- Australia

- /

- Life Sciences

- /

- ASX:TRJ

Some Investors May Be Willing To Look Past Trajan Group Holdings' (ASX:TRJ) Soft Earnings

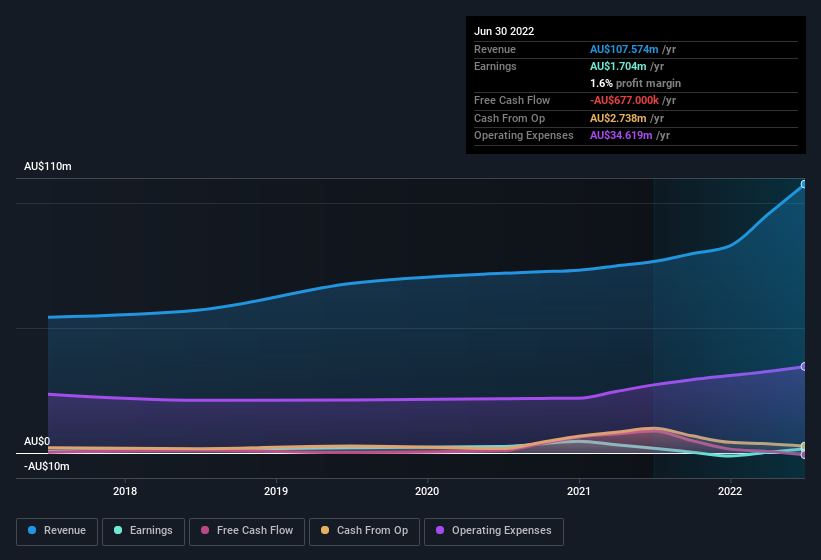

The market for Trajan Group Holdings Limited's (ASX:TRJ) shares didn't move much after it posted weak earnings recently. We think that the softer headline numbers might be getting counterbalanced by some positive underlying factors.

See our latest analysis for Trajan Group Holdings

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. As it happens, Trajan Group Holdings issued 17% more new shares over the last year. That means its earnings are split among a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of Trajan Group Holdings' EPS by clicking here.

How Is Dilution Impacting Trajan Group Holdings' Earnings Per Share (EPS)?

Unfortunately, Trajan Group Holdings' profit is down 20% per year over three years. And even focusing only on the last twelve months, we see profit is down 9.4%. Like a sack of potatoes thrown from a delivery truck, EPS fell harder, down 73% in the same period. And so, you can see quite clearly that dilution is influencing shareholder earnings.

In the long term, if Trajan Group Holdings' earnings per share can increase, then the share price should too. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

How Do Unusual Items Influence Profit?

On top of the dilution, we should also consider the AU$2.8m impact of unusual items in the last year, which had the effect of suppressing profit. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And, after all, that's exactly what the accounting terminology implies. In the twelve months to June 2022, Trajan Group Holdings had a big unusual items expense. All else being equal, this would likely have the effect of making the statutory profit look worse than its underlying earnings power.

Our Take On Trajan Group Holdings' Profit Performance

To sum it all up, Trajan Group Holdings took a hit from unusual items which pushed its profit down; without that, it would have made more money. But on the other hand, the company issued more shares, so without buying more shares each shareholder will end up with a smaller part of the profit. Considering all the aforementioned, we'd venture that Trajan Group Holdings' profit result is a pretty good guide to its true profitability, albeit a bit on the conservative side. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. For example, we've discovered 3 warning signs that you should run your eye over to get a better picture of Trajan Group Holdings.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Valuation is complex, but we're here to simplify it.

Discover if Trajan Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:TRJ

Trajan Group Holdings

Develops, manufactures, and sells analytical and life science products and devices in Malaysia, Japan, Australia, New Zealand, the United States, Europe, the Middle East, Africa, and India.

Very undervalued with flawless balance sheet.

Market Insights

Community Narratives