Mesoblast (ASX:MSB) Valuation Spotlight as FDA Reviews Opioid-Reducing Therapy Data

Reviewed by Simply Wall St

Mesoblast (ASX:MSB) revealed that the US FDA will convene in December to review data from its Phase 3 trial on rexlemestrocel-L. The focus will be on opioid reduction in chronic low back pain patients. This closely follows updated FDA guidance prioritizing non-opioid therapies in response to the ongoing opioid crisis.

See our latest analysis for Mesoblast.

Mesoblast shares have seen sharp swings this year, with the latest price at $2.22 and a 30-day share price return of -20.71% reflecting recent volatility around regulatory updates. Despite near-term hurdles, the one-year total shareholder return stands at an impressive 41.4%. This suggests that long-term investors who stayed the course have been rewarded with strong gains, even as momentum has faded recently.

If regulatory catalysts in biotech interest you, it could be worth exploring other innovators. You can discover See the full list for free.

Given Mesoblast’s recent clinical momentum and valuation metrics, is the stock trading at a bargain ahead of potential FDA approval, or have investors already anticipated its growth prospects in the share price?

Price-to-Book of 3.1x: Is it justified?

Relative to the last close price of A$2.22, Mesoblast trades at a price-to-book (P/B) ratio of 3.1x, which appears attractive versus its biotech peers.

The price-to-book ratio compares a company's market value to its net assets and is commonly used when profits are negative or inconsistent, as is often the case in early-stage biotech firms. For Mesoblast, with no current profitability but meaningful assets from R&D efforts, this measure is especially relevant.

Current market pricing puts Mesoblast's P/B well below both the Australian Biotechs industry average (5.1x) and its peer average (4.3x). This notable discount signals that the market is either undervaluing its asset base or remains cautious about future profitability. Given that the company's own price-to-book ratio is lower than these benchmarks, there may be upside if investor sentiment shifts or milestones are reached.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 3.1x (UNDERVALUED)

However, regulatory setbacks or slower than expected commercialisation could quickly undermine the current value case and weigh on Mesoblast’s share price outlook.

Find out about the key risks to this Mesoblast narrative.

Another View: The DCF Perspective

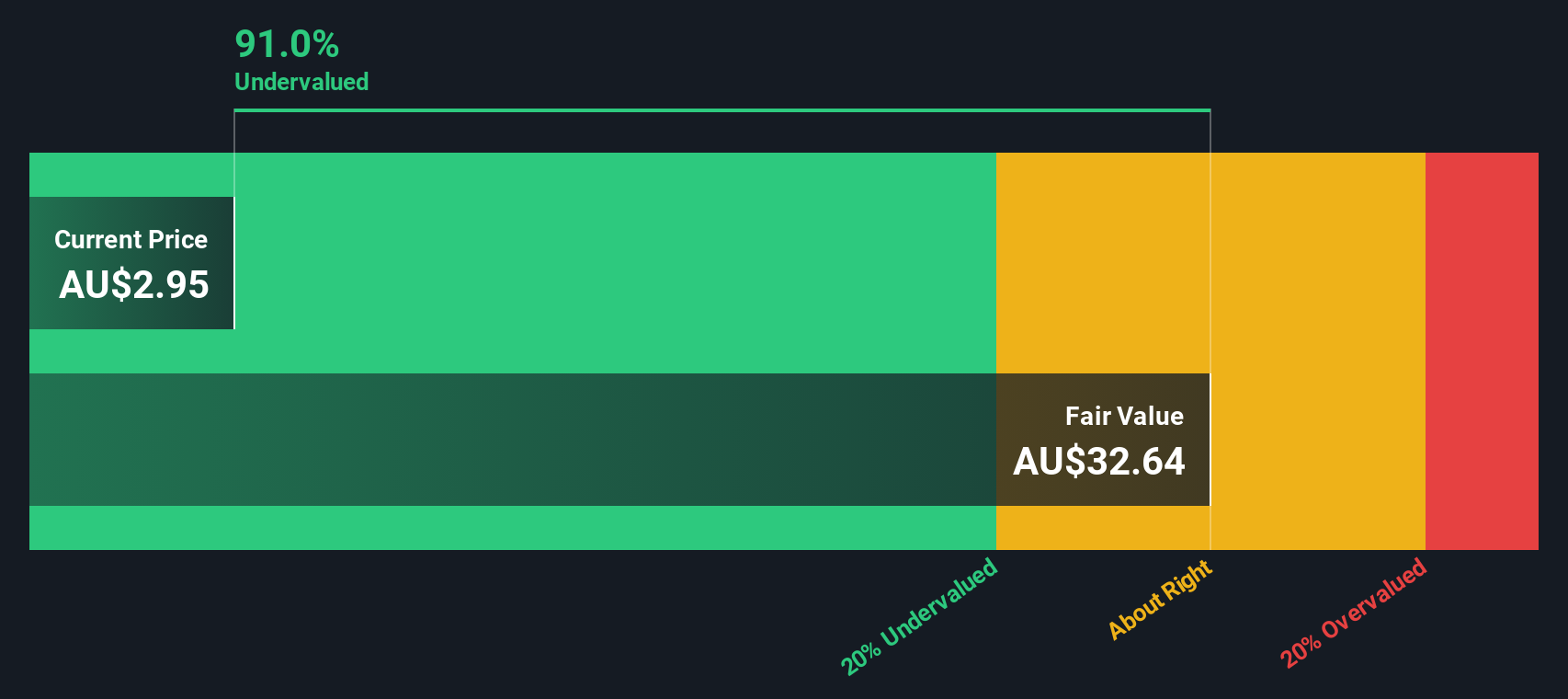

While the price-to-book ratio suggests Mesoblast is undervalued compared to peers, our DCF model presents an even starker picture. Based on projected cash flows, Mesoblast is trading roughly 93% below its estimated fair value. Are investors overlooking significant upside, or is the model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mesoblast for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 886 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mesoblast Narrative

If you prefer to form your own perspective or want to dive deeper into the figures, you can assemble your own story in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Mesoblast.

Seeking Your Next Big Opportunity?

If you want an edge, smart investors always keep their radar on fresh opportunities. The market is brimming with high-potential stocks that fit all kinds of strategies. Miss them and you could be leaving gains on the table.

- Uncover stocks with strong cash flow potential by reviewing these 886 undervalued stocks based on cash flows and pinpointing those trading below their true worth.

- Target companies breaking new ground in healthcare by checking out these 32 healthcare AI stocks and see who’s transforming AI in medicine.

- Amplify your passive income strategy by exploring these 16 dividend stocks with yields > 3% with reliable yields that can bolster your returns, even in unpredictable markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MSB

Mesoblast

Engages in the development of regenerative medicine products in Australia, the United States, Singapore, and Switzerland.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives