- Australia

- /

- Life Sciences

- /

- ASX:PIQ

Strong week for Proteomics International Laboratories (ASX:PIQ) shareholders doesn't alleviate pain of one-year loss

Proteomics International Laboratories Ltd (ASX:PIQ) shareholders will doubtless be very grateful to see the share price up 33% in the last week. But that's small comfort given the dismal price performance over the last year. During that time the share price has sank like a stone, descending 51%. The share price recovery is not so impressive when you consider the fall. You could argue that the sell-off was too severe.

The recent uptick of 33% could be a positive sign of things to come, so let's take a look at historical fundamentals.

Given that Proteomics International Laboratories didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last twelve months, Proteomics International Laboratories increased its revenue by 15%. We think that is pretty nice growth. Unfortunately it seems investors wanted more, because the share price is down 51% in that time. It may well be that the business remains approximately on track, but its revenue growth has simply been delayed. To our minds it isn't enough to just look at revenue, anyway. Always consider when profits will flow.

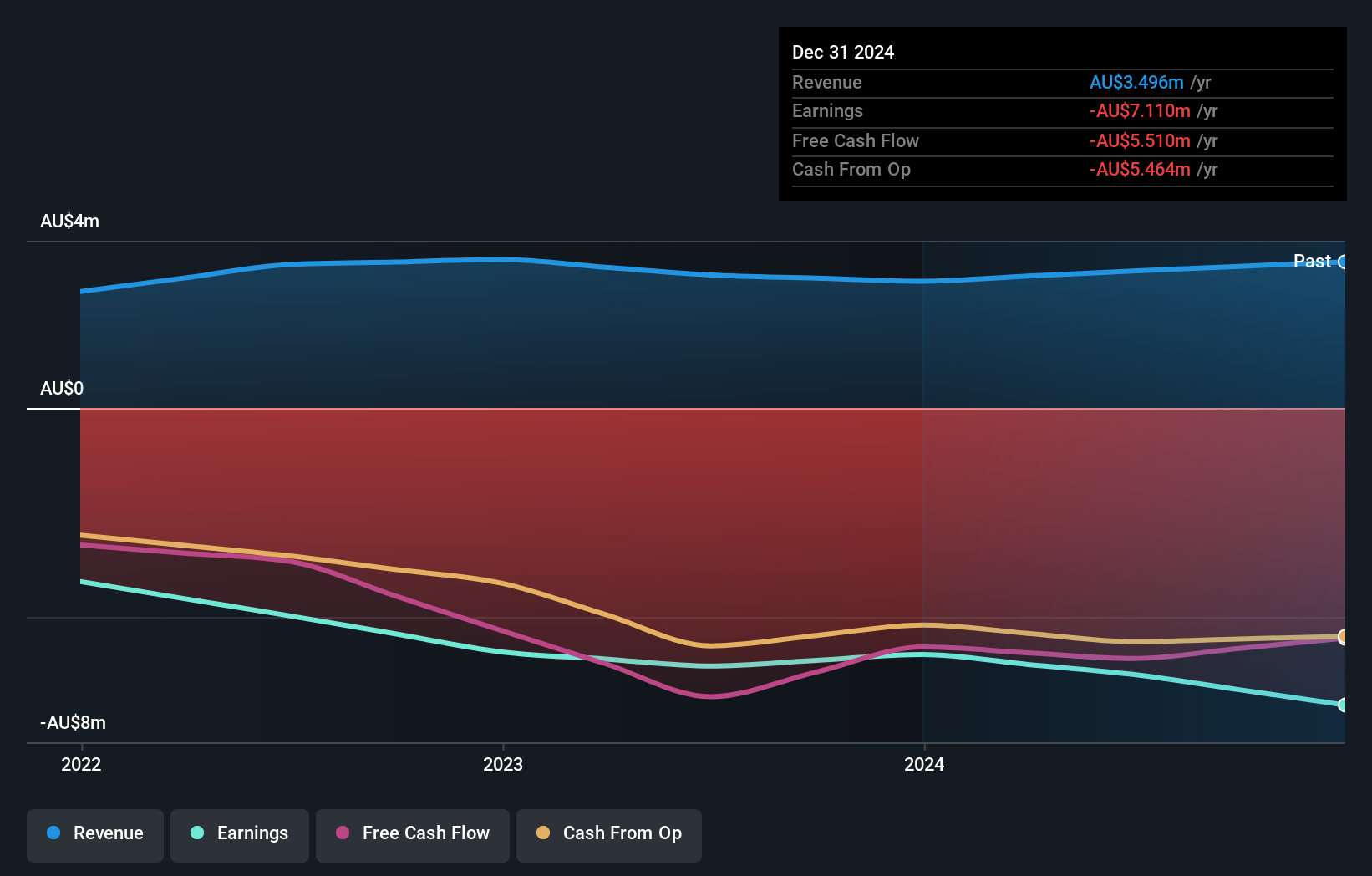

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Investors in Proteomics International Laboratories had a tough year, with a total loss of 51%, against a market gain of about 14%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 4%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Proteomics International Laboratories better, we need to consider many other factors. Take risks, for example - Proteomics International Laboratories has 4 warning signs (and 1 which is significant) we think you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:PIQ

Proteomics International Laboratories

Operates as a medical technology company with a focus on the area of proteomics in Australia, New Zealand, the United States, Europe, India, and Southeast Asia.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives