- Australia

- /

- Capital Markets

- /

- ASX:FID

Top 3 ASX Dividend Stocks To Boost Your Portfolio

Reviewed by Simply Wall St

As the Australian market navigates a period of slight downturn, with the ASX200 down 0.4% and all sectors losing ground, investors are closely watching how economic factors like the Reserve Bank's decision to hold interest rates at 4.35% impact their portfolios. In such an environment, dividend stocks can offer a reliable income stream and potential stability, making them an attractive option for those seeking to bolster their investments amidst broader market fluctuations.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Perenti (ASX:PRN) | 6.93% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.71% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 8.34% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.37% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.30% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.56% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.40% | ★★★★★☆ |

| GrainCorp (ASX:GNC) | 6.09% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.24% | ★★★★★☆ |

| Grange Resources (ASX:GRR) | 8.33% | ★★★★☆☆ |

Click here to see the full list of 37 stocks from our Top ASX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

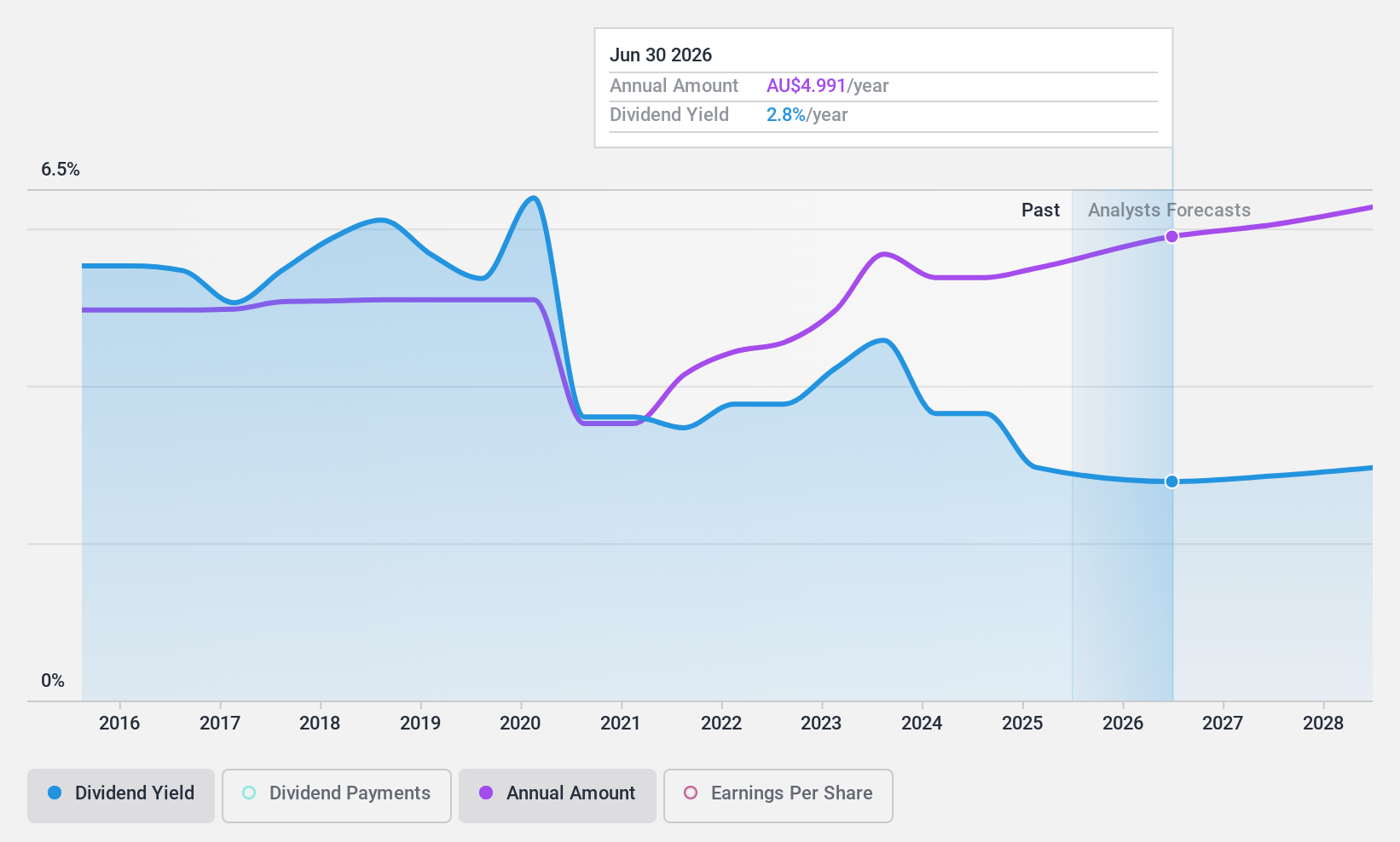

Commonwealth Bank of Australia (ASX:CBA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Commonwealth Bank of Australia offers financial services across Australia, New Zealand, and internationally with a market cap of A$241.38 billion.

Operations: Commonwealth Bank of Australia's revenue segments include Retail Banking Services (Incl. Bankwest) at A$12.47 billion, Business Banking at A$8.14 billion, New Zealand operations at A$2.86 billion, and Institutional Banking and Markets contributing A$2.51 billion.

Dividend Yield: 3.2%

Commonwealth Bank of Australia's dividend payments have been volatile over the past decade, with a current payout ratio of 82.1% indicating coverage by earnings. Despite this, its dividend yield is relatively low at 3.22% compared to top Australian payers. Recent executive changes and significant fixed-income offerings indicate strategic shifts, while insider selling raises some concerns about internal confidence in future performance stability.

- Dive into the specifics of Commonwealth Bank of Australia here with our thorough dividend report.

- Our expertly prepared valuation report Commonwealth Bank of Australia implies its share price may be too high.

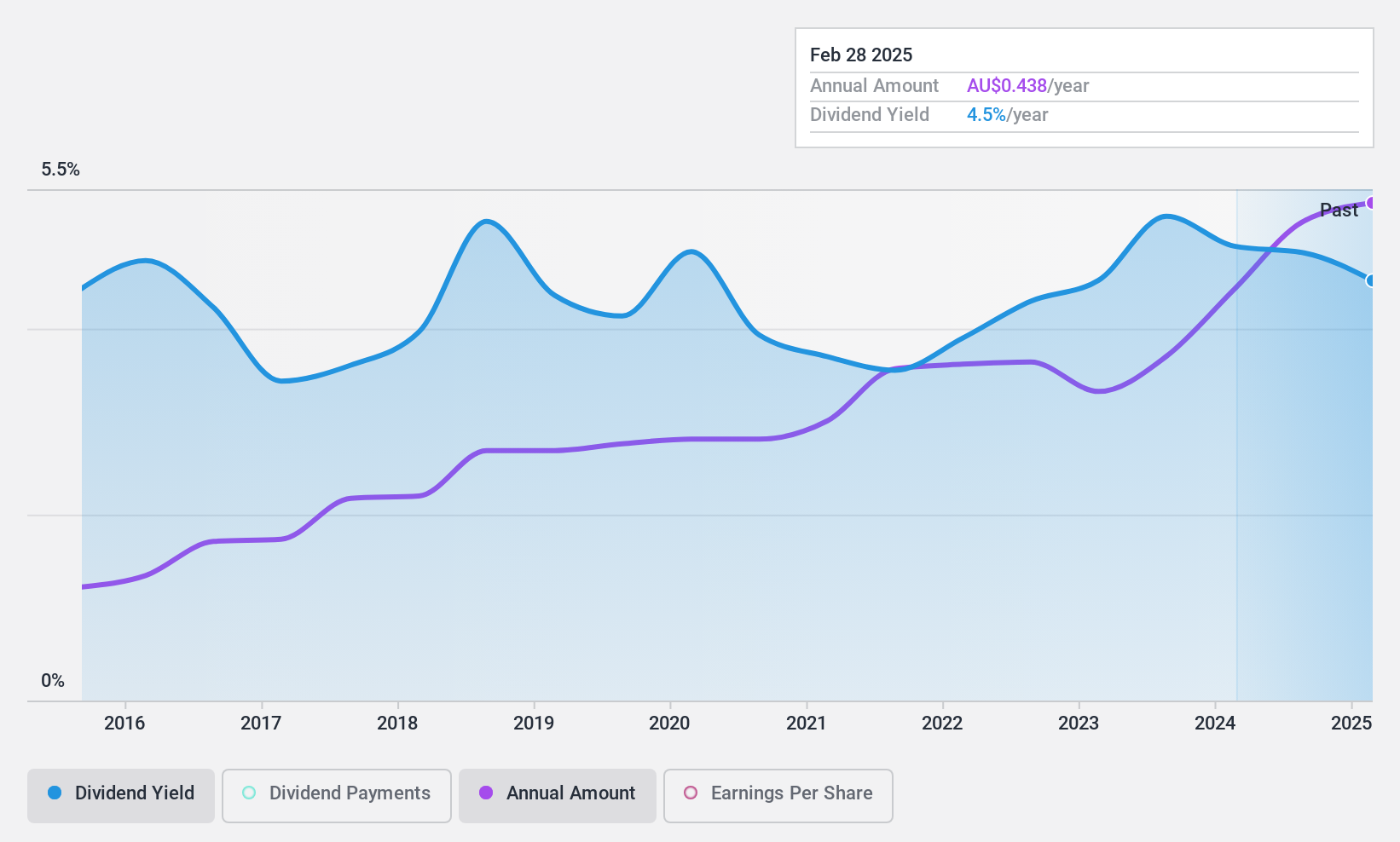

Fiducian Group (ASX:FID)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fiducian Group Ltd, with a market cap of A$288.02 million, operates in Australia through its subsidiaries to provide financial services.

Operations: Fiducian Group Ltd generates revenue through its diverse financial services operations in Australia, with contributions from Funds Management (A$22.08 million), Corporate Services (A$15.06 million), Financial Planning (A$27.69 million), and Platform Administration (A$15.97 million).

Dividend Yield: 4.3%

Fiducian Group's dividends are well-covered by both earnings and cash flows, with a payout ratio of 82.3% and a cash payout ratio of 63.8%. The company reported net income growth to A$15.04 million for the year ending June 2024, supporting its stable dividend history over the past decade. Although its dividend yield of 4.3% is below Australia's top payers, Fiducian has consistently increased dividends over ten years, enhancing its appeal to income-focused investors.

- Delve into the full analysis dividend report here for a deeper understanding of Fiducian Group.

- The valuation report we've compiled suggests that Fiducian Group's current price could be quite moderate.

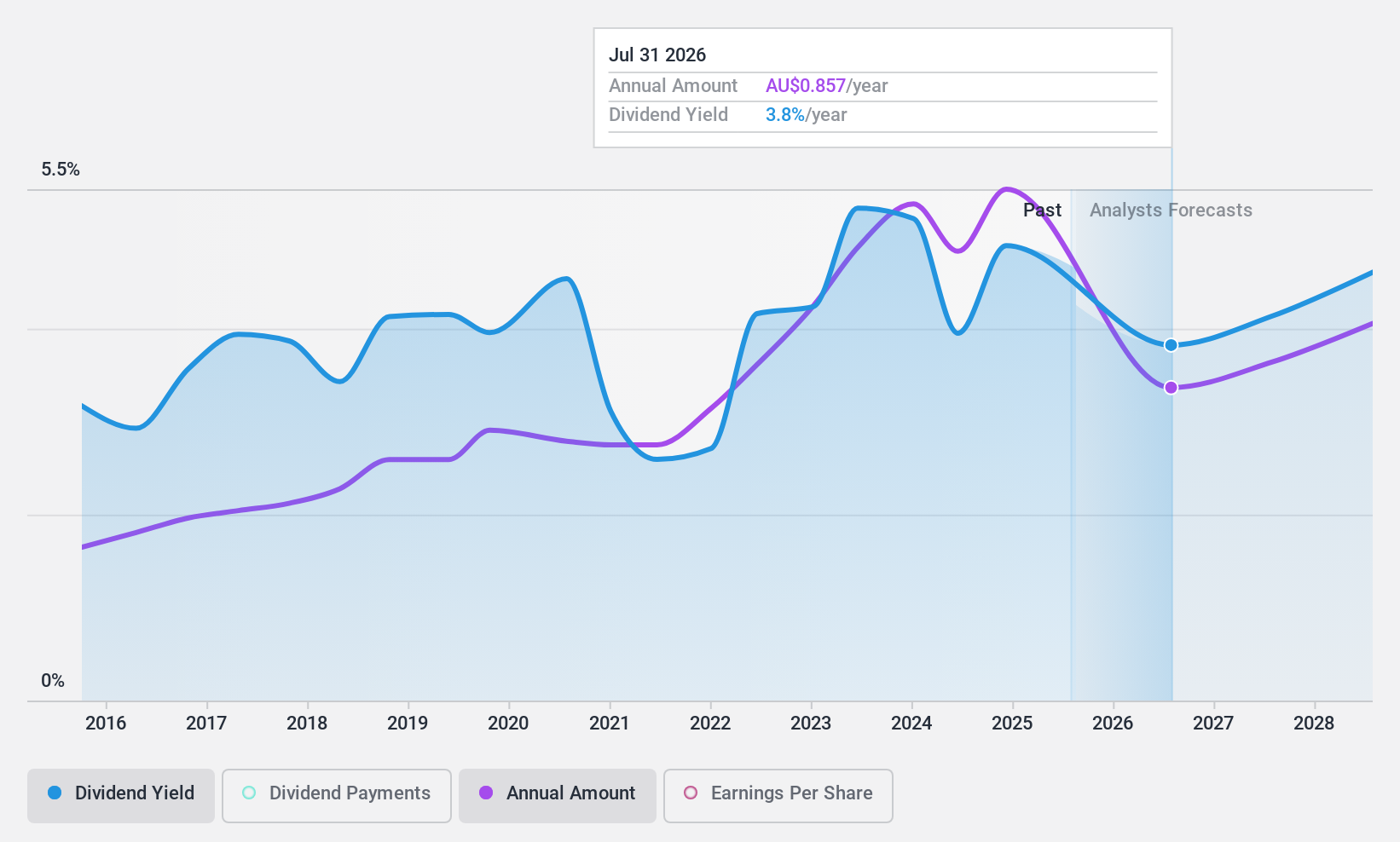

Premier Investments (ASX:PMV)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Premier Investments Limited operates specialty retail fashion chains across Australia, New Zealand, Asia, and Europe with a market cap of A$5.27 billion.

Operations: Premier Investments Limited generates revenue from its retail segment, amounting to A$1.61 billion, and its investment segment, contributing A$208.53 million.

Dividend Yield: 4.2%

Premier Investments' dividend yield of 4.24% is modest compared to Australia's top payers, but its dividends are well-covered by earnings and cash flows with payout ratios of 82.2% and 59.1%, respectively. The company has maintained a stable and growing dividend over the past decade, recently announcing a A$0.70 per share dividend for the six months ending July 2024. Despite a slight decline in annual revenue to A$1.62 billion, dividends remain reliable amidst strategic M&A discussions with Myer Holdings Limited.

- Click to explore a detailed breakdown of our findings in Premier Investments' dividend report.

- The analysis detailed in our Premier Investments valuation report hints at an inflated share price compared to its estimated value.

Taking Advantage

- Explore the 37 names from our Top ASX Dividend Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FID

Fiducian Group

Through its subsidiaries, provides financial services in Australia.

Outstanding track record with flawless balance sheet and pays a dividend.