- Australia

- /

- Retail REITs

- /

- ASX:HDN

Did Recent Multi-Million Dollar Acquisitions Just Shift HomeCo Daily Needs REIT's (ASX:HDN) Investment Narrative?

Reviewed by Sasha Jovanovic

- HomeCo Daily Needs REIT recently declared a cash distribution of 2.15 cents per unit for the September 2025 quarter and completed acquisitions including a six-property retail portfolio for A$222 million and the Armstrong Creek Shopping Centre for A$55.6 million.

- These moves expand HDN’s exposure to high-growth population corridors with long-term leased assets, supporting consistent income and future development potential in Australia’s retail property sector.

- We'll explore how the recent major property acquisitions reinforce HomeCo's approach to growing income streams through high-occupancy retail assets.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

HomeCo Daily Needs REIT Investment Narrative Recap

At its core, HomeCo Daily Needs REIT appeals to those who value stable, recurring income backed by high-occupancy retail centers anchored in growth corridors. The recent series of acquisitions, including the A$222,000,000 retail portfolio and Armstrong Creek Shopping Centre, enhances this positioning but does not materially change the most immediate risk: ongoing e-commerce expansion, which could still challenge foot traffic and long-term leasing demand for physical retail centers. In the short term, these acquisitions may slightly accelerate revenue growth but do not significantly impact this operational risk.

The declaration of a 2.15 cents per unit cash distribution for the September 2025 quarter is especially relevant, reinforcing HDN’s ongoing intent to deliver consistent income to unitholders. While these dividend announcements underline management’s focus on regular distributions, investors should keep in mind that dividend sustainability can shift depending on the success of the newly acquired assets and broader trends influencing leasing demand.

In contrast, hidden pressures from the rise of online shopping could still pose challenges that investors should be aware of...

Read the full narrative on HomeCo Daily Needs REIT (it's free!)

HomeCo Daily Needs REIT's outlook anticipates A$337.8 million in revenue and A$244.1 million in earnings by 2028. This is based on a -0.8% annual revenue decline and a decrease in earnings of A$6.2 million from the current A$250.3 million.

Uncover how HomeCo Daily Needs REIT's forecasts yield a A$1.44 fair value, a 9% upside to its current price.

Exploring Other Perspectives

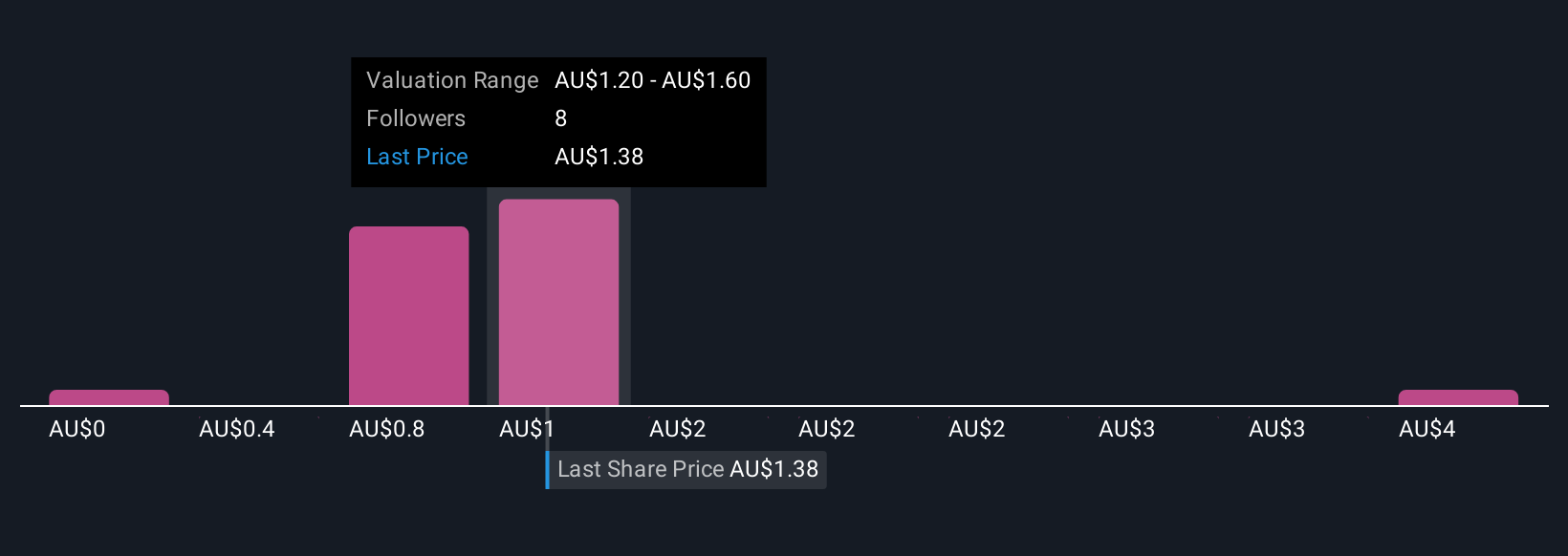

Six fair value estimates from the Simply Wall St Community range between A$0.40 and A$4.00, highlighting widely differing opinions on HDN's potential. As analysts debate risks from shifting consumer behaviour, these varied viewpoints invite you to review how such factors could influence future returns.

Explore 6 other fair value estimates on HomeCo Daily Needs REIT - why the stock might be worth less than half the current price!

Build Your Own HomeCo Daily Needs REIT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HomeCo Daily Needs REIT research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free HomeCo Daily Needs REIT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HomeCo Daily Needs REIT's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HomeCo Daily Needs REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HDN

HomeCo Daily Needs REIT

An Australian Real Estate Investment Trust listed on the ASX with a mandate to invest in convenience-based assets across the target sub-sectors of Neighbourhood Retail, Large Format Retail and Health & Services.

Slight risk second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives