Stock Analysis

Over the past year, the Australian market has shown a healthy uptick, growing by 9.9%, despite remaining flat in the last week. With earnings forecasted to grow by 14% annually, investors might consider dividend stocks that not only offer potential for steady income but also align with these promising market conditions.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Lindsay Australia (ASX:LAU) | 7.06% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 5.01% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 3.95% | ★★★★★☆ |

| Charter Hall Group (ASX:CHC) | 3.56% | ★★★★★☆ |

| Eagers Automotive (ASX:APE) | 6.80% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.21% | ★★★★★☆ |

| Fortescue (ASX:FMG) | 9.23% | ★★★★★☆ |

| Diversified United Investment (ASX:DUI) | 3.02% | ★★★★★☆ |

| New Hope (ASX:NHC) | 8.98% | ★★★★☆☆ |

| Macquarie Group (ASX:MQG) | 3.14% | ★★★★☆☆ |

Click here to see the full list of 26 stocks from our Top ASX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Charter Hall Group (ASX:CHC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Charter Hall Group, listed on the ASX under ticker CHC, operates as a prominent Australian property investment and funds management group with a market capitalization of approximately A$5.87 billion.

Operations: Charter Hall Group generates revenue from funds management and property investments, amounting to A$515.60 million and A$142.20 million respectively.

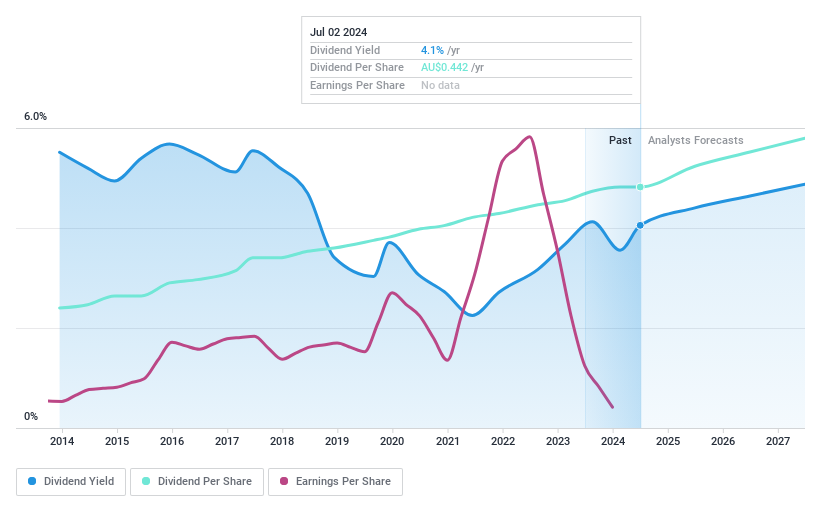

Dividend Yield: 3.6%

Charter Hall Group offers a dividend yield of 3.56%, which is modest compared to the top Australian dividend stocks. Despite this, its dividends are well-supported by both earnings and cash flows, with payout ratios of 43.8% and 45.3% respectively, indicating sustainability. The company's dividends have shown stability and growth over the past decade, although its recent profit margin declined to 11.7%. Additionally, it is trading at a significant discount (44.5%) below estimated fair value, suggesting potential undervaluation.

- Dive into the specifics of Charter Hall Group here with our thorough dividend report.

- According our valuation report, there's an indication that Charter Hall Group's share price might be on the expensive side.

Fortescue (ASX:FMG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fortescue Ltd is an Australian company that specializes in exploring, developing, producing, processing, and selling iron ore domestically and internationally, with a market capitalization of approximately A$66.66 billion.

Operations: Fortescue Ltd generates the majority of its revenue from the metals segment, particularly iron ore, amounting to A$18.47 billion, with an additional A$0.08 billion derived from the energy sector.

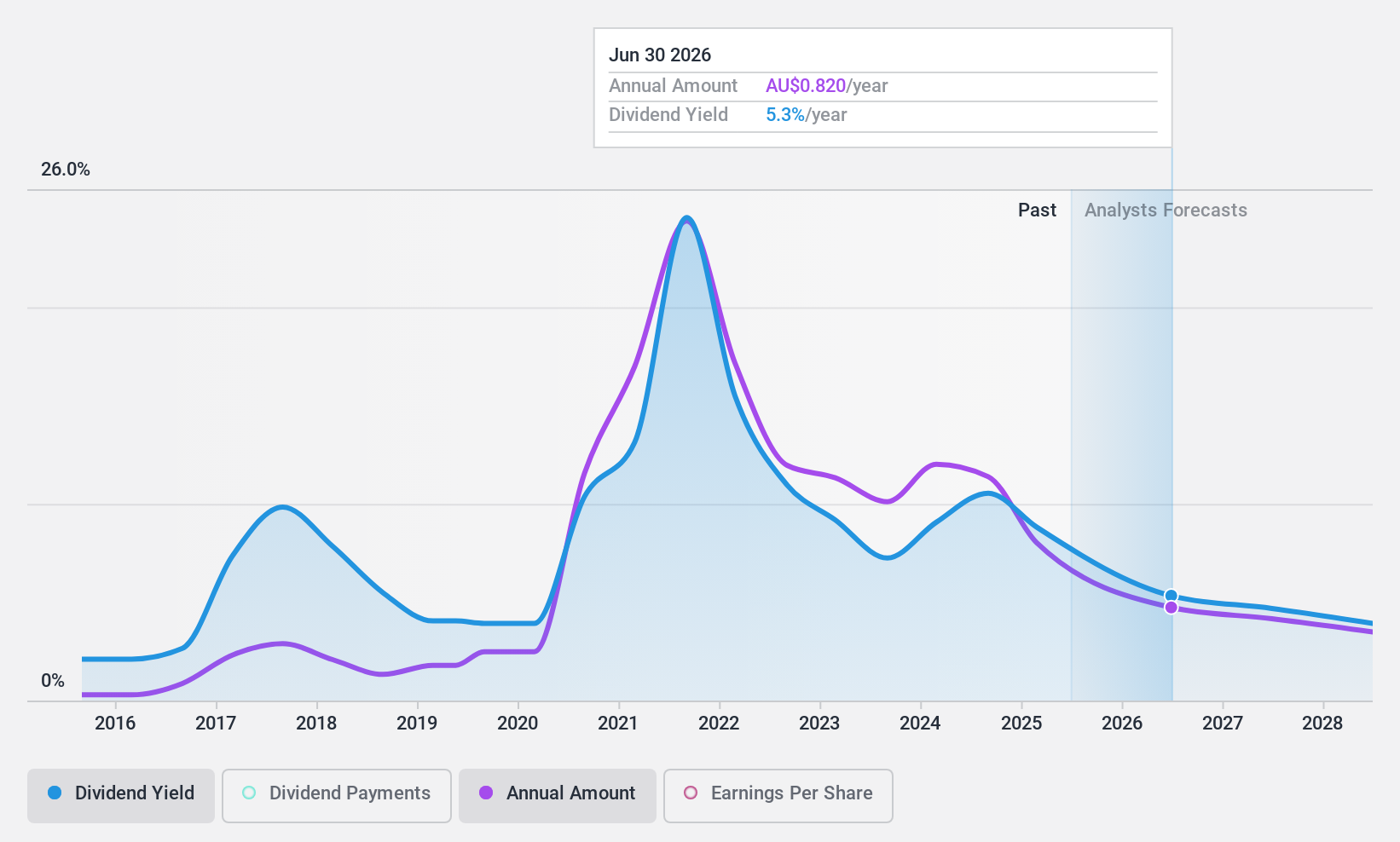

Dividend Yield: 9.2%

Fortescue's dividend yield of 9.23% ranks well above the Australian market average, yet its dividends have shown volatility over the past decade. Despite this, both earnings and cash flows adequately cover the payouts with payout ratios of 74.2% and 73.1%, respectively. Trading at a P/E ratio of 7.7x, Fortescue offers good value relative to peers but faces an expected earnings decline averaging 18.4% annually over the next three years, raising concerns about future dividend sustainability.

- Unlock comprehensive insights into our analysis of Fortescue stock in this dividend report.

- Our valuation report here indicates Fortescue may be undervalued.

Premier Investments (ASX:PMV)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Premier Investments Limited is a specialty retail company managing fashion chains across Australia, New Zealand, Asia, and Europe with a market capitalization of A$5.16 billion.

Operations: Premier Investments Limited generates revenue primarily through its retail operations, which amounted to A$1.63 billion, and its investment activities contributed an additional A$217.83 million.

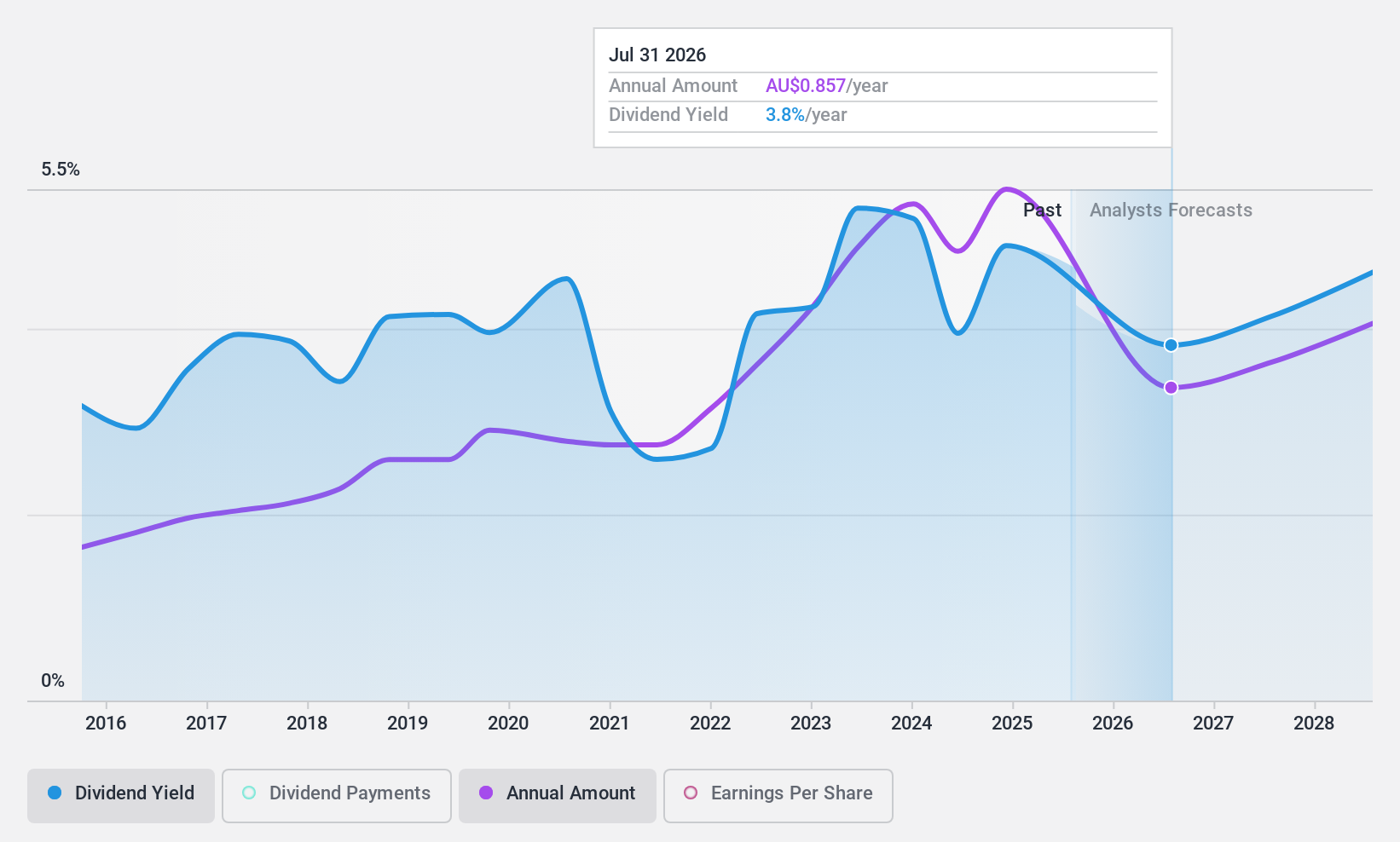

Dividend Yield: 4.2%

Premier Investments has demonstrated a decade of stable and increasing dividends, currently offering a 4.21% yield, which is lower than the top Australian dividend payers. The company maintains a healthy payout ratio of 71.5% from earnings and 55% from cash flows, ensuring dividend sustainability. Recently, Premier announced potential demergers of its Smiggle and Peter Alexander brands following a strategic review aimed at enhancing growth, coinciding with an all-time high share price spike after reporting increased half-year profits.

- Click here and access our complete dividend analysis report to understand the dynamics of Premier Investments.

- Upon reviewing our latest valuation report, Premier Investments' share price might be too pessimistic.

Seize The Opportunity

- Click this link to deep-dive into the 26 companies within our Top ASX Dividend Stocks screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Charter Hall Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CHC

Charter Hall Group

Charter Hall is one of Australia’s leading fully integrated property investment and funds management groups.

Excellent balance sheet established dividend payer.