- Australia

- /

- Construction

- /

- ASX:SXE

Australian Dividend Stocks Delivering Up To 6.9% Yields

Reviewed by Kshitija Bhandaru

As the Australian market exhibits a cautious equilibrium, with gains in the mining sector balancing out losses among financial heavyweights, investors are closely monitoring the Reserve Bank of Australia's upcoming policy decisions. Amidst this backdrop, dividend stocks continue to attract attention for their potential to offer investors steady income streams, particularly those delivering yields up to 6.9% in sectors less sensitive to interest rate fluctuations.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Computershare (ASX:CPU) | 3.15% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.73% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.38% | ★★★★★☆ |

| Korvest (ASX:KOV) | 6.79% | ★★★★★☆ |

| McGrath (ASX:MEA) | 6.32% | ★★★★☆☆ |

| Vita Life Sciences (ASX:VLS) | 3.66% | ★★★★☆☆ |

| Atlas Arteria (ASX:ALX) | 7.66% | ★★★★☆☆ |

| Northern Star Resources (ASX:NST) | 2.23% | ★★★★☆☆ |

| Brambles (ASX:BXB) | 3.03% | ★★★★☆☆ |

| Wesfarmers (ASX:WES) | 2.92% | ★★★★☆☆ |

Click here to see the full list of 26 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

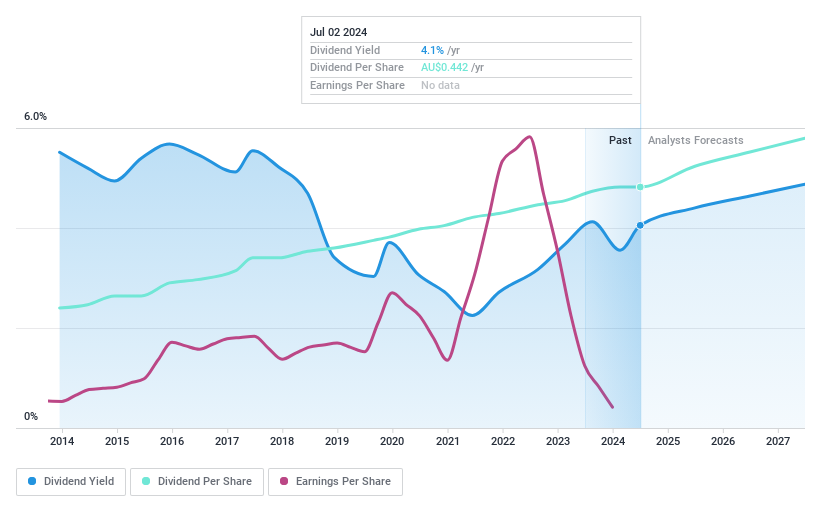

Charter Hall Group (ASX:CHC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Charter Hall Group is a prominent Australian property investment and funds management company with a market capitalization of approximately A$6.24 billion.

Operations: Charter Hall Group generates revenue primarily through its funds management and property investments segments, with A$515.60 million and A$142.20 million respectively.

Dividend Yield: 3.3%

Charter Hall Group's dividend yield stands at A$3.35%, underperforming the top quartile of Australian dividend stocks. Despite a decade of stable and growing payouts, supported by a payout ratio of 43.8% and cash payout ratio of 45.3%, recent financials show a dip in net income from A$179.3 million to A$48.9 million year-on-year, alongside reduced sales revenue, signaling potential headwinds for future dividend growth despite current earnings and cash flow coverage. Trading at a significant discount to estimated fair value suggests valuation appeal amidst challenges.

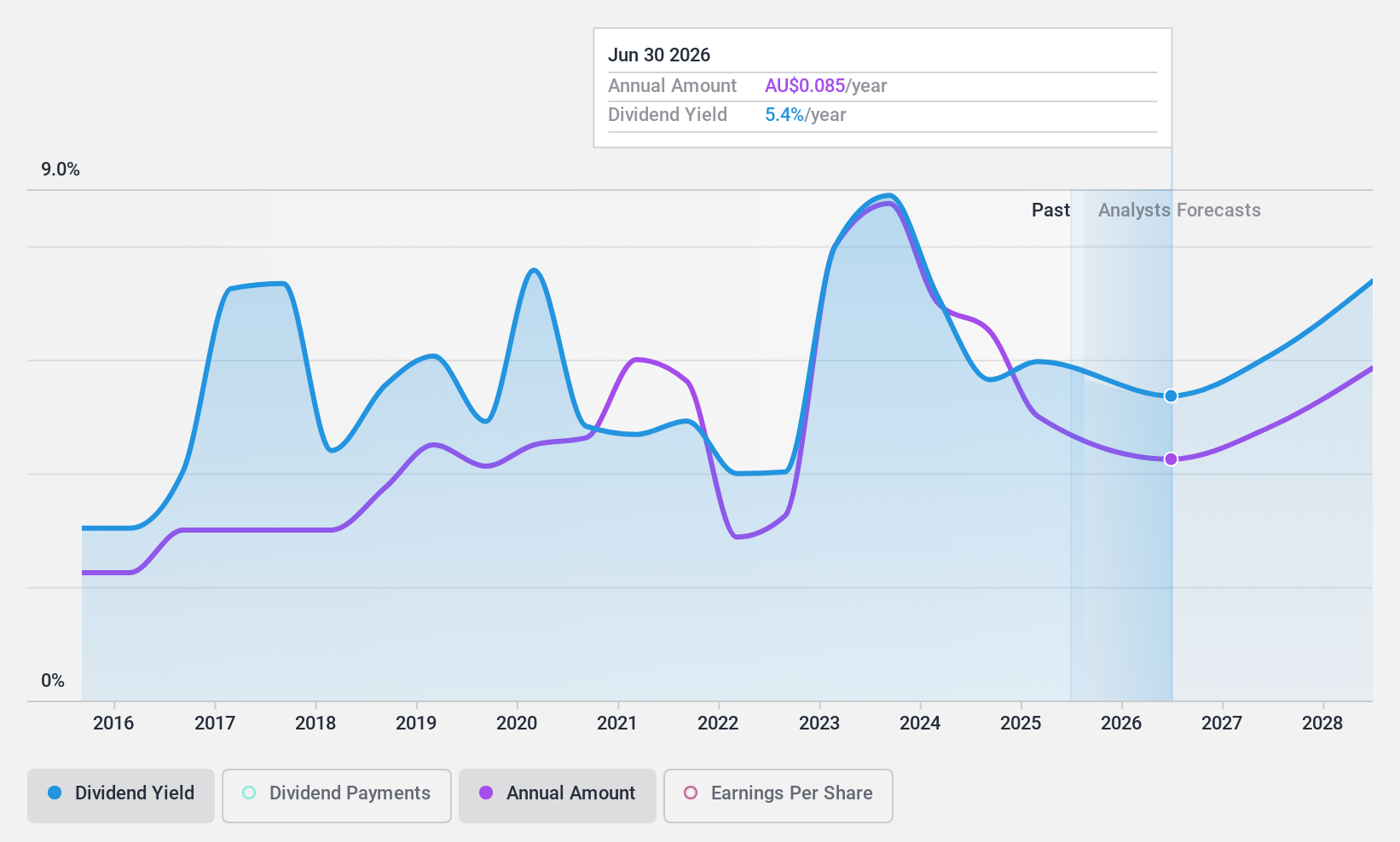

Accent Group (ASX:AX1)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Accent Group Limited is a retailer and distributor specializing in lifestyle footwear, apparel, and accessories across Australia and New Zealand, with a market capitalization of approximately A$1.14 billion.

Operations: Accent Group Limited's revenue is primarily derived from its multi-channel retail operations in performance and lifestyle footwear, totaling A$1.40 billion.

Dividend Yield: 6.9%

Accent Group's recent dividend of A$0.085, despite a high yield of 6.93%, is shadowed by a payout ratio exceeding earnings at 107.2%, indicating potential sustainability issues. The company's dividends have shown volatility over the past decade, lacking reliability and stability. However, the stock trades at a substantial discount to fair value and is supported by cash flows with a cash payout ratio at 39%. Half-yearly sales dipped to A$732.9 million from A$746.49 million, with net income falling to A$42.24 million from A$58.33 million year-on-year; yet earnings are expected to grow by 11.9% annually, suggesting possible future improvement in dividend coverage.

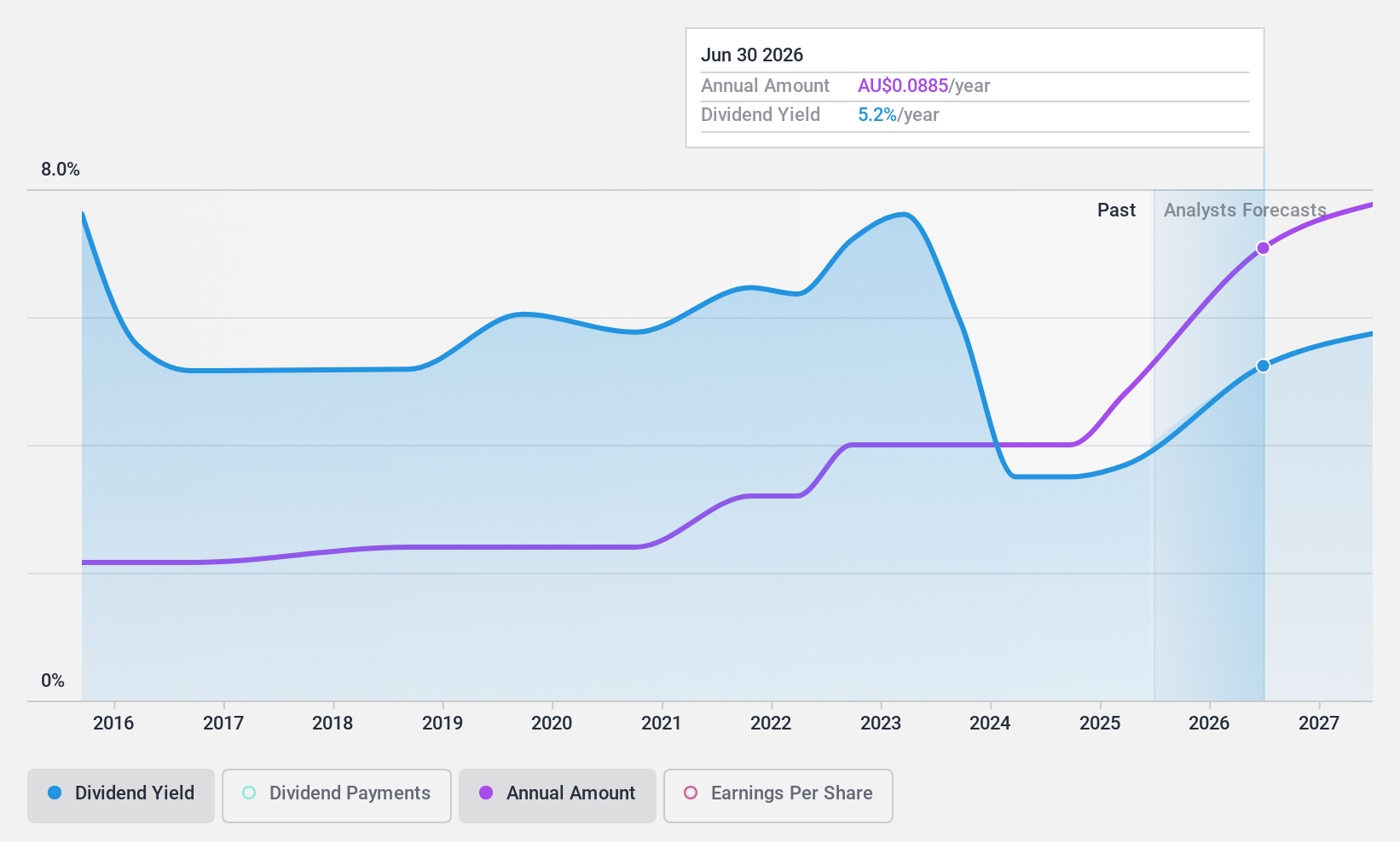

Southern Cross Electrical Engineering (ASX:SXE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Southern Cross Electrical Engineering Limited is an Australian company specializing in electrical, instrumentation, communication, and maintenance services with a market capitalization of approximately A$247.33 million.

Operations: Southern Cross Electrical Engineering Limited generates its revenue primarily through the provision of electrical services, amounting to A$464.88 million.

Dividend Yield: 5.3%

Southern Cross Electrical Engineering's dividends, while covered by earnings and cash flows with payout ratios of 66.5% and 78.1% respectively, have been inconsistent over the past decade, reflecting a lack of reliability for investors seeking stable income. The stock is currently undervalued at 18.6% below fair value and has experienced earnings growth of 13.3% annually over five years. However, its dividend yield at 5.32% trails the Australian market's top dividend payers. Recent inclusion in the S&P/ASX indices could signal enhanced visibility but half-year sales remained flat with a slight dip in net income year-on-year.

Next Steps

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 23 more companies for you to explore.Click here to unveil our expertly curated list of 26 Top Dividend Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore small companies with big growth potential before they take off.

- Fuel your portfolio with fast-growing stocks poised for rapid expansion.

- Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SXE

Southern Cross Electrical Engineering

Provides electrical, instrumentation, communications, security, and maintenance services and products to resources, commercial, and infrastructure sectors in Australia.

Flawless balance sheet average dividend payer.