Alf Moufarrige became the CEO of Servcorp Limited (ASX:SRV) in 1999, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

See our latest analysis for Servcorp

Comparing Servcorp Limited's CEO Compensation With the industry

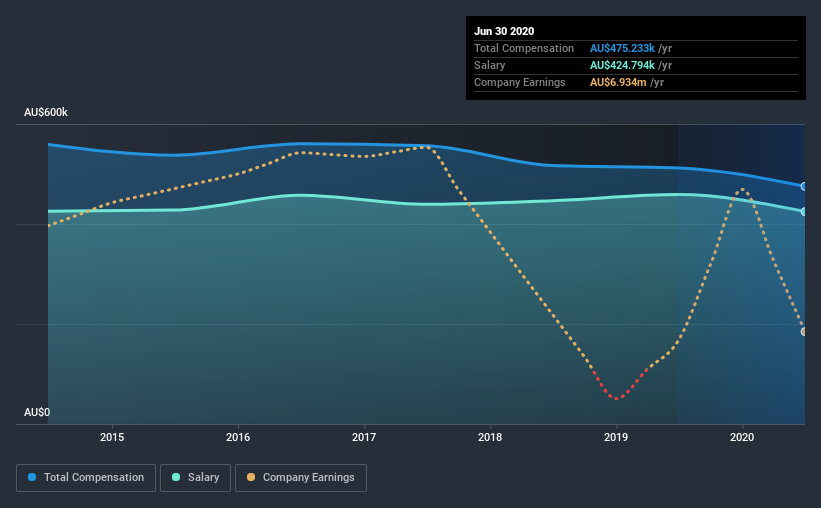

Our data indicates that Servcorp Limited has a market capitalization of AU$287m, and total annual CEO compensation was reported as AU$475k for the year to June 2020. That's a slight decrease of 7.2% on the prior year. We note that the salary portion, which stands at AU$424.8k constitutes the majority of total compensation received by the CEO.

On comparing similar companies from the same industry with market caps ranging from AU$130m to AU$518m, we found that the median CEO total compensation was AU$595k. This suggests that Servcorp remunerates its CEO largely in line with the industry average. Moreover, Alf Moufarrige also holds AU$5.6m worth of Servcorp stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$425k | AU$459k | 89% |

| Other | AU$50k | AU$53k | 11% |

| Total Compensation | AU$475k | AU$512k | 100% |

Speaking on an industry level, nearly 81% of total compensation represents salary, while the remainder of 19% is other remuneration. Servcorp is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Servcorp Limited's Growth Numbers

Over the last three years, Servcorp Limited has shrunk its earnings per share by 44% per year. In the last year, its revenue is up 4.5%.

The decline in EPS is a bit concerning. And the modest revenue growth over 12 months isn't much comfort against the reduced EPS. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Servcorp Limited Been A Good Investment?

Since shareholders would have lost about 41% over three years, some Servcorp Limited investors would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

As previously discussed, Alf is compensated close to the median for companies of its size, and which belong to the same industry. In the meantime, the company has reported declining EPS growth and shareholder returns over the last three years. It's tough to call out the compensation as inappropriate, but shareholders might not favor a raise before company performance improves.

CEO compensation can have a massive impact on performance, but it's just one element. We've identified 2 warning signs for Servcorp that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Servcorp, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:SRV

Servcorp

Provides executive serviced and virtual offices, coworking and IT, communications, and secretarial services in Australia, New Zealand, Southeast Asia, the United States, Europe, the Middle East, North Asia, and internationally.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives