As the ASX200 shows signs of resilience, closing up by about half a percent ahead of the King’s birthday public holiday, investors are keenly observing market movements and sector performances. In this context, growth companies with high insider ownership on the ASX offer a unique appeal, as these insiders often have a vested interest in the company's success which can align closely with shareholder interests during varying economic climates.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

| Cettire (ASX:CTT) | 28.7% | 29.9% |

| Gratifii (ASX:GTI) | 15.6% | 112.4% |

| Acrux (ASX:ACR) | 14.6% | 115.3% |

| Doctor Care Anywhere Group (ASX:DOC) | 28.4% | 96.4% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

| Change Financial (ASX:CCA) | 26.6% | 85.4% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Botanix Pharmaceuticals (ASX:BOT) | 11.4% | 120.9% |

| Liontown Resources (ASX:LTR) | 16.4% | 63.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Aussie Broadband (ASX:ABB)

Simply Wall St Growth Rating: ★★★★☆☆

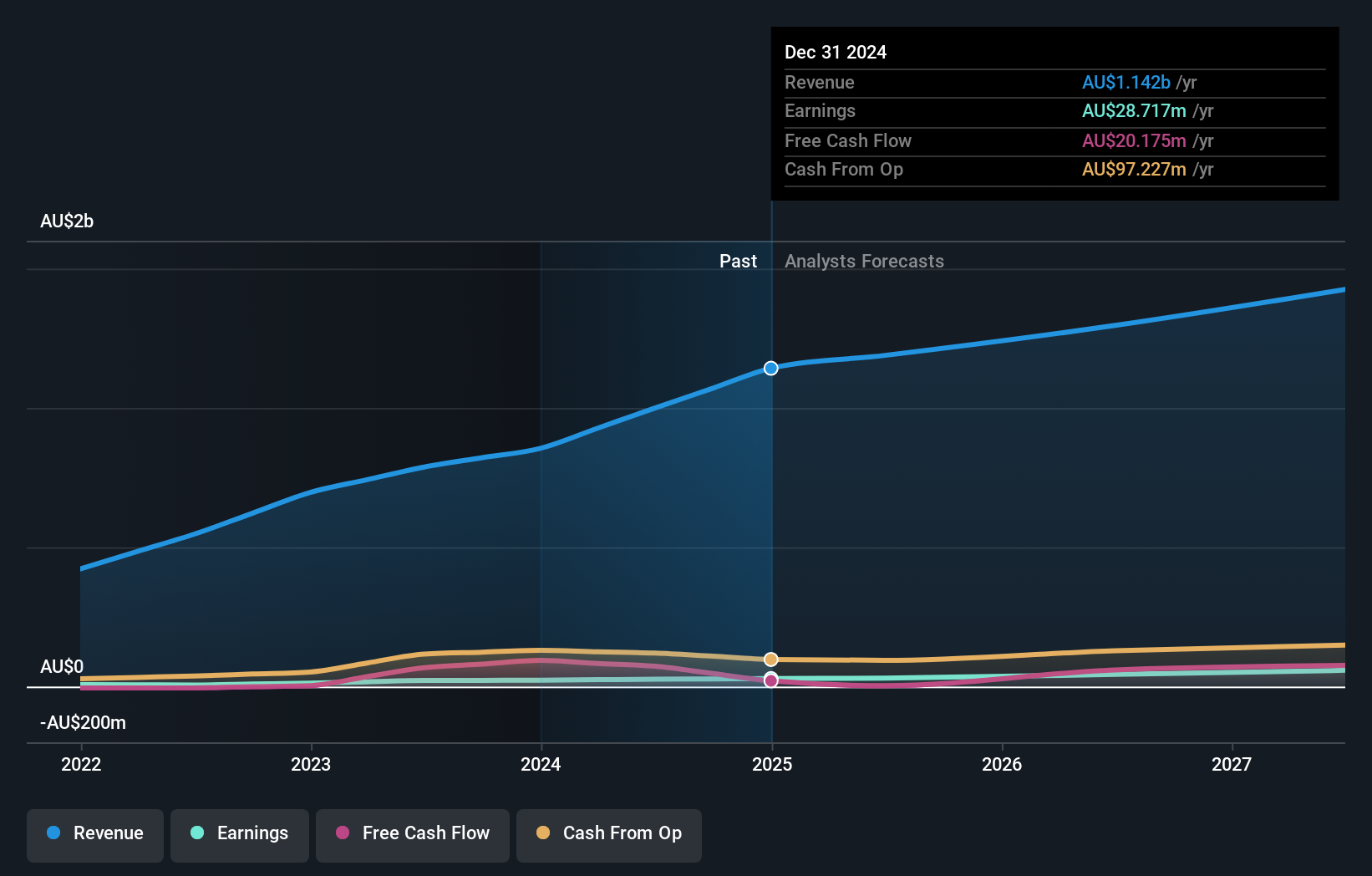

Overview: Aussie Broadband Limited operates as a telecommunications service provider catering to both residential and business customers across Australia, with a market capitalization of approximately A$1.04 billion.

Operations: The company generates revenue through three primary segments: A$549.59 million from residential services, A$125.25 million from wholesale operations, and A$85.85 million from enterprise and government clients.

Insider Ownership: 10.8%

Earnings Growth Forecast: 26.5% p.a.

Aussie Broadband, actively pursuing growth through acquisitions, recently targeted a significant purchase funded by a A$120 million equity raise. Despite insider trading showing more purchases than sales recently, shareholder dilution has occurred over the past year. The company's earnings are expected to grow significantly at 26.5% annually, outpacing the Australian market's 13.9%. However, its revenue growth at 13% per year lags behind the desired 20% threshold for high-growth entities.

- Dive into the specifics of Aussie Broadband here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Aussie Broadband is priced lower than what may be justified by its financials.

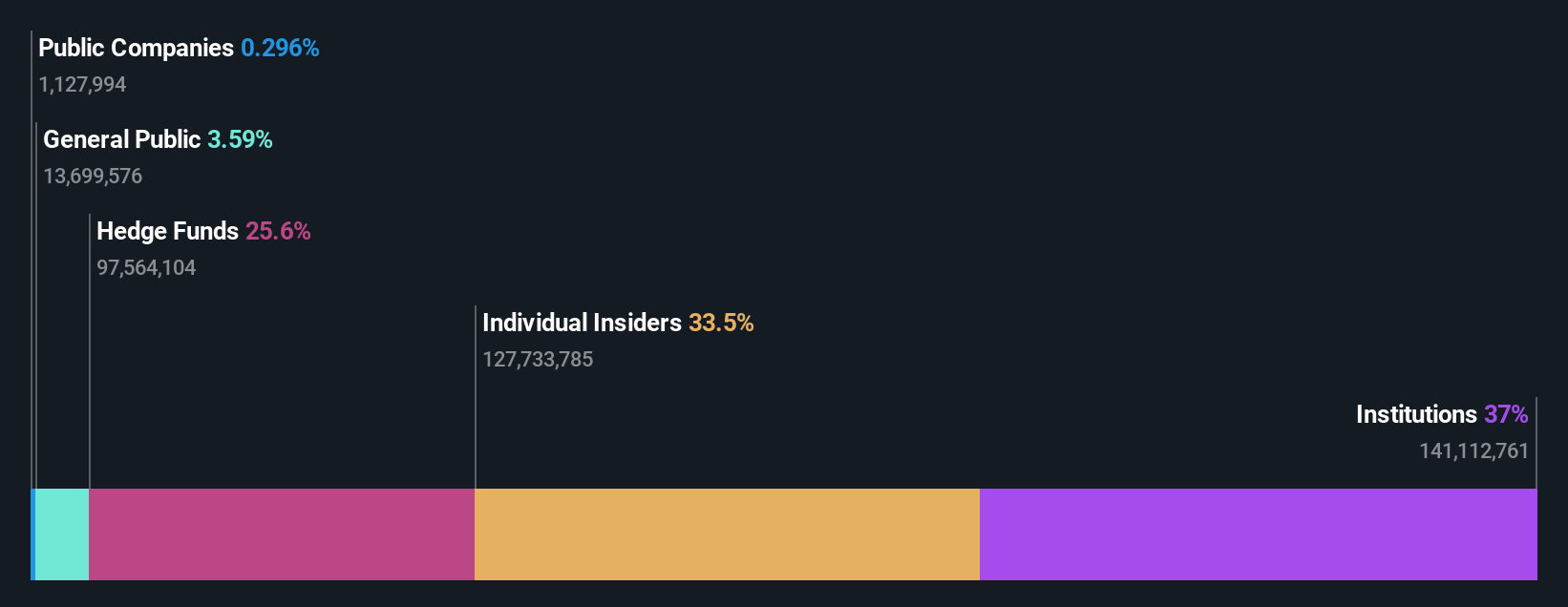

Cettire (ASX:CTT)

Simply Wall St Growth Rating: ★★★★★★

Overview: Cettire Limited operates as an online retailer of luxury goods in Australia, the United States, and other international markets, with a market capitalization of approximately A$964.62 million.

Operations: The company generates its revenue primarily from online retail sales, which amounted to A$582.79 million.

Insider Ownership: 28.7%

Earnings Growth Forecast: 29.9% p.a.

Cettire, recently presenting at the Bell Potter Emerging Leaders Conference, shows promising financial trends despite some concerns. The company became profitable this year and trades at a substantial discount to its estimated fair value. Expected to significantly outperform the Australian market, Cettire's earnings and revenue growth forecasts are very high, with earnings projected to increase by 29.91% annually and revenue by 24% annually. However, shareholder dilution occurred over the past year, raising some investor concerns about equity value erosion.

- Click here and access our complete growth analysis report to understand the dynamics of Cettire.

- The valuation report we've compiled suggests that Cettire's current price could be inflated.

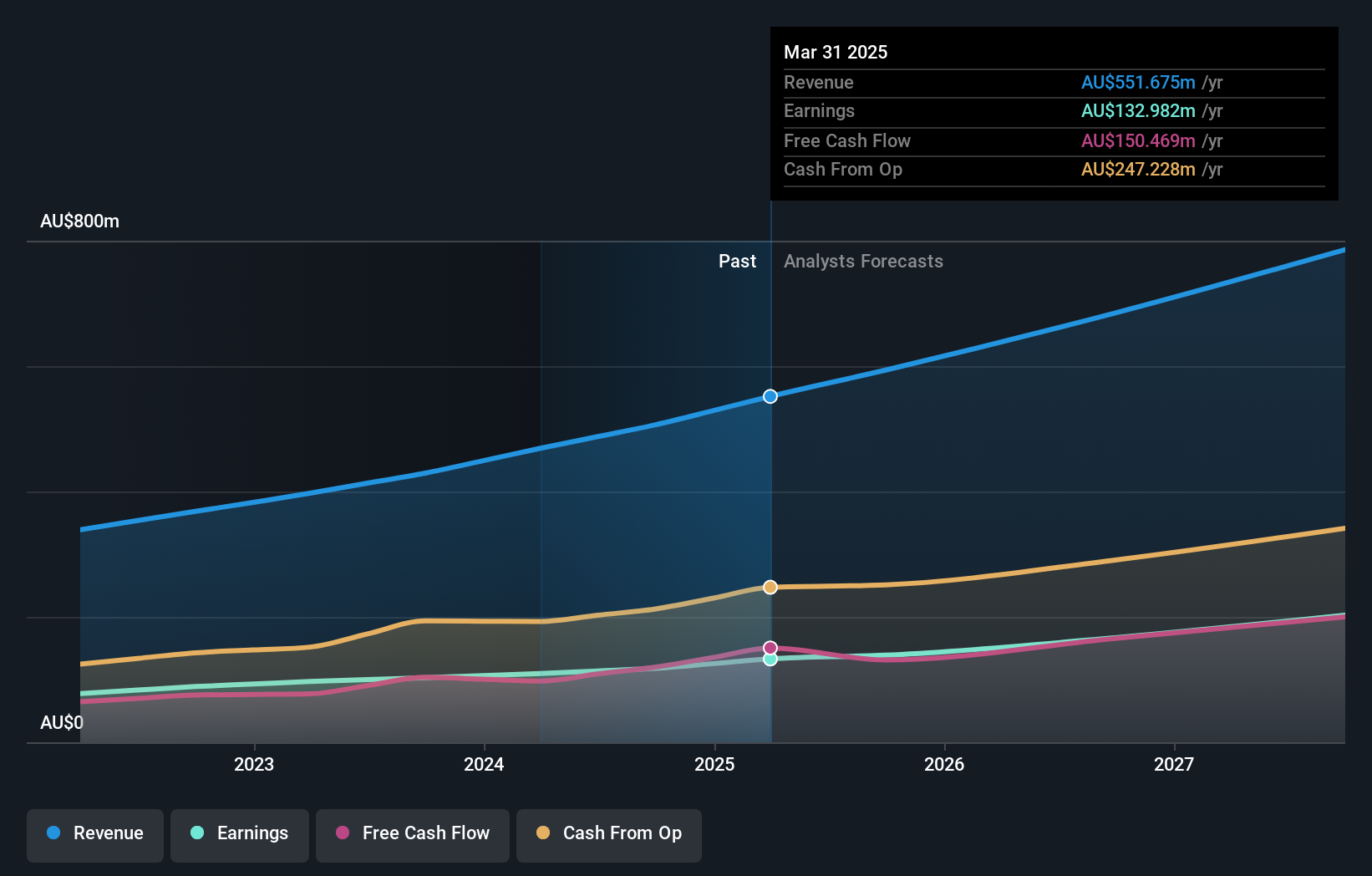

Technology One (ASX:TNE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited is a company that focuses on developing, marketing, selling, implementing, and supporting integrated enterprise business software solutions both in Australia and internationally, with a market capitalization of A$5.94 billion.

Operations: The company generates revenue through three primary segments: software sales contributing A$317.24 million, corporate services at A$83.83 million, and consulting services totaling A$68.13 million.

Insider Ownership: 12.3%

Earnings Growth Forecast: 14.3% p.a.

Technology One, an Australian software company, exhibits a balanced growth profile with a Price-To-Earnings ratio below the industry average. While its earnings and revenue are forecasted to grow at 14.3% and 11.1% per year respectively—outpacing the Australian market—the growth rates do not reach the high threshold of 20% annually considered significant. However, Technology One has demonstrated solid past performance with earnings up by 13.1% last year and maintains a strong future outlook with a projected Return on Equity of 32.6%.

- Get an in-depth perspective on Technology One's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Technology One implies its share price may be too high.

Taking Advantage

- Reveal the 91 hidden gems among our Fast Growing ASX Companies With High Insider Ownership screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ABB

Aussie Broadband

Provides telecommunications and technology services in Australia.

Excellent balance sheet with reasonable growth potential.