Shareholders May Not Be So Generous With Pharmaxis Ltd's (ASX:PXS) CEO Compensation And Here's Why

In the past three years, the share price of Pharmaxis Ltd (ASX:PXS) has struggled to grow and now shareholders are sitting on a loss. In addition, the company's per-share earnings growth is not looking good, despite growing revenues. The AGM coming up on 02 November 2021 will be an opportunity for shareholders to have their concerns addressed by the board and for them to exercise their influence on management through voting on resolutions such as executive remuneration. We think shareholders may be cautious of approving a pay rise for the CEO at the moment, based on our analysis below.

View our latest analysis for Pharmaxis

How Does Total Compensation For Gary Phillips Compare With Other Companies In The Industry?

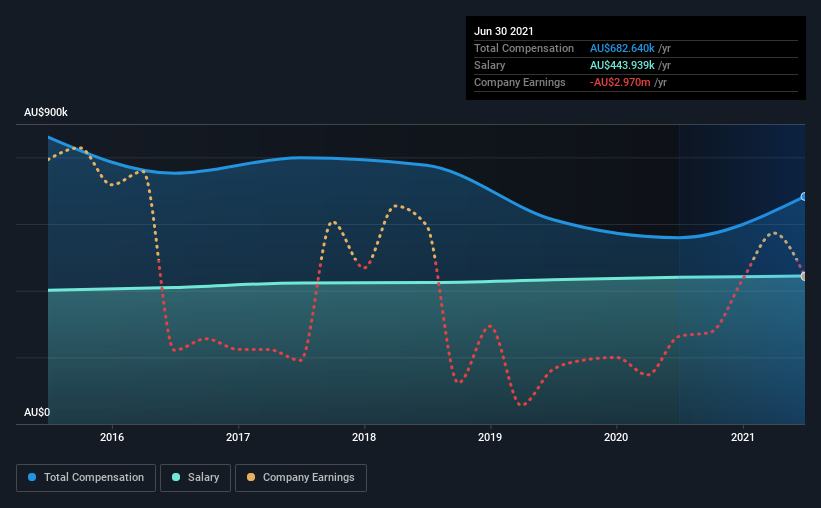

According to our data, Pharmaxis Ltd has a market capitalization of AU$57m, and paid its CEO total annual compensation worth AU$683k over the year to June 2021. Notably, that's an increase of 22% over the year before. Notably, the salary which is AU$443.9k, represents most of the total compensation being paid.

For comparison, other companies in the industry with market capitalizations below AU$266m, reported a median total CEO compensation of AU$470k. Hence, we can conclude that Gary Phillips is remunerated higher than the industry median. What's more, Gary Phillips holds AU$291k worth of shares in the company in their own name.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | AU$444k | AU$440k | 65% |

| Other | AU$239k | AU$119k | 35% |

| Total Compensation | AU$683k | AU$559k | 100% |

Talking in terms of the industry, salary represented approximately 59% of total compensation out of all the companies we analyzed, while other remuneration made up 41% of the pie. Pharmaxis is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Pharmaxis Ltd's Growth

Over the last three years, Pharmaxis Ltd has shrunk its earnings per share by 3.1% per year. Its revenue is up 87% over the last year.

The reduction in EPS, over three years, is arguably concerning. On the other hand, the strong revenue growth suggests the business is growing. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Pharmaxis Ltd Been A Good Investment?

Few Pharmaxis Ltd shareholders would feel satisfied with the return of -55% over three years. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

The loss to shareholders over the past three years is certainly concerning and possibly has something to do with the fact that the company's earnings haven't grown. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 3 warning signs for Pharmaxis that investors should look into moving forward.

Switching gears from Pharmaxis, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:SNT

Syntara

Operates as a clinical-stage drug development company that focuses on blood-related cancers in Australia.

Excellent balance sheet slight.

Market Insights

Community Narratives