Servcorp Limited's (ASX:SRV) dividend will be increasing from last year's payment of the same period to A$0.12 on 5th of October. This makes the dividend yield 8.0%, which is above the industry average.

Check out our latest analysis for Servcorp

Servcorp's Payment Has Solid Earnings Coverage

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Before making this announcement, Servcorp's dividend was higher than its profits, but the free cash flows quite comfortably covered it. Generally, we think cash is more important than accounting measures of profit, so with the cash flows easily covering the dividend, we don't think there is much reason to worry.

According to analysts, EPS should be several times higher next year. If recent patterns in the dividend continue, we could see the payout ratio reaching 52% which is fairly sustainable.

Dividend Volatility

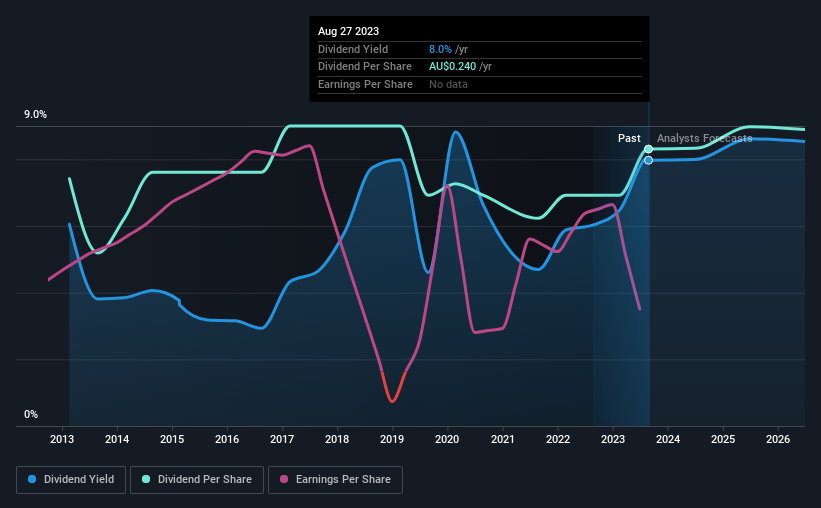

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2013, the annual payment back then was A$0.214, compared to the most recent full-year payment of A$0.24. This means that it has been growing its distributions at 1.1% per annum over that time. The dividend has seen some fluctuations in the past, so even though the dividend was raised this year, we should remember that it has been cut in the past.

Servcorp May Find It Hard To Grow The Dividend

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. However, Servcorp has only grown its earnings per share at 2.2% per annum over the past five years. The earnings growth is anaemic, and the company is paying out 192% of its profit. This gives limited room for the company to raise the dividend in the future.

Our Thoughts On Servcorp's Dividend

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. Overall, we don't think this company has the makings of a good income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 3 warning signs for Servcorp that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SRV

Servcorp

Provides executive serviced and virtual offices, coworking and IT, communications, and secretarial services in Australia, New Zealand, Southeast Asia, the United States, Europe, the Middle East, North Asia, and internationally.

Outstanding track record, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion