In the last week, the Australian market has been flat, but over the past 12 months, it has risen by 10%, with earnings expected to grow by 12% annually in the coming years. In this context, identifying undervalued stocks can offer significant opportunities for investors looking to capitalize on potential growth at a reasonable price.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Duratec (ASX:DUR) | A$1.30 | A$2.59 | 49.9% |

| Elders (ASX:ELD) | A$9.28 | A$18.11 | 48.8% |

| Hansen Technologies (ASX:HSN) | A$4.24 | A$8.21 | 48.3% |

| DroneShield (ASX:DRO) | A$1.40 | A$2.70 | 48.2% |

| Mader Group (ASX:MAD) | A$5.48 | A$10.53 | 48% |

| Cettire (ASX:CTT) | A$1.54 | A$2.97 | 48.2% |

| Atlas Arteria (ASX:ALX) | A$5.16 | A$10.09 | 48.9% |

| VEEM (ASX:VEE) | A$1.705 | A$3.24 | 47.5% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Superloop (ASX:SLC) | A$1.69 | A$3.31 | 49% |

Below we spotlight a couple of our favorites from our exclusive screener.

Atlas Arteria (ASX:ALX)

Overview: Atlas Arteria Limited (ASX:ALX) owns, develops, and operates toll roads with a market cap of A$7.49 billion.

Operations: Atlas Arteria's revenue segments include APRR (A$1.70 billion), ADELAC (A$36.90 million), Warnow Tunnel (A$25.10 million), Chicago Skyway (A$128.90 million), and Dulles Greenway (A$115 million).

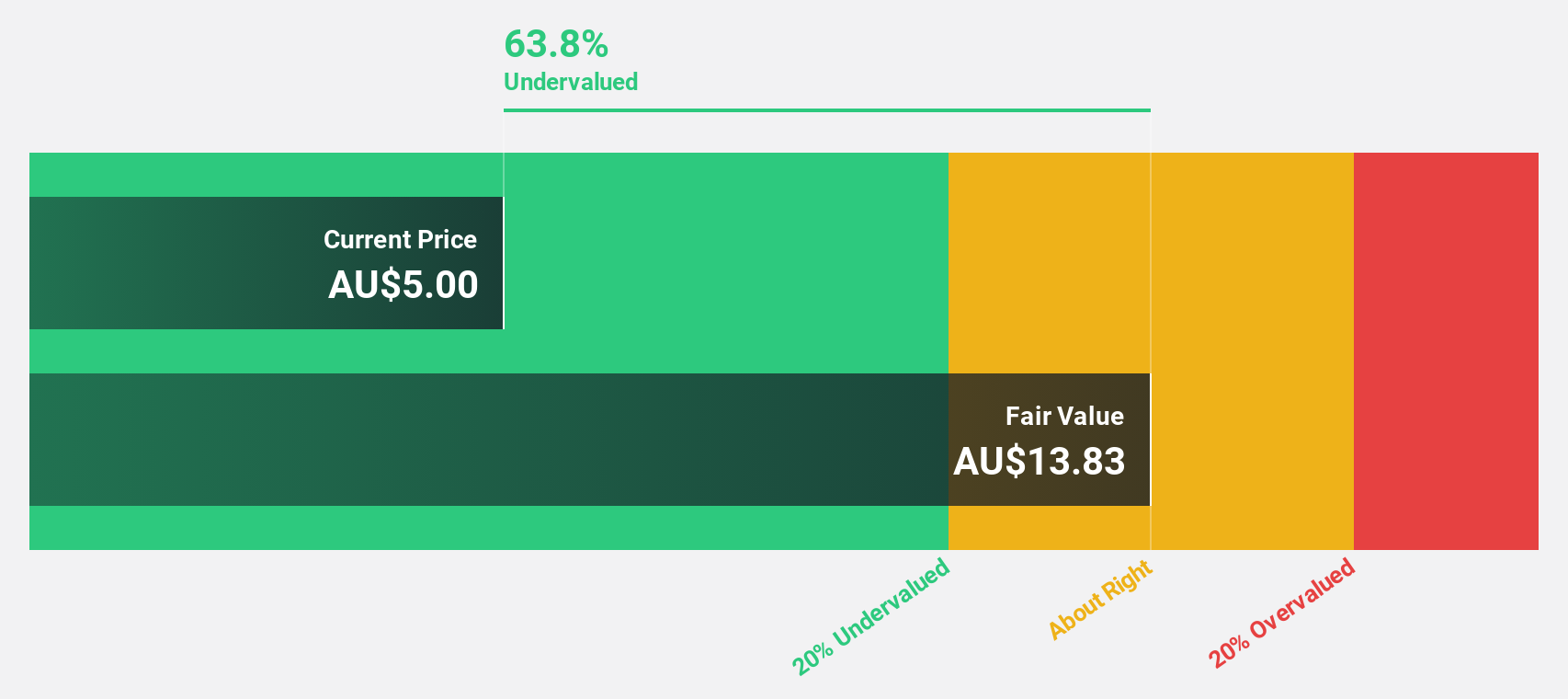

Estimated Discount To Fair Value: 48.9%

Atlas Arteria (A$5.16) is trading at 48.9% below its estimated fair value of A$10.09, highlighting significant undervaluation based on discounted cash flow analysis. Despite a high dividend yield of 7.75%, it isn't well-covered by earnings or free cash flows, raising sustainability concerns. However, the company's earnings are forecast to grow significantly at 20.3% per year over the next three years, outpacing the broader Australian market's growth rate of 12.1%.

- The analysis detailed in our Atlas Arteria growth report hints at robust future financial performance.

- Click here to discover the nuances of Atlas Arteria with our detailed financial health report.

Cettire (ASX:CTT)

Overview: Cettire Limited operates an online luxury goods retailing business in Australia, the United States, and internationally, with a market cap of A$582.35 million.

Operations: Sure, here is the summary sentence for the revenue segments: The company generated A$742.26 million from online retail sales.

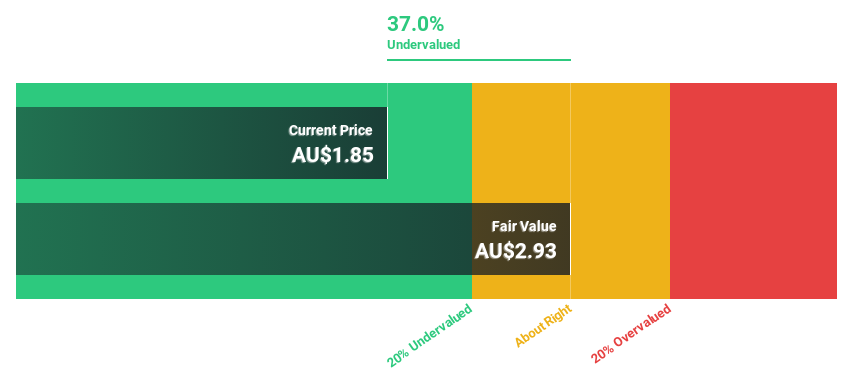

Estimated Discount To Fair Value: 48.2%

Cettire (A$1.54) is trading significantly below its estimated fair value of A$2.97, indicating it may be undervalued based on discounted cash flow analysis. Despite a volatile share price and declining profit margins, the company's earnings are forecast to grow 29% annually, outpacing the Australian market's growth rate of 12.1%. Recent financial guidance for Q1 FY2025 projects healthy revenue growth, with sales tracking 20% higher year-on-year through July and August 2024.

- Upon reviewing our latest growth report, Cettire's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Cettire's balance sheet by reading our health report here.

Data#3 (ASX:DTL)

Overview: Data#3 Limited provides IT solutions and services across Australia, Fiji, and the Pacific Islands, with a market cap of approximately A$1.24 billion.

Operations: The company's revenue primarily comes from its role as a value-added IT reseller and IT solutions provider, generating A$805.75 million.

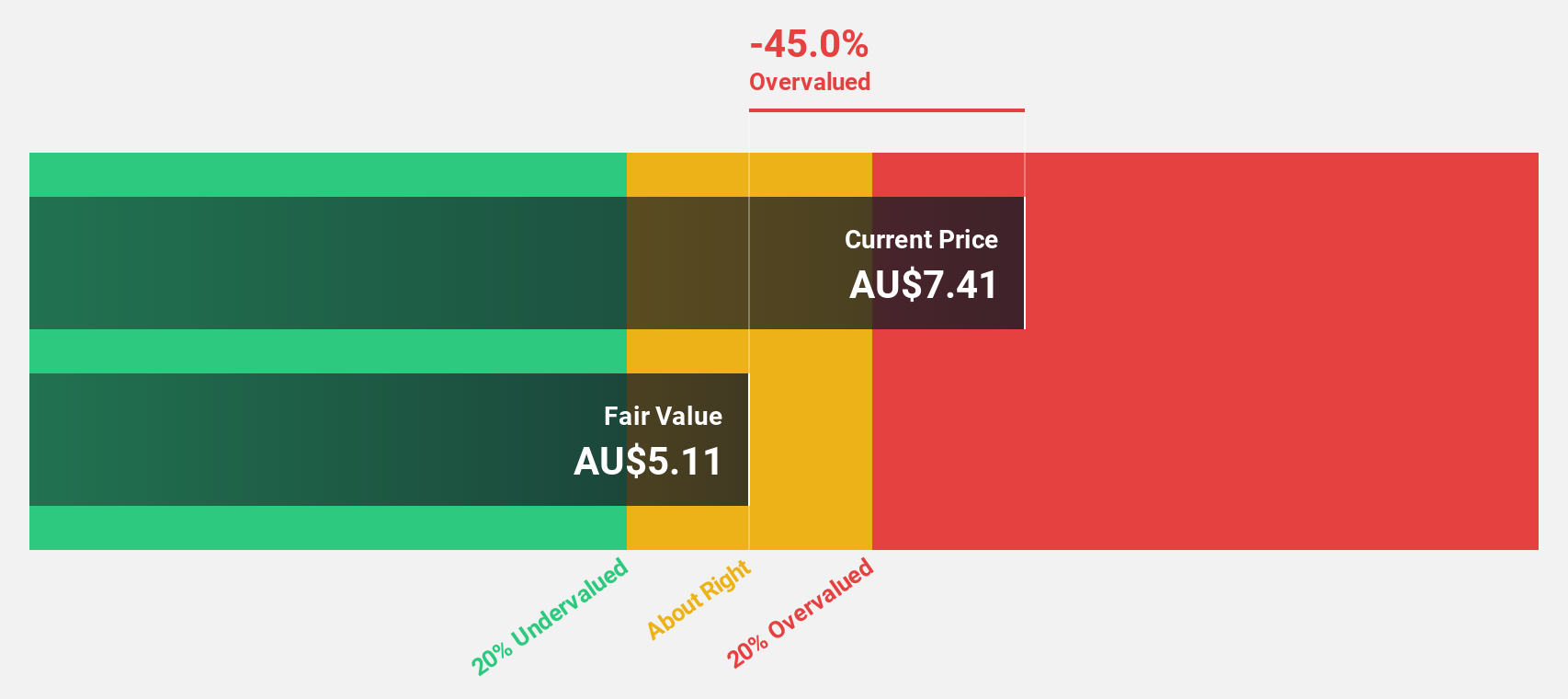

Estimated Discount To Fair Value: 41%

Data#3 (A$7.98) is trading at a 41% discount to its estimated fair value of A$13.53, suggesting it is undervalued based on cash flows. Recent earnings reports show net income increased to A$43.31 million from A$37.03 million year-on-year, with revenue slightly up at A$815.68 million. However, its dividend yield of 3.23% isn't well covered by earnings or free cash flow, and forecasted annual profit growth of 11% lags behind the broader market's 12%.

- The growth report we've compiled suggests that Data#3's future prospects could be on the up.

- Navigate through the intricacies of Data#3 with our comprehensive financial health report here.

Make It Happen

- Explore the 53 names from our Undervalued ASX Stocks Based On Cash Flows screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DTL

Data#3

Engages in the provision of information technology (IT) solutions and services in Australia, Fiji, and the Pacific Islands.

Outstanding track record with flawless balance sheet.