How Does Regulatory Scrutiny Impact Telix Pharmaceuticals (ASX:TLX) Valuation?

Reviewed by Simply Wall St

Telix Pharmaceuticals (ASX:TLX) recently revealed it received a subpoena from the U.S. Securities and Exchange Commission regarding its prostate cancer drug disclosures. This has sparked legal investigations into whether shareholders may have been misled.

See our latest analysis for Telix Pharmaceuticals.

Even with regulatory scrutiny weighing on sentiment, Telix Pharmaceuticals has managed several positive milestones in recent months, including upgraded earnings guidance and the launch of a new cancer pain therapy trial. Despite the headline risk, its 1-month share price return is a strong 12.3%. However, over the past year, investors have seen a total shareholder return of -22.3%. Long-term holders are still sitting on a 140% gain over three years and nearly 672% since 2020. Although momentum has faded from its earlier strong performance, underlying business developments remain in focus.

If you’re watching Telix’s ups and downs and want to see what else is emerging in healthcare, check out See the full list for free.

With the share price still trading at a hefty discount to analyst targets and big gains over the longer term, is Telix undervalued in the face of regulatory risk, or is the market already pricing in all the future growth?

Price-to-Sales of 5.6x: Is it justified?

Telix Pharmaceuticals trades at a price-to-sales ratio of 5.6x, which is significantly below both its peer group and the broader Australian biotech industry. At its last close of A$16.67, the stock appears attractively priced compared to industry benchmarks.

The price-to-sales (P/S) ratio measures how much investors are willing to pay for each dollar of sales. In pharmaceuticals and biotech, where profits may be unpredictable or volatile due to high R&D spending, the P/S ratio offers a straightforward lens on growth and market position.

With Telix valued at just 5.6x sales against the peer average of 19.4x and below the wider Australian biotech industry average of 12.9x, the market appears to be heavily discounting future potential or factoring in recent regulatory headwinds. However, this ratio still sits just above the calculated fair price-to-sales ratio of 5.5x, suggesting the market might be moving toward a more conservative benchmark for value in this sector.

Explore the SWS fair ratio for Telix Pharmaceuticals

Result: Price-to-Sales of 5.6x (UNDERVALUED)

However, regulatory investigations and volatile biotech sentiment could quickly shift market perspectives. This poses fresh risks to Telix’s current valuation narrative.

Find out about the key risks to this Telix Pharmaceuticals narrative.

Another View: SWS DCF Model Offers Further Insight

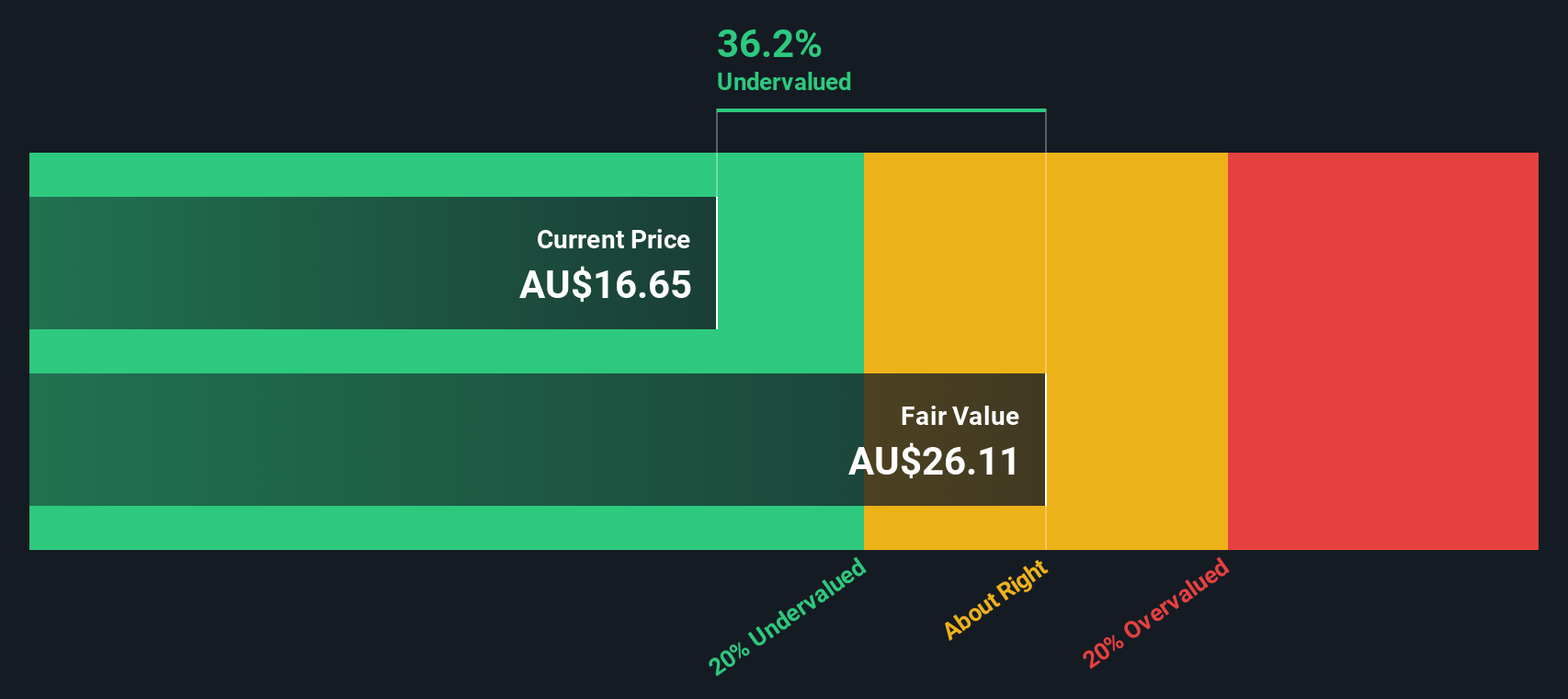

Looking through the lens of our SWS DCF model, Telix Pharmaceuticals appears to be trading at a 35.3% discount to its estimated intrinsic value of A$25.75 per share. This result also suggests the market may be overly cautious based on current risks. Could this alternative approach point to deeper value, or is the discount a reflection of lingering uncertainty?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Telix Pharmaceuticals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Telix Pharmaceuticals Narrative

If you see the story differently or want to dive deeper into the numbers yourself, it’s easy to build your perspective in just minutes. Do it your way

A great starting point for your Telix Pharmaceuticals research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your investing to just one company. Uncover powerful opportunities and get ahead by using the Simply Wall Street Screener to spot your next winning stock.

- Find stocks with high yields and secure your income potential by tracking these 17 dividend stocks with yields > 3%, delivering robust returns above 3%.

- Capitalize on emerging technologies by backing tomorrow’s leaders now with these 27 AI penny stocks, making strides in artificial intelligence innovation.

- Uncover value and strength by seeking out these 3556 penny stocks with strong financials that boast resilient financials you won’t want to miss.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telix Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TLX

Telix Pharmaceuticals

A commercial-stage biopharmaceutical company, focuses on the development and commercialization of therapeutic and diagnostic radiopharmaceuticals.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives