than the previous year.

- The company’s growth in both revenue and earnings per share points to strengthened operational execution compared to the prior year.

- We'll explore how Supply Network’s double-digit revenue increase informs its investment narrative and operational outlook moving forward.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Supply Network's Investment Narrative?

For investors considering Supply Network Limited, the big picture hinges on the belief that the company can translate consistently strong operational performance into sustainable returns, even as the business faces elevated expectations. The latest results slightly outpaced management's own conservative guidance, confirming resilience in both sales and profit figures. While this outperformance could strengthen near-term sentiment and support the company’s momentum, the stock's high price-to-earnings ratio and premium to consensus fair value still stand out as crucial considerations. Additionally, the ambitious revenue growth targets outlined for the next year come with operational risks, particularly around the transition to new ERP software and a sales platform, any unexpected disruption here could weigh on margins and short-term earnings. The recent update suggests some catalysts for optimism but doesn't fundamentally alter the main risk themes that investors were weighing before.

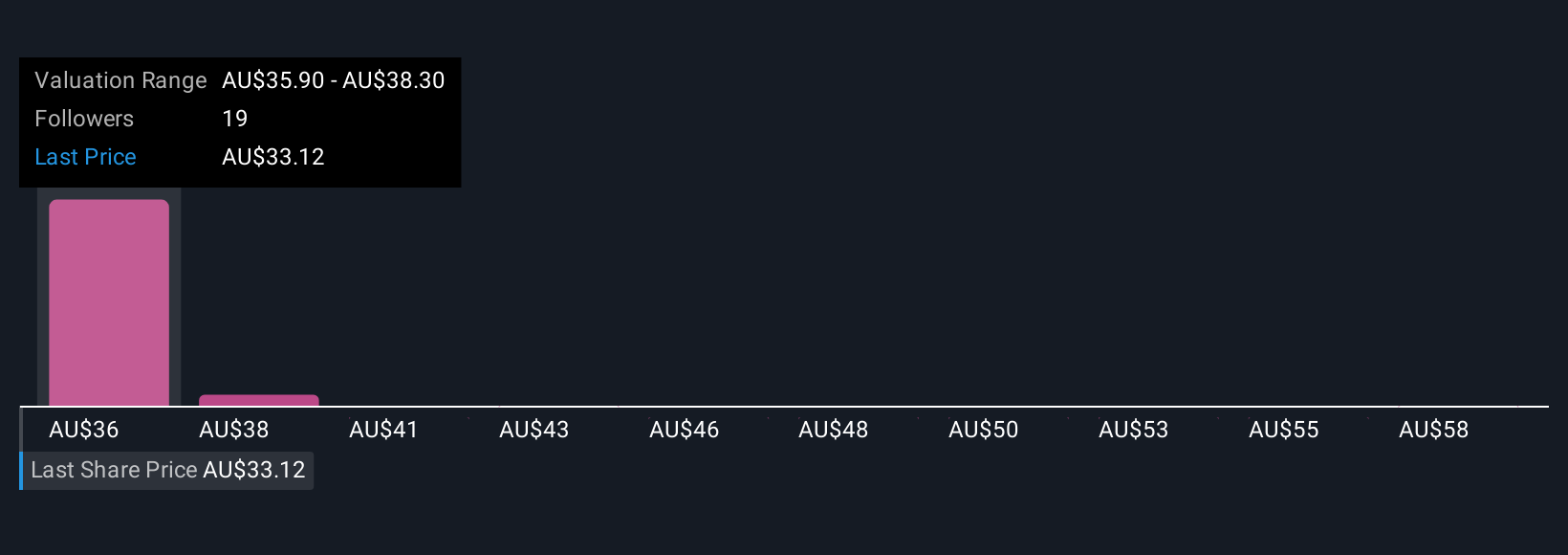

But, against these gains, the transition to new software systems could pose real operational risks. Supply Network's shares are on the way up, but they could be overextended by 16%. Uncover the fair value now.Exploring Other Perspectives

Explore 6 other fair value estimates on Supply Network - why the stock might be worth 14% less than the current price!

Build Your Own Supply Network Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Supply Network research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Supply Network research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Supply Network's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SNL

Supply Network

Provides aftermarket parts to the commercial vehicle market in Australia and New Zealand.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives