- Australia

- /

- Specialty Stores

- /

- ASX:AUK

Jacky Yang Is The Executive Director of AuMake Limited (ASX:AUK) And They Just Picked Up 27% More Shares

Even if it's not a huge purchase, we think it was good to see that Jacky Yang, the Executive Director of AuMake Limited (ASX:AUK) recently shelled out AU$100k to buy stock, at AU$0.06 per share. That purchase might not be huge but it did increase their holding by 27%.

View our latest analysis for AuMake

AuMake Insider Transactions Over The Last Year

Notably, that recent purchase by Jacky Yang is the biggest insider purchase of AuMake shares that we've seen in the last year. That means that an insider was happy to buy shares at above the current price of AU$0.042. While their view may have changed since the purchase was made, this does at least suggest they have had confidence in the company's future. To us, it's very important to consider the price insiders pay for shares is very important. As a general rule, we feel more positive about a stock if insiders have bought shares at above current prices, because that suggests they viewed the stock as good value, even at a higher price.

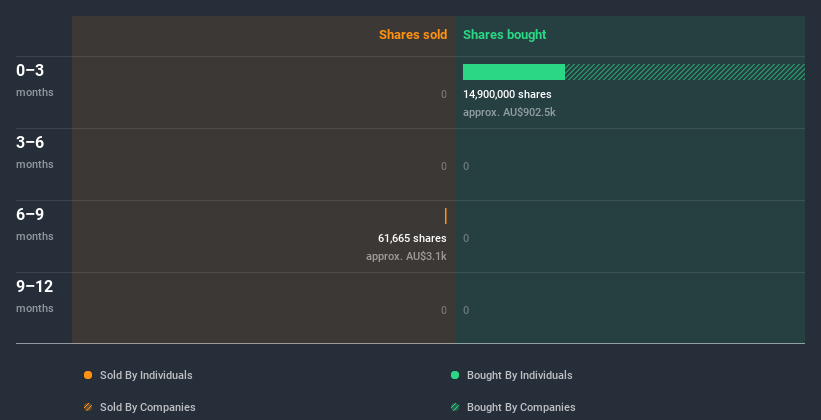

Over the last year, we can see that insiders have bought 4.17m shares worth AU$250k. But they sold 61.67k shares for AU$3.1k. In total, AuMake insiders bought more than they sold over the last year. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

There are always plenty of stocks that insiders are buying. So if that suits your style you could check each stock one by one or you could take a look at this free list of companies. (Hint: insiders have been buying them).

Insider Ownership of AuMake

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. I reckon it's a good sign if insiders own a significant number of shares in the company. Insiders own 29% of AuMake shares, worth about AU$7.1m. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

So What Does This Data Suggest About AuMake Insiders?

It's certainly positive to see the recent insider purchases. We also take confidence from the longer term picture of insider transactions. But we don't feel the same about the fact the company is making losses. Insiders likely see value in AuMake shares, given these transactions (along with notable insider ownership of the company). So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. To help with this, we've discovered 5 warning signs (2 shouldn't be ignored!) that you ought to be aware of before buying any shares in AuMake.

Of course AuMake may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading AuMake or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:AUK

AuMake

Engages in the sale of various products through its online e-commerce store in Australia, Hong Kong, Mainland China, and New Zealand.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives