- Australia

- /

- Metals and Mining

- /

- ASX:FMG

Top ASX Dividend Stocks To Watch In September 2024

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has remained flat, although the Materials sector gained 6.9% during that time. With the market up 15% over the past year and earnings forecasted to grow by 12% annually, identifying dividend stocks with strong fundamentals and consistent payouts can be particularly rewarding in these conditions.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Perenti (ASX:PRN) | 7.44% | ★★★★★☆ |

| Fortescue (ASX:FMG) | 9.82% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 6.61% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.24% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.52% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.07% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.61% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.56% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.28% | ★★★★★☆ |

| Grange Resources (ASX:GRR) | 7.27% | ★★★★☆☆ |

Click here to see the full list of 37 stocks from our Top ASX Dividend Stocks screener.

We'll examine a selection from our screener results.

Fortescue (ASX:FMG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fortescue Ltd engages in the exploration, development, production, processing, and sale of iron ore in Australia, China, and internationally with a market cap of A$59.67 billion.

Operations: Fortescue Ltd generates its revenue primarily from the metals segment, which accounts for $18.13 billion, and the energy segment, contributing $91 million.

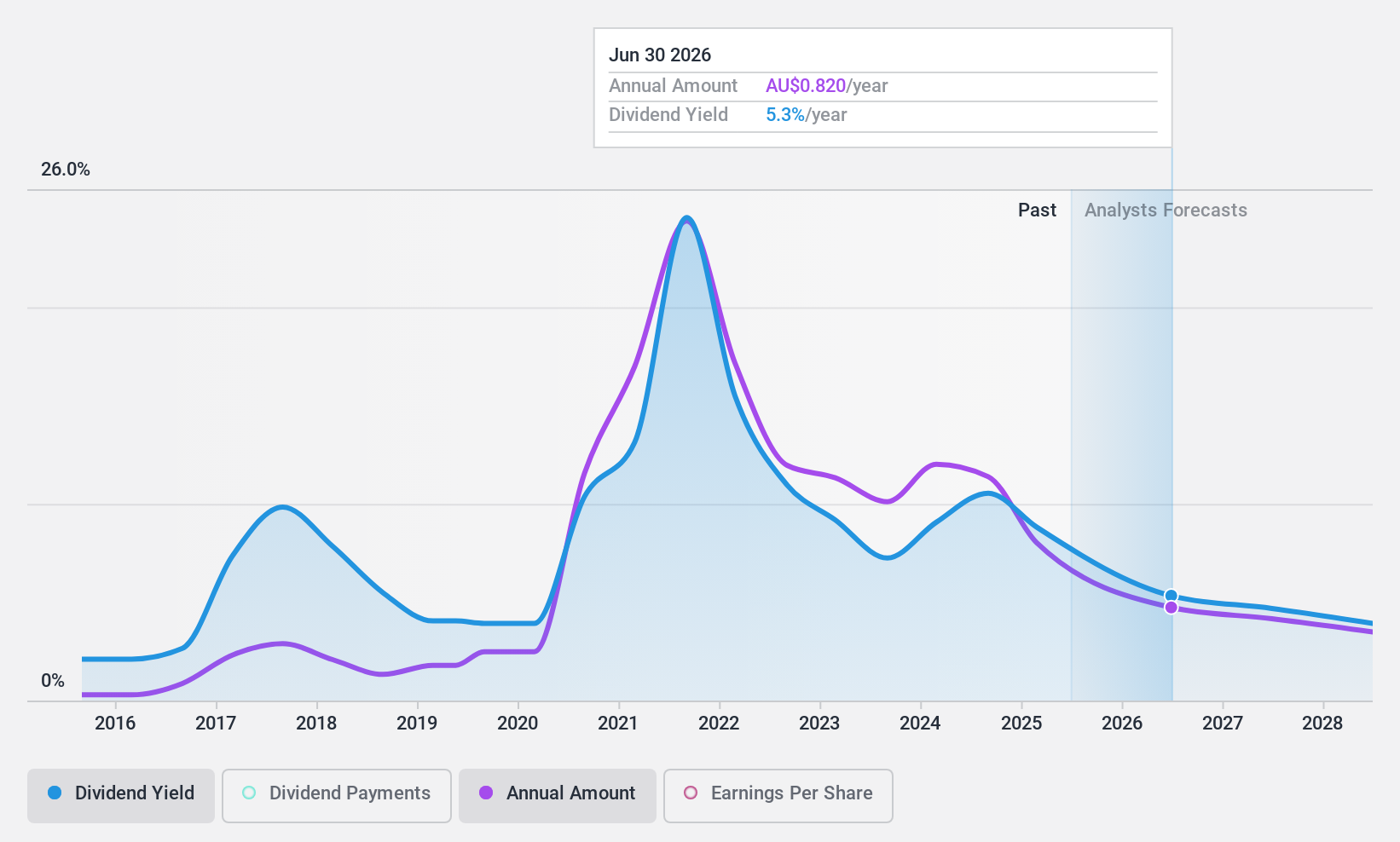

Dividend Yield: 9.8%

Fortescue's dividend yield is among the top 25% in the Australian market, but its payments have been volatile over the past decade. Despite a reasonable payout ratio of 71.1% and cash payout ratio of 79.3%, earnings are forecasted to decline by 26.1% annually for the next three years, raising concerns about sustainability. Recent board changes include Dr. Larry Marshall as Lead Independent Director and a decreased ordinary dividend of A$0.89 per security for FY2024.

- Unlock comprehensive insights into our analysis of Fortescue stock in this dividend report.

- Our valuation report unveils the possibility Fortescue's shares may be trading at a discount.

Nick Scali (ASX:NCK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nick Scali Limited, with a market cap of A$1.38 billion, sources and retails household furniture and related accessories in Australia, the United Kingdom, and New Zealand.

Operations: Nick Scali Limited generates A$468.19 million from the retailing of furniture.

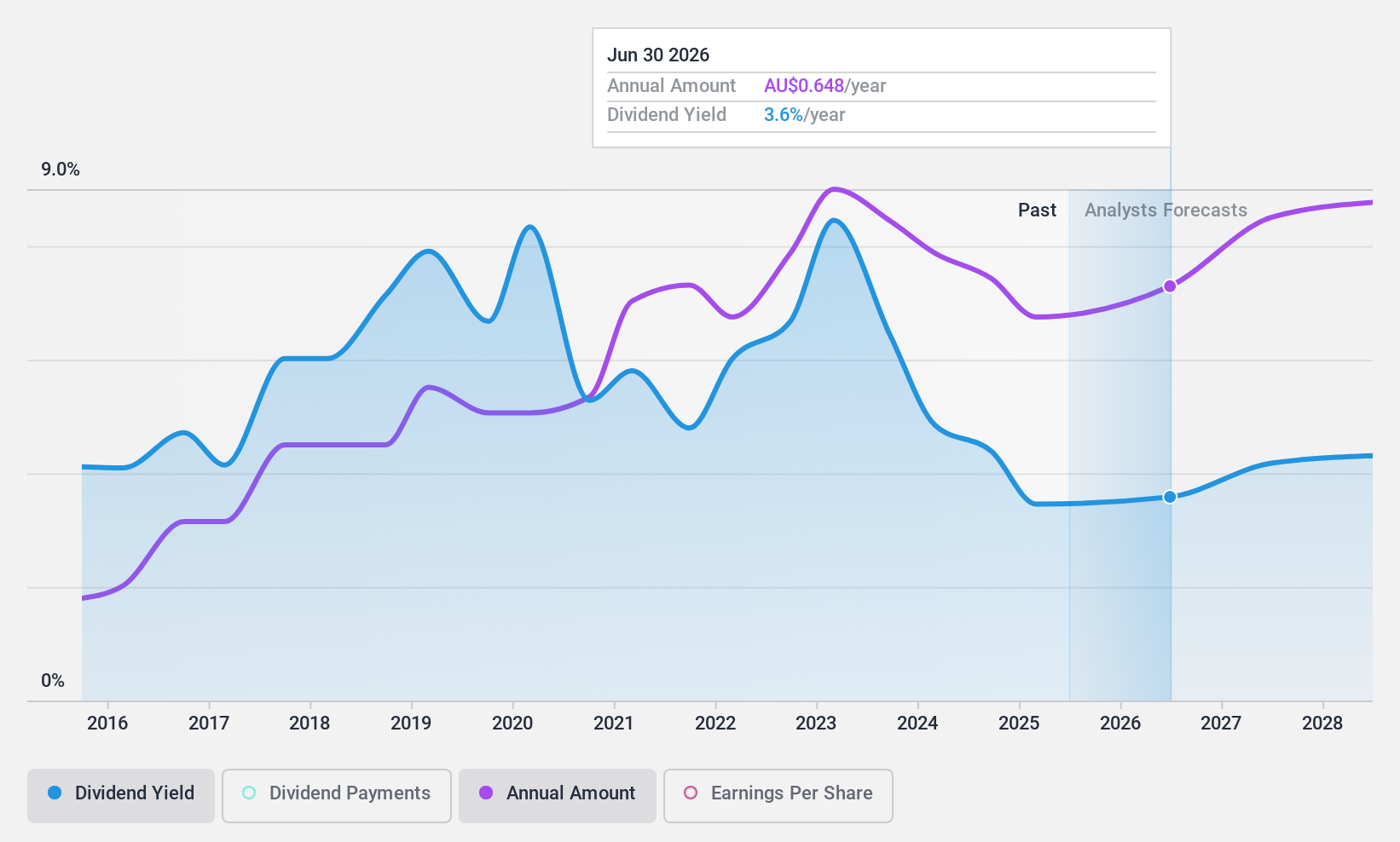

Dividend Yield: 4.1%

Nick Scali's dividend payments are well-covered by both earnings (68.9% payout ratio) and free cash flows (54.8% cash payout ratio). The company has a history of stable and growing dividends over the past decade, although its current yield of 4.07% is lower than the top 25% in Australia. Recent financial results showed a decline in net income to A$80.61 million from A$101.08 million last year, with diluted EPS dropping to A$0.987 from A$1.248, potentially impacting future payouts.

- Delve into the full analysis dividend report here for a deeper understanding of Nick Scali.

- Our valuation report here indicates Nick Scali may be undervalued.

National Storage REIT (ASX:NSR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: National Storage REIT (ASX:NSR) is the largest self-storage provider in Australia and New Zealand, operating over 225 centres for more than 90,000 residential and commercial customers, with a market cap of A$3.55 billion.

Operations: National Storage REIT generates revenue primarily from the operation and management of its storage centres, amounting to A$354.69 million.

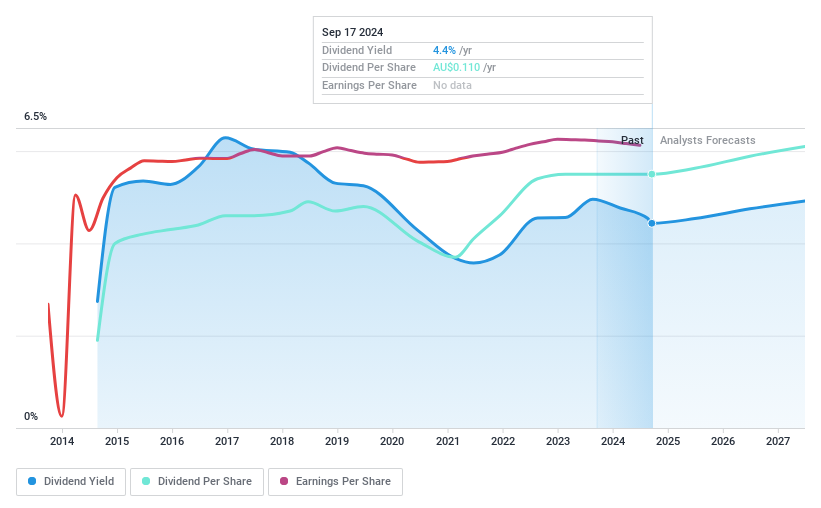

Dividend Yield: 4.3%

National Storage REIT's dividend payments have been stable and reliable over the past decade, with a current yield of 4.28%, though this is below the top 25% in Australia. The payout ratio of 55.5% indicates dividends are well-covered by earnings, and an 83% cash payout ratio suggests sufficient free cash flow coverage. Recent financials showed increased revenue to A$355.37 million but a decline in net income to A$28.93 million, which could affect future distributions.

- Dive into the specifics of National Storage REIT here with our thorough dividend report.

- Insights from our recent valuation report point to the potential overvaluation of National Storage REIT shares in the market.

Make It Happen

- Delve into our full catalog of 37 Top ASX Dividend Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FMG

Fortescue

Engages in the exploration, development, production, processing, and sale of iron ore in Australia, China, and internationally.

Outstanding track record with excellent balance sheet and pays a dividend.