- Australia

- /

- Metals and Mining

- /

- ASX:ARR

American Rare Earths Leads ASX Penny Stocks To Consider

Reviewed by Simply Wall St

As the Australian market experiences a gradual decline, influenced by profit-taking and external geopolitical tensions, investors are seeking opportunities beyond traditional large-cap stocks. Penny stocks, though an older term, continue to attract attention for their potential to offer surprising value and growth at lower price points. By focusing on companies with strong balance sheets and solid fundamentals, investors may uncover hidden gems that provide upside without many of the risks typically associated with this segment of the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.50 | A$70.76M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.65 | A$124.05M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.57 | A$396.25M | ✅ 4 ⚠️ 2 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.67 | A$441.56M | ✅ 5 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$3.08 | A$725.72M | ✅ 4 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.25 | A$756.37M | ✅ 4 ⚠️ 3 View Analysis > |

| Accent Group (ASX:AX1) | A$1.845 | A$1.11B | ✅ 4 ⚠️ 2 View Analysis > |

| Lindsay Australia (ASX:LAU) | A$0.71 | A$225.19M | ✅ 4 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.37 | A$159.91M | ✅ 3 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.815 | A$146.19M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 1,001 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

American Rare Earths (ASX:ARR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: American Rare Earths Limited focuses on the exploration and development of mineral resources in Australia and the United States, with a market cap of A$139.54 million.

Operations: American Rare Earths Limited currently does not report any revenue segments.

Market Cap: A$139.54M

American Rare Earths Limited, with a market cap of A$139.54 million, is pre-revenue and debt-free, focusing on the exploration of mineral resources in Australia and the U.S. Recent developments include significant progress at their Cowboy State Mine in Wyoming, where groundwater monitoring wells have been installed as part of environmental permitting efforts. The company also reported promising assay results from its Halleck Creek project, highlighting elevated rare earth mineralization. Leadership changes have strengthened its executive team with seasoned professionals to advance its U.S.-based strategy for developing a secure critical minerals supply chain.

- Click here to discover the nuances of American Rare Earths with our detailed analytical financial health report.

- Learn about American Rare Earths' historical performance here.

Horizon Gold (ASX:HRN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Horizon Gold Limited is involved in the exploration, evaluation, development, and production of gold deposits in Australia with a market cap of A$86.90 million.

Operations: The company's revenue segment consists of A$0.08 million from exploration activities in Australia.

Market Cap: A$86.9M

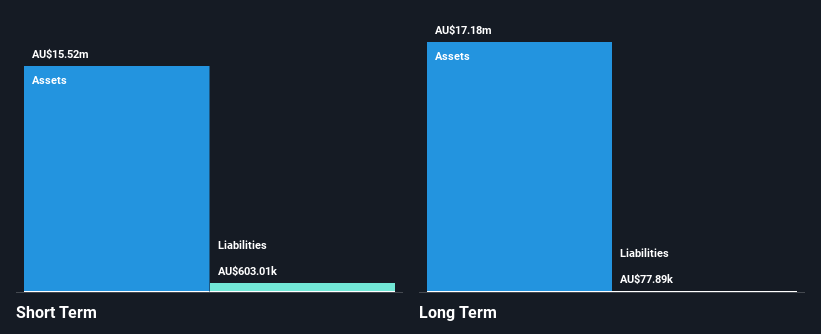

Horizon Gold Limited, with a market cap of A$86.90 million, is pre-revenue and debt-free, focusing on gold exploration in Australia. The company recently reported a small net income for the half-year ended December 31, 2024, marking an improvement from the previous year's loss. Its management team is experienced with an average tenure of 4.5 years and has seen leadership changes to bolster corporate development efforts as it progresses through the Gum Creek Feasibility Study. While its short-term assets cover liabilities, long-term liabilities remain uncovered by current assets. Shareholder dilution has been minimal over the past year.

- Unlock comprehensive insights into our analysis of Horizon Gold stock in this financial health report.

- Gain insights into Horizon Gold's past trends and performance with our report on the company's historical track record.

Kogan.com (ASX:KGN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kogan.com Ltd is an online retailer based in Australia with a market capitalization of A$401.23 million.

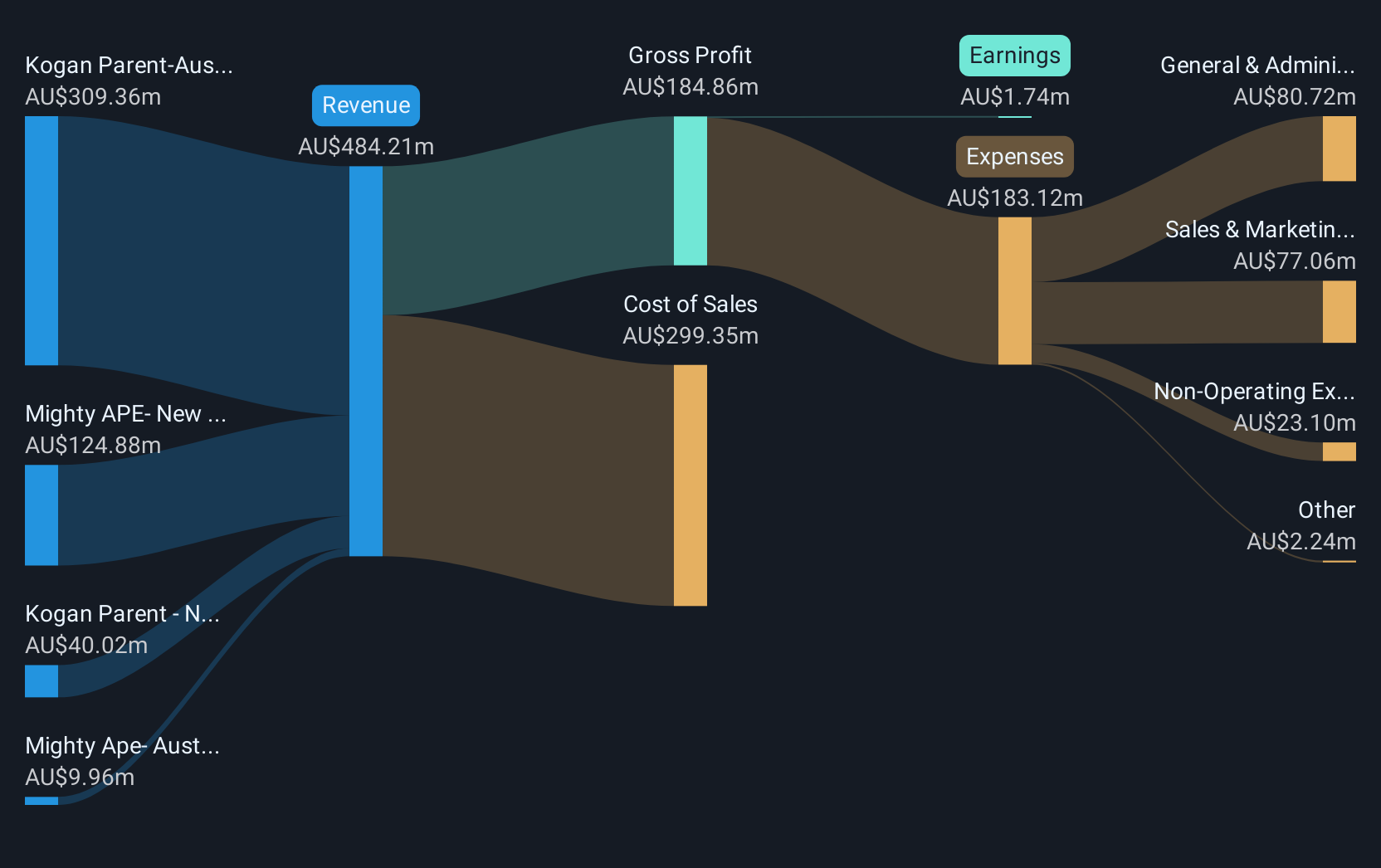

Operations: The company's revenue is derived from its operations in Australia, with A$309.36 million from Kogan Parent and A$9.96 million from Mighty Ape, as well as in New Zealand, where it generates A$40.02 million from Kogan Parent and A$124.88 million from Mighty Ape.

Market Cap: A$401.23M

Kogan.com, with a market cap of A$401.23 million, is debt-free and has extended its buyback plan duration until May 2026. Despite stable weekly volatility over the past year, Kogan faces challenges with negative earnings growth of -73.9% last year and declining profit margins from 1.4% to 0.4%. Its dividend yield of 3.47% isn't well covered by earnings, yet the company trades at a substantial discount to estimated fair value. The seasoned management team averages a tenure of 14.6 years, while short-term assets comfortably cover both short- and long-term liabilities without shareholder dilution in the past year.

- Click here and access our complete financial health analysis report to understand the dynamics of Kogan.com.

- Learn about Kogan.com's future growth trajectory here.

Taking Advantage

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 998 more companies for you to explore.Click here to unveil our expertly curated list of 1,001 ASX Penny Stocks.

- Want To Explore Some Alternatives? These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ARR

American Rare Earths

Explores and develops mineral resources in the United States.

Flawless balance sheet with low risk.

Market Insights

Community Narratives