- Australia

- /

- Specialty Stores

- /

- ASX:APE

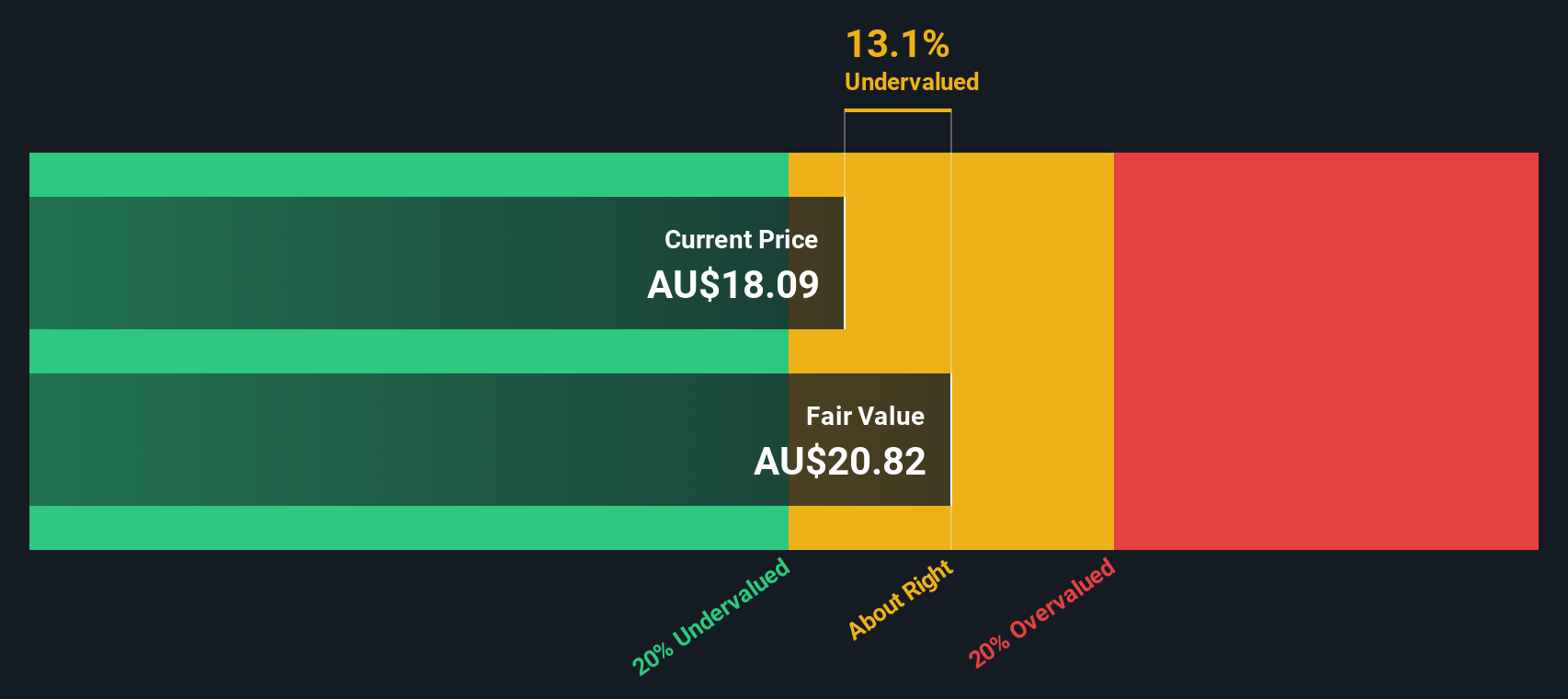

Eagers Automotive (ASX:APE): Assessing Valuation Following $500 Million Capital Raise

Reviewed by Simply Wall St

Eagers Automotive (ASX:APE) has just wrapped up a significant follow-on equity offering, raising more than AUD 500 million split across several tranches. This move often prompts investors to re-examine the company’s outlook and capital strategy.

See our latest analysis for Eagers Automotive.

After raising fresh capital, Eagers Automotive has kept the momentum firmly in its corner, with a 71% share price return over the past 90 days and an impressive total shareholder return of 230.8% for the year. Short-term strength and longer-term outperformance are clearly aligned.

If you’re curious what else is delivering standout results lately, consider broadening your search and discover See the full list for free.

With shares soaring and fresh capital in hand, investors are left asking whether Eagers Automotive’s strong run is a sign there is still value left to unlock, or if the market has already priced in all of its future growth.

Most Popular Narrative: 19% Overvalued

Compared to the latest closing price, the narrative’s fair value for Eagers Automotive is meaningfully lower. Here is the catalyst that shapes this outlook.

The perceived competitive moat from Eagers' physical dealership network and its expansion is factored into the valuation. However, the accelerating trend towards online and direct-to-consumer vehicle sales may structurally weaken its core business model. This could risk lower net margins as foot traffic declines while fixed dealership costs remain high.

Curious what concrete projections are hiding behind that caution? The narrative leans heavily on a future where core profit engines face major market shifts. See what assumptions could drive this valuation gap.

Result: Fair Value of $28.60 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, strong electric vehicle market share and a record-low cost base could still drive profits higher than bearish forecasts suggest.

Find out about the key risks to this Eagers Automotive narrative.

Another View: Discounted Cash Flow Signals Upside

While analysts see Eagers Automotive as overvalued relative to future earnings and market risks, our SWS DCF model presents a different perspective. It estimates fair value at A$36.46, which is slightly above the current share price. Could market optimism about long-term cash flows be justified?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Eagers Automotive for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Eagers Automotive Narrative

If you see things differently, or want to dive into the numbers on your own terms, creating your own narrative takes just minutes. Do it your way

A great starting point for your Eagers Automotive research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t sit on the sidelines while new opportunities unfold. Now’s your chance to unlock even more investment potential with standout picks you might otherwise overlook.

- Spot untapped growth by scanning for these 3588 penny stocks with strong financials showing robust financials and unique upside potential in emerging sectors.

- Benefit from stable returns and consistent payouts by checking out these 22 dividend stocks with yields > 3% with high yields that can boost your portfolio’s longevity.

- Capitalize on breakthrough technologies and innovation by tracking these 28 quantum computing stocks at the forefront of quantum computing advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eagers Automotive might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:APE

Eagers Automotive

Owns and operates motor vehicle dealerships in Australia and New Zealand.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives