- Australia

- /

- Retail REITs

- /

- ASX:BWP

BWP Trust (ASX:BWP): Assessing Valuation Following New $300m Debt Raise and Strategic Funding Changes

Reviewed by Simply Wall St

BWP Trust (ASX:BWP) has completed the pricing of an AUD 300 million five-year Medium Term Note, featuring a 4.55% fixed coupon and maturing in October 2030. This supports several ongoing strategic goals.

See our latest analysis for BWP Trust.

BWP Trust’s latest funding move comes alongside a solid year for investors, with a 1-year total shareholder return of 18.6% and impressive share price momentum. The stock is up 11.7% in the last three months alone. The steady gains hint at growing confidence as the company adapts to market shifts and builds on recent initiatives.

If you want to broaden your search for opportunities beyond real estate, now’s a great chance to discover fast growing stocks with high insider ownership

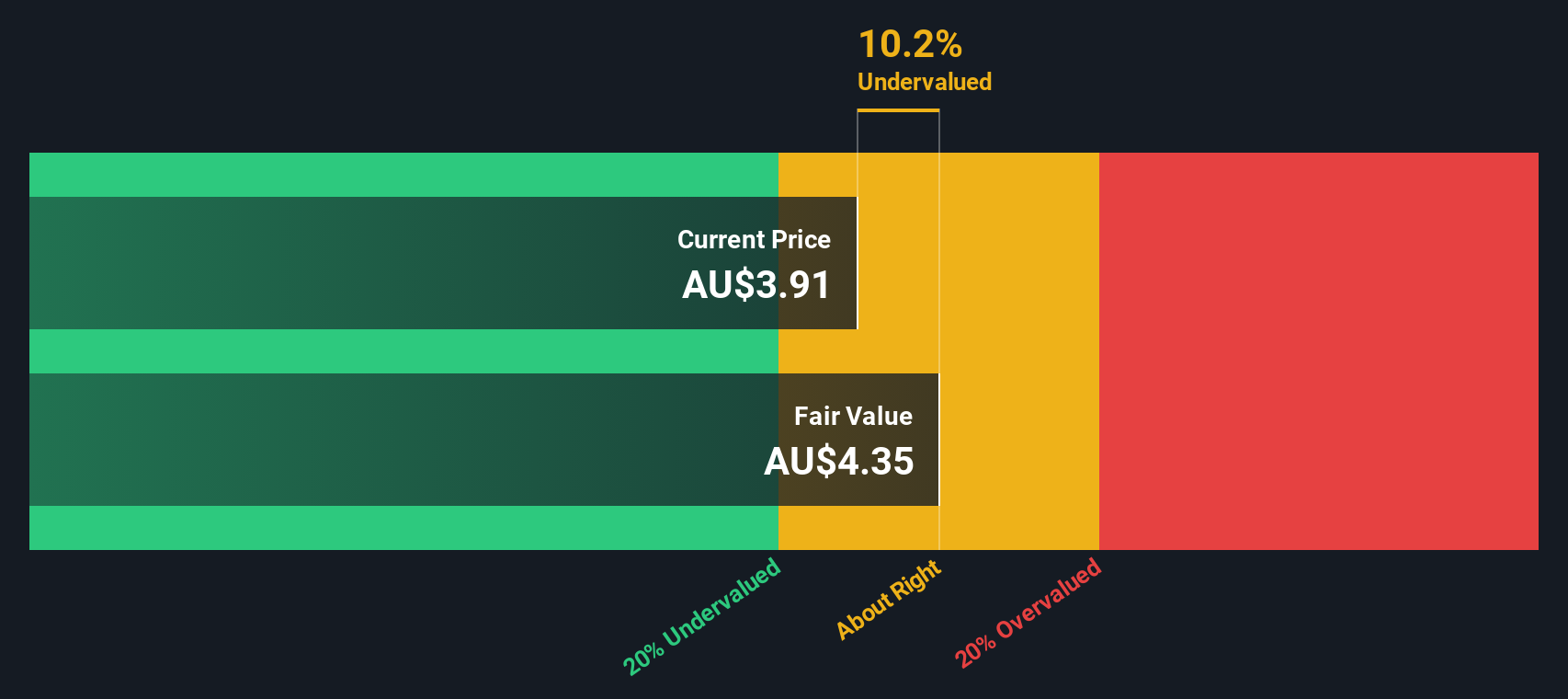

Still, after such strong returns and steady performance, investors may be wondering whether BWP Trust is trading at a discount to its true value or if the recent rally has already priced in its future growth prospects.

Most Popular Narrative: Fairly Valued

With BWP Trust trading at $3.91 and the most popular narrative fair value set at $3.86, both market and consensus expectations are strikingly aligned. This provides a compelling perspective on what is driving this agreement.

The continued acceleration of e-commerce, combined with demographic shifts like urban densification and an ageing population, is likely to erode long-term demand for suburban large-format, brick-and-mortar retail spaces. This may result in lower occupancy rates and subdued rental growth, ultimately impacting revenue growth and long-term asset values. BWP Trust's high concentration of income from Bunnings and limited diversification exposes it to increased tenant risk. Any future changes in Bunnings' store footprint, renegotiated lease terms, or non-renewals could significantly impact revenue predictability and earnings stability, especially as retailer strategies evolve.

Want to know the secret math behind this valuation call? The consensus hinges on a bold pivot in revenue and profit forecasts, paired with surprising assumptions about future earnings multiples. Explore what’s really shaping this price target and find out what makes this outlook tick.

Result: Fair Value of $3.86 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a stronger balance sheet and recently extended Bunnings leases could reinforce earnings stability and challenge the notion that growth will remain subdued.

Find out about the key risks to this BWP Trust narrative.

Another View: Our DCF Model Suggests Undervaluation

While the consensus view sees BWP Trust as fairly priced using earnings multiples, our DCF model tells a different story. It estimates BWP’s fair value at A$4.35 per share, about 10% above where it trades now. This could signal untapped upside. Are investors overlooking future cash flows?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own BWP Trust Narrative

If you think there’s more to the story or want to see the numbers for yourself, you can dive into the data and craft a personalized view in just a few minutes. Do it your way.

A great starting point for your BWP Trust research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let your next big opportunity pass you by. The smartest investors are always open to new trends, hidden gems, and promising themes. Here’s where you can start today:

- Catch the momentum of market disruptors and see which companies stand out with these 881 undervalued stocks based on cash flows for their growth potential and attractive price tags.

- Boost your income stream and identify top performers delivering substantial payouts by checking out these 17 dividend stocks with yields > 3%.

- Stay on the frontier of finance by spotting innovation leaders through these 80 cryptocurrency and blockchain stocks in the digital asset space.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BWP Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BWP

BWP Trust

Established and listed on the Australian Securities Exchange (‘ASX’) in 1998, BWP Trust (‘BWP’ or ‘the Trust’) is a real estate investment trust investing in and managing commercial properties throughout Australia.

Good value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives