Stock Analysis

Roby Zomer became the CEO of MGC Pharmaceuticals Limited (ASX:MXC) in 2016, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for MGC Pharmaceuticals.

View our latest analysis for MGC Pharmaceuticals

Comparing MGC Pharmaceuticals Limited's CEO Compensation With the industry

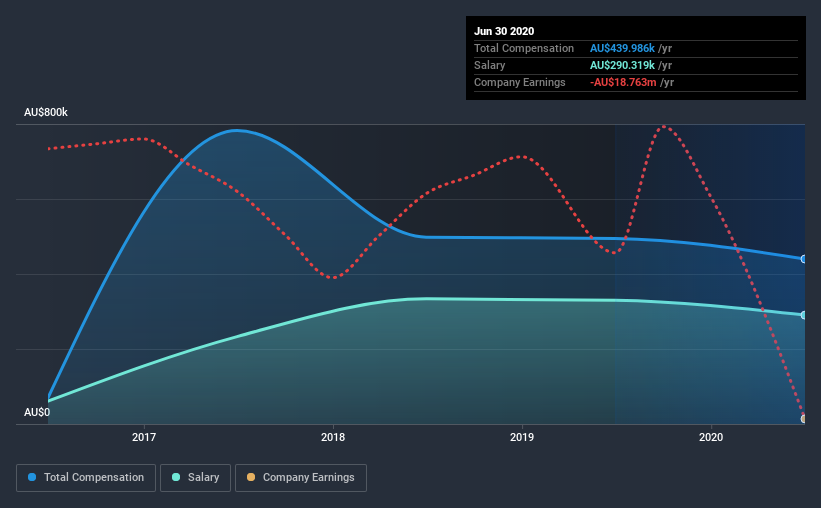

At the time of writing, our data shows that MGC Pharmaceuticals Limited has a market capitalization of AU$46m, and reported total annual CEO compensation of AU$440k for the year to June 2020. That's a notable decrease of 11% on last year. We note that the salary portion, which stands at AU$290.3k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below AU$262m, we found that the median total CEO compensation was AU$412k. This suggests that MGC Pharmaceuticals remunerates its CEO largely in line with the industry average. Furthermore, Roby Zomer directly owns AU$858k worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$290k | AU$330k | 66% |

| Other | AU$150k | AU$165k | 34% |

| Total Compensation | AU$440k | AU$495k | 100% |

On an industry level, around 66% of total compensation represents salary and 34% is other remuneration. MGC Pharmaceuticals is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at MGC Pharmaceuticals Limited's Growth Numbers

Over the past three years, MGC Pharmaceuticals Limited has seen its earnings per share (EPS) grow by 2.4% per year. Its revenue is up 213% over the last year.

It's great to see that revenue growth is strong. With that in mind, the modestly improving EPS seems positive. So while we'd stop short of saying growth is absolutely outstanding, there are definitely some clear positives! Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has MGC Pharmaceuticals Limited Been A Good Investment?

With a three year total loss of 72% for the shareholders, MGC Pharmaceuticals Limited would certainly have some dissatisfied shareholders. So shareholders would probably want the company to be lessto generous with CEO compensation.

In Summary...

As we noted earlier, MGC Pharmaceuticals pays its CEO in line with similar-sized companies belonging to the same industry. This doesn't look good when you place it against the backdrop of negative shareholder returns and flat EPS growth. CEO pay isn't exceptionally high, but considering poor performance, shareholders will likely hold off support for a raise until results improve.

CEO pay is simply one of the many factors that need to be considered while examining business performance. In our study, we found 6 warning signs for MGC Pharmaceuticals you should be aware of, and 1 of them can't be ignored.

Important note: MGC Pharmaceuticals is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you decide to trade MGC Pharmaceuticals, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Argent BioPharma is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:RGT

Argent BioPharma

A drug discovery clinical-stage biopharmaceutical company, provides medicines targeting immunology and neurology worldwide.

Mediocre balance sheet with weak fundamentals.