- Australia

- /

- Specialty Stores

- /

- ASX:HT8

Should You Be Adding Harris Technology Group (ASX:HT8) To Your Watchlist Today?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Harris Technology Group (ASX:HT8). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for Harris Technology Group

How Fast Is Harris Technology Group Growing Its Earnings Per Share?

In the last three years Harris Technology Group's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. It's good to see that Harris Technology Group's EPS have grown from AU$0.0053 to AU$0.0059 over twelve months. I doubt many would complain about that 11% gain.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Harris Technology Group shareholders can take confidence from the fact that EBIT margins are up from 9.0% to 12%, and revenue is growing. That's great to see, on both counts.

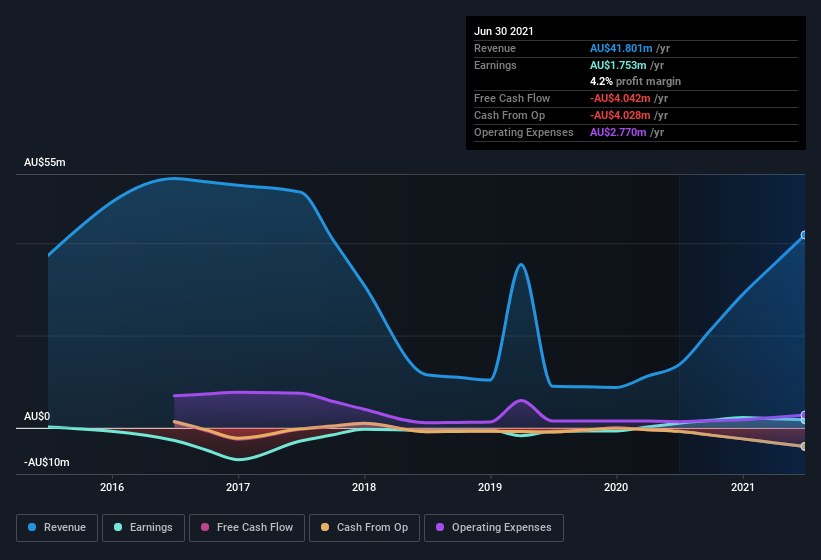

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Harris Technology Group isn't a huge company, given its market capitalization of AU$28m. That makes it extra important to check on its balance sheet strength.

Are Harris Technology Group Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

It's good to see Harris Technology Group insiders walking the walk, by spending AU$518k on shares in just twelve months. And when you consider that there was no insider selling, you can understand why shareholders might believe that lady luck will grace this business. Zooming in, we can see that the biggest insider purchase was by CEO, MD & Executive Director Garrison Huang for AU$133k worth of shares, at about AU$0.11 per share.

On top of the insider buying, we can also see that Harris Technology Group insiders own a large chunk of the company. In fact, they own 36% of the shares, making insiders a very influential shareholder group. I'm always comforted by solid insider ownership like this, as it implies that those running the business are genuinely motivated to create shareholder value. Valued at only AU$28m Harris Technology Group is really small for a listed company. That means insiders only have AU$10m worth of shares, despite the large proportional holding. That might not be a huge sum but it should be enough to keep insiders motivated!

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Garrison Huang, is paid less than the median for similar sized companies. I discovered that the median total compensation for the CEOs of companies like Harris Technology Group with market caps under AU$281m is about AU$411k.

The Harris Technology Group CEO received total compensation of just AU$91k in the year to . That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Is Harris Technology Group Worth Keeping An Eye On?

One important encouraging feature of Harris Technology Group is that it is growing profits. Better yet, insiders are significant shareholders, and have been buying more shares. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. We don't want to rain on the parade too much, but we did also find 5 warning signs for Harris Technology Group (1 shouldn't be ignored!) that you need to be mindful of.

The good news is that Harris Technology Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Harris Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:HT8

Harris Technology Group

Engages in the technology distribution and online retailing businesses in Australia.

Flawless balance sheet with low risk.

Market Insights

Community Narratives