- Australia

- /

- Medical Equipment

- /

- ASX:CSX

CleanSpace Holdings Limited's (ASX:CSX) Shares Bounce 29% But Its Business Still Trails The Industry

Despite an already strong run, CleanSpace Holdings Limited (ASX:CSX) shares have been powering on, with a gain of 29% in the last thirty days. The last 30 days bring the annual gain to a very sharp 60%.

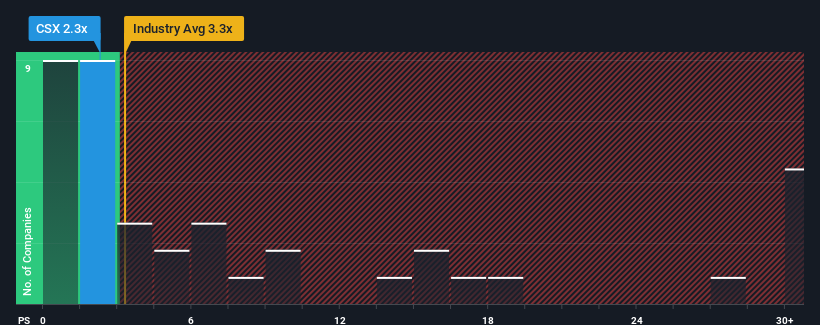

Although its price has surged higher, CleanSpace Holdings' price-to-sales (or "P/S") ratio of 2.3x might still make it look like a buy right now compared to the Medical Equipment industry in Australia, where around half of the companies have P/S ratios above 3.3x and even P/S above 16x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for CleanSpace Holdings

What Does CleanSpace Holdings' Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, CleanSpace Holdings has been doing very well. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on CleanSpace Holdings will help you shine a light on its historical performance.How Is CleanSpace Holdings' Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like CleanSpace Holdings' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 30% last year. However, this wasn't enough as the latest three year period has seen the company endure a nasty 69% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 14% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we understand why CleanSpace Holdings' P/S is lower than most of its industry peers. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

The latest share price surge wasn't enough to lift CleanSpace Holdings' P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of CleanSpace Holdings revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You need to take note of risks, for example - CleanSpace Holdings has 3 warning signs (and 2 which shouldn't be ignored) we think you should know about.

If you're unsure about the strength of CleanSpace Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:CSX

CleanSpace Holdings

Designs, manufactures, and sells respirators and related products and services for people working in industrial and healthcare environments in the United Kingdom, rest of Europe, the Asia Pacific, North America, and internationally.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026