We Think Some Shareholders May Hesitate To Increase Starpharma Holdings Limited's (ASX:SPL) CEO Compensation

The underwhelming share price performance of Starpharma Holdings Limited (ASX:SPL) in the past three years would have disappointed many shareholders. In addition, the company's per-share earnings growth is not looking good, despite growing revenues. In light of this performance, shareholders will have a chance to question the board in the upcoming AGM on 29 November 2022, where they can impact on future company performance by voting on resolutions, including executive compensation. Here's our take on why we think shareholders might be hesitant about approving a raise at the moment.

Check out the opportunities and risks within the AU Pharmaceuticals industry.

How Does Total Compensation For Jackie Fairley Compare With Other Companies In The Industry?

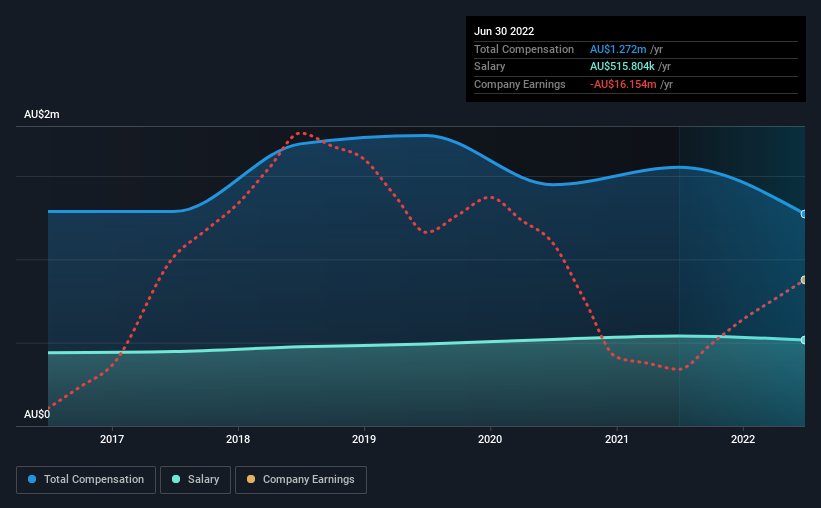

At the time of writing, our data shows that Starpharma Holdings Limited has a market capitalization of AU$217m, and reported total annual CEO compensation of AU$1.3m for the year to June 2022. That's a notable decrease of 18% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at AU$516k.

On comparing similar-sized companies in the industry with market capitalizations below AU$303m, we found that the median total CEO compensation was AU$600k. This suggests that Jackie Fairley is paid more than the median for the industry. Furthermore, Jackie Fairley directly owns AU$2.1m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | AU$516k | AU$540k | 41% |

| Other | AU$756k | AU$1.0m | 59% |

| Total Compensation | AU$1.3m | AU$1.6m | 100% |

On an industry level, roughly 67% of total compensation represents salary and 33% is other remuneration. In Starpharma Holdings' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Starpharma Holdings Limited's Growth

Starpharma Holdings Limited has reduced its earnings per share by 6.5% a year over the last three years. Its revenue is up 48% over the last year.

The decrease in EPS could be a concern for some investors. But on the other hand, revenue growth is strong, suggesting a brighter future. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Starpharma Holdings Limited Been A Good Investment?

With a total shareholder return of -59% over three years, Starpharma Holdings Limited shareholders would by and large be disappointed. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

The company's earnings haven't grown and possibly because of that, the stock has performed poorly, resulting in a loss for the company's shareholders. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 3 warning signs for Starpharma Holdings you should be aware of, and 1 of them can't be ignored.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SPL

Starpharma Holdings

A biopharmaceutical company, engages in the research, development, and commercialization of dendrimer products for pharmaceutical, life science, and other applications worldwide.

Excellent balance sheet very low.

Similar Companies

Market Insights

Community Narratives