Is the SEC Subpoena Shifting the Risk Landscape for Telix Pharmaceuticals (ASX:TLX)?

Reviewed by Sasha Jovanovic

- In recent days, Telix Pharmaceuticals disclosed it received a subpoena from the U.S. Securities and Exchange Commission concerning its disclosures about prostate cancer therapeutic candidates, prompting the Rosen Law Firm to announce an investigation into potential securities violations on behalf of shareholders.

- This regulatory development highlights the increased scrutiny around pharmaceutical company disclosures and raises questions about transparency in clinical program communications.

- We’ll explore how heightened regulatory attention could impact Telix’s investment narrative and shape perceptions of its future risk profile.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Telix Pharmaceuticals' Investment Narrative?

To be a Telix Pharmaceuticals shareholder right now takes faith in the company’s ability to execute on its rich pipeline of radiopharmaceutical innovations and expand U.S. commercialization, particularly as recent product news signals meaningful clinical and commercial advances. The biggest short-term catalysts had been upcoming data from new drug candidates like TLX090 for bone metastasis pain and the expected expedited FDA review for TLX101-CDx, alongside commercial momentum for Gozellix and Illuccix. However, the SEC subpoena regarding prostate cancer program disclosures has introduced a real risk element, at least to market sentiment, evidenced by the sharp 10% share price drop after the announcement. Unless the investigation uncovers something materially concerning, the core business drivers and near-term milestones still appear to be in play, but the cloud of added scrutiny may heighten volatility and slow sentiment recovery. For now, how Telix manages its responses to regulators could shape the balance between future opportunity and perceived risk. On the other hand, regulatory inquiries can quickly reshape the outlook in ways investors should not overlook.

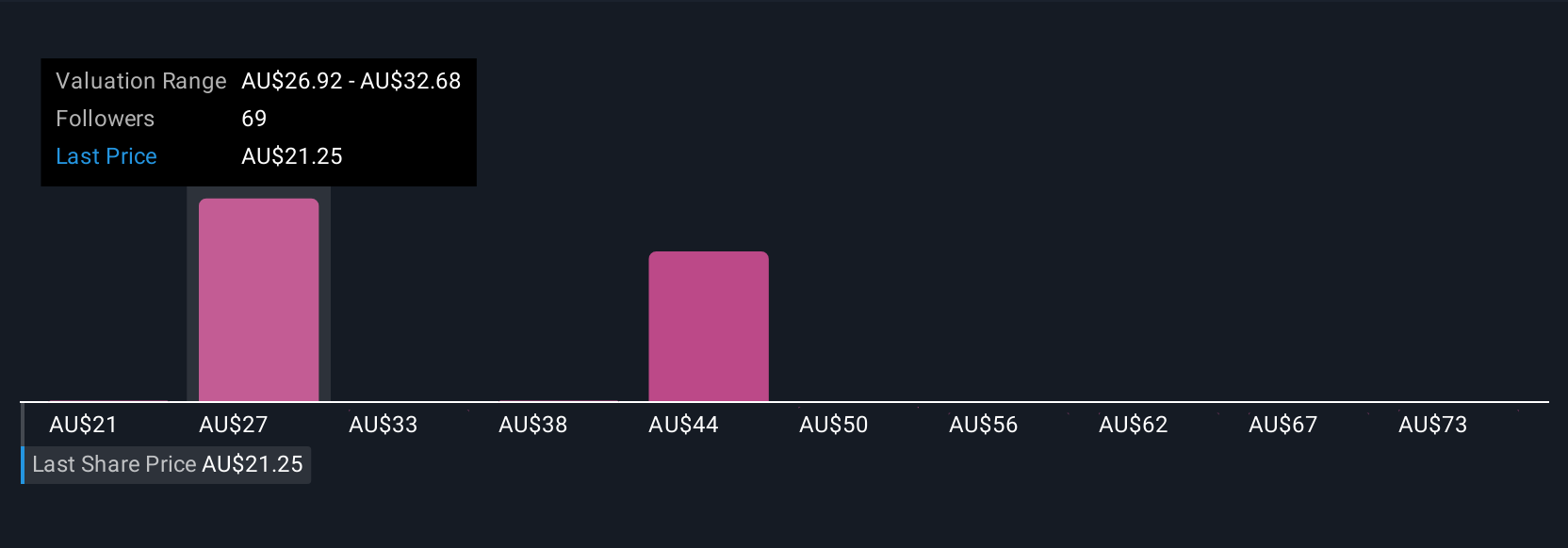

Despite retreating, Telix Pharmaceuticals' shares might still be trading 37% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 39 other fair value estimates on Telix Pharmaceuticals - why the stock might be worth over 3x more than the current price!

Build Your Own Telix Pharmaceuticals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Telix Pharmaceuticals research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Telix Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Telix Pharmaceuticals' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telix Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TLX

Telix Pharmaceuticals

A commercial-stage biopharmaceutical company, focuses on the development and commercialization of therapeutic and diagnostic radiopharmaceuticals.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives